Emerging markets, wean thyself—the Fed has given you one last fix

It was a great day for the addicts yesterday. The substance provider announced that it would keep on supplying for at least a little more time—maybe until the end of the year. That substance, of course, is newly created currency. The provider is the US Federal Reserve. There are several sets of addicts. Some of them are domestic, and the others are in other countries.

It was a great day for the addicts yesterday. The substance provider announced that it would keep on supplying for at least a little more time—maybe until the end of the year. That substance, of course, is newly created currency. The provider is the US Federal Reserve. There are several sets of addicts. Some of them are domestic, and the others are in other countries.

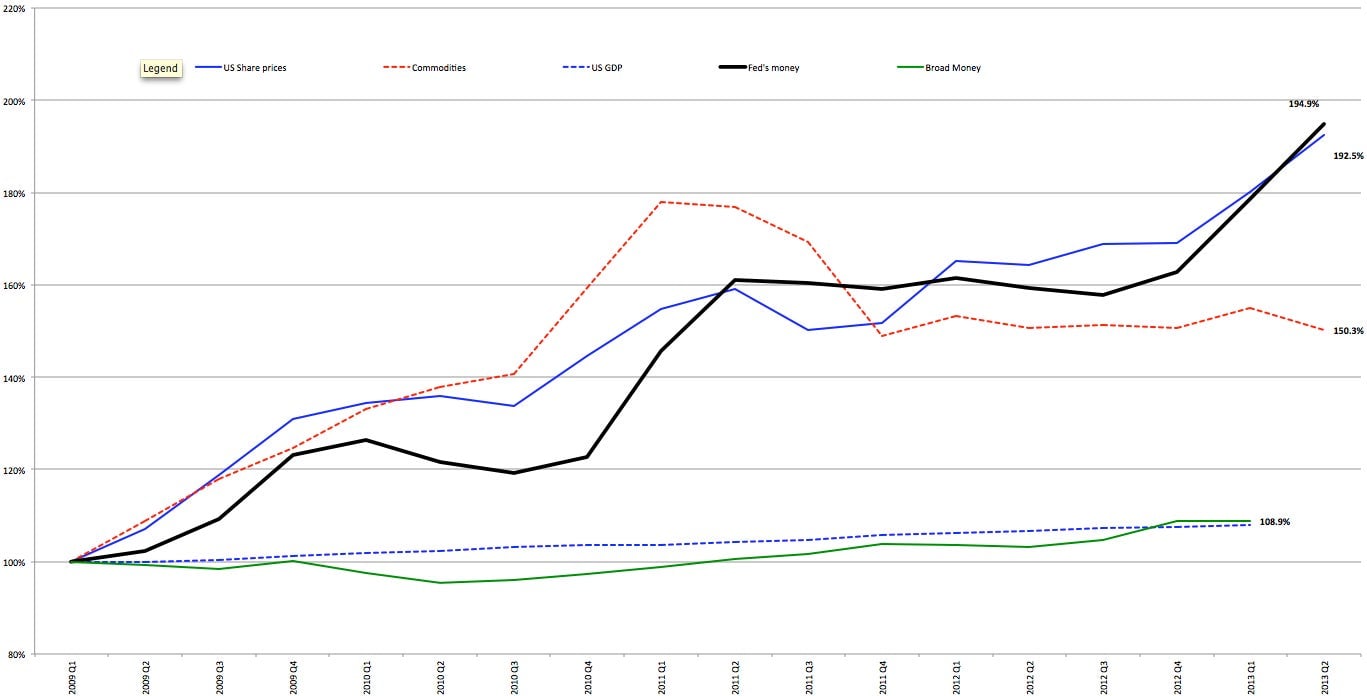

The graph below shows some of the reasons why these groups have become addicted. The solid black line depicts the time path of monetary creation since the first quarter of 2009, just after the financial crisis that exploded in September 2008. As evident in the graph, monetary creation and share prices followed almost parallel paths during that period. Monetary stocks ended up being 195%, and share prices 192% of their March 2009 level. It is no wonder that the share traders hoped that the Fed would keep on delivering the substance. (Broad money refers to currency plus all deposits in the banks, plus some paper issued by the banks.)

A second set of hopefuls: the producers and traders of commodities. Lately they have not been as happy as the share traders. Initially, the time path of their products’ prices was parallel to that of monetary creation. However, after the first quarter of 2011, they first fell sharply and then stabilized. This group is afraid that any tapering of the quantitative easing 3 program—the modern name of massive monetary creation—would lead to a sharper fall in those prices.

