Will emerging economies take advantage of the Fed’s reprieve to get their houses in order?

The US Federal Reserve’s surprise decision to keep the money spigot flowing provided an unexpected respite for emerging economies like India, Indonesia, South Africa, Turkey, and Brazil, which have been hit by capital outflows and currency devaluations as investors anticipated the end of the Fed’s $85 billion-a-month bond buying program.

The US Federal Reserve’s surprise decision to keep the money spigot flowing provided an unexpected respite for emerging economies like India, Indonesia, South Africa, Turkey, and Brazil, which have been hit by capital outflows and currency devaluations as investors anticipated the end of the Fed’s $85 billion-a-month bond buying program.

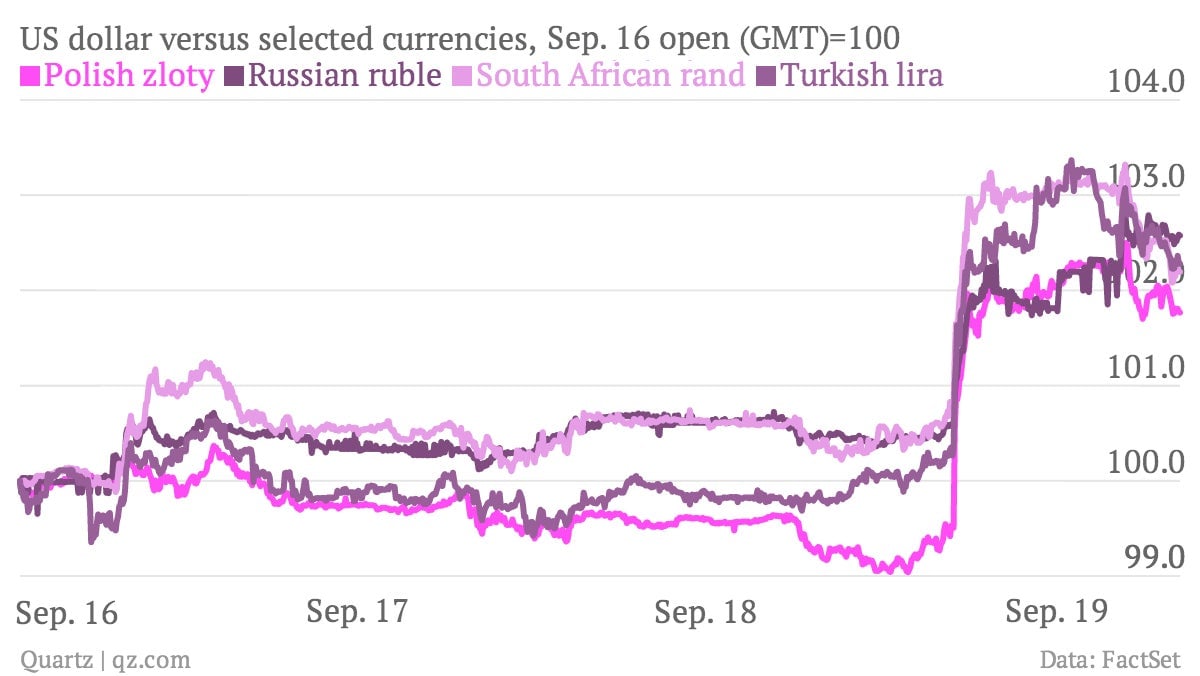

Investors that had fled emerging markets in recent months came rushing back on Thursday. The MSCI Emerging Markets Index surged more than 2%, led by stocks in Indonesia, the Philippines, Thailand, and India. A broad range of Asian currencies rallied by 1-2% against the US dollar, as did other developing markets’ currencies in countries like Poland, Russia, Turkey and South Africa.

The question now is what economic policy makers in those emerging markets will do with their unexpected reprieve. Will they use the extra time to institute badly needed structural reforms? Or did Ben Bernanke’s gift merely delay the inevitable—an investor exodus from emerging markets that will take years to recover from?

“The fact that the ‘money train’ will continue for a while means the risk of a hard-landing or a balance of payments crisis has been greatly reduced, if not averted. But, the Fed only postponed its tapering and will not print money forever,” wrote HSBC’s Frederic Neumann, co-head of Asian economics research. “To avoid another rough summer, policy-makers in Asia will need to use this brief window to implement structural reforms to put Asian growth on a more sustainable path.”

What needs to change? Economists and institutions like the International Monetary Fund have a laundry list of reforms to shore up government balance sheets and improve competitiveness and productivity: trimming current account and budget deficits, making infrastructure improvements, creating more flexible labor markets, and easing restrictions on foreign ownership.

“Many emerging markets have just had to sit back and watch the capital flow in. They haven’t had to try very hard to attract it,” Morgan Stanley strategist James Lord told Reuters earlier this month. “Now they’re going to have to work harder. That means reforms.”

Attempts to make structural changes should be helped by the fact that the emerging market downturn of recent months was gentle by historical standards, with few of the bank failures or bankruptcies that characterized previous emerging market reversals. But the fact remains that many emerging markets are still struggling, regardless of this week’s Fed-driven market reversal, and many of the prescribed reforms will be a tough sell politically.

“The Fed’s dovish tone does provide some breathing space, but that’s all it really is,” JPMorgan Chase & Co. said in a research note, as cited by Bloomberg Businessweek.

And of course there’s at least one group that wouldn’t mind if the emerging economies’ renewed lease on life ends up coming to naught: The short sellers who bet against them in anticipation of the Fed’s taper.

Additional reporting by Jason Karaian