The emerging markets had also another reason to hope for renewed doses of monetary creation. When Ben Bernanke casually said a few months ago that the Fed will eventually stop creating money at breakneck speed the prices of long-term bonds in the United States markets fell sharply (or, what is the same, the long-term interest rate went up sharply). This shifted the relative appeal of United States’ and developing countries’ bonds. Since the first are seen as safer than the second, an increase in the interest rates paid by the first relative to those paid by the second caused capital to flow from the developing to the countries to the United States.

This effect reinforced a tendency that was already pushing capital out of the emerging markets. As the prices of commodities fell from their 2011 peak, investments in commodity production and in financial assets issued by commodity-producing countries tended to decline. Some capital started to flow out of these countries because they looked less attractive than during the boom of commodity prices. The reduced inflows of dollars resulting from lower exports and capital inflows turned into capital outflows led to currency depreciations in several of these countries. The currency depreciation reduced the dollar equivalent of their interest rates (a 10% interest rate in pesos, when translated into dollars after a currency depreciation of 15%, is equivalent to about minus 5% interest rate in dollars).

Countries could increase their interest rates to compensate for the currency depreciation. However, they are quite reluctant to do it because that would further slow down their economies. Thus, with interest rates falling in dollar terms in the emerging markets, and increasing rates in the United States, the capital outflows from the first ones accelerated. No wonder that these guys wanted the Fed to keep on printing money.

There was another set of hopefuls—the ordinary citizens that profit from the growth of the economy. They were the humblest of the hopefuls because, as shown in the graph, monetary creation has been translated into a very modest production increase. While money created by the Fed increased by 95% during the period covered in the graph, real GDP (that is, eliminating the effect of inflation) increased only 8% (about 1.94% growth per year). Still, people have come to believe that what is good for the financial market is good for them.

Finally, yet another set of hopefuls: the banks. The Fed’s monetary creation has resulted in a small increase in bank deposits and other liquid resources, shown in the graph as broad money. Even if small, this growth has allowed the banks to remain liquid even if challenged by uncollectible loans. Those experiencing difficulties to collect would become illiquid and in danger of failing if the Fed stops creating more money. As expressed by Warren Buffet, when the tide goes out you discover who’s been swimming naked. Banks didn’t want the tide to go out. At least some of them.

Thus, the Fed’s policy meeting faced a lot of hopefuls who could exert strong pressures. At the end of the meeting, it announced plans to keep on buying $85 billion each month. Ben Bernanke spread happiness throughout the land. The Dow Jones Industrial Average went up by 0.95% from 2:00 p.m., the time of the announcement, to the end of the day. Nasdaq went up by 1.01%, S&P by 1.22%. The yields of 10-year United States government bonds went down from almost 2.9% to 2.70%, wiping out a lot of the losses that bond holders had experienced in the last several weeks.

The Fed knows that its Sept. 18 decision will keep the addicts happy only for a little while. The current rate of monetary creation is unsustainable. Eventually, it will lead to inflation. People feel that this danger does not exist because they don’t see inflation going up. However, as the Fed knows very well, the impact of monetary creation is felt with a lag of at least 18 months. Thus, the Fed is flying in the dark, by the seat of its pants. The amount already created is so huge that adding to it is increasingly dangerous.

Worse still, this excessive monetary creation is doing a lot of damage in another dimension. It is preparing the field for another financial crisis. This is so because the Fed is fooling many investors (not just in the financial but also in the real markets) into investments that are profitable only at the current interest rates. These investments will turn sour once the Fed stop printing money and the rates go back to their normal levels. Losing money, they will not be able to increase production and employment. They will not be able to service their debts. And a new financial crisis would be in the making. This is what happened in the boom that preceded the 2008 bust.

The emerging markets are already advancing in that direction. Some have very large stashes of dollar reserves, which they are now using to try to finance the capital flows without being forced to further depreciate their currencies or increase their interest rates. But even large stashes of reserves can go fast. Brazil, for example, recently announced that it would spend $100 billion, about a third of its dollar reserves, for this purpose during the last four months of the year. If people panic, or the commodity prices go down further, the reserves would disappear faster.

Eventually, all the addicts will have to face the termination of the party. If the Fed does not take the punchbowl away, the market will do it through interest rate increases provoked not by the Fed but by inflationary expectations (that is, when people suspect that inflation will go up, they demand higher interest rates to compensate for the decrease in the purchasing power of their money). Then, the Fed would not be able to do anything. If it keeps on creating the substance, this will be so liquefied by inflation that it will not produce any pleasure to any of the hopefuls. They, and the rest of the economy, and the emerging markets, will have to suffer the terrible hangover of this long and wild monetary party—which some, just some, enjoyed (take a look back a the graph to appreciate the difference between the booming financial sector and the rest of the economy).

Bernanke gave the addicts only one of the last doses they will get.