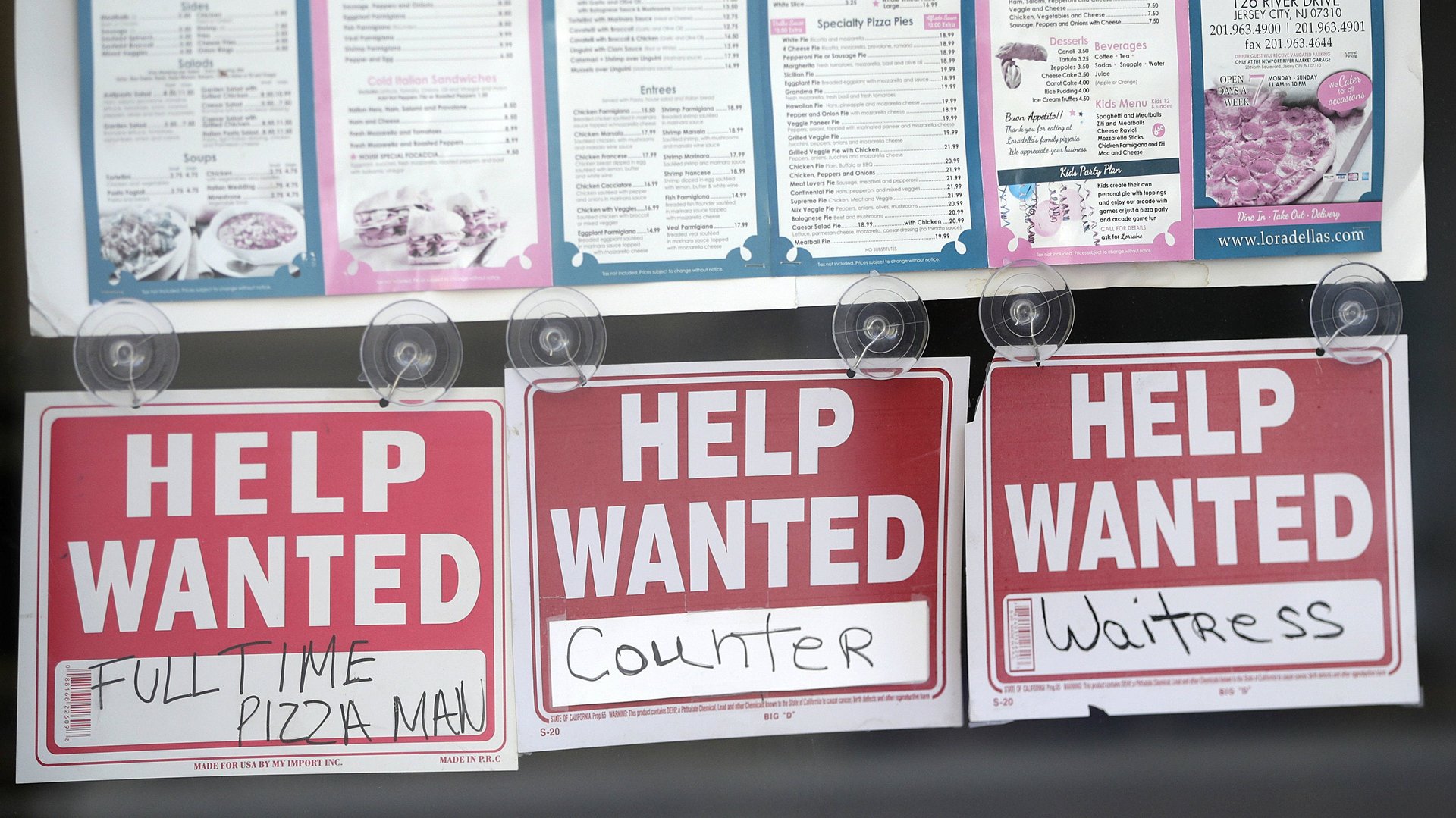

The strange thing about America’s historically low unemployment rate

For the past 100 years or so, economists have observed an inverse relationship between inflation and unemployment. Even after all this time, this correlation remains poorly understood. Now, in one of the field’s periodic intellectual crises, economists are questioning where there is still a relationship at all.

For the past 100 years or so, economists have observed an inverse relationship between inflation and unemployment. Even after all this time, this correlation remains poorly understood. Now, in one of the field’s periodic intellectual crises, economists are questioning where there is still a relationship at all.

The link between inflation and unemployment was formalized in 1958 by New Zealand economist William Phillips. The correlation has important policy implications, because it suggests that if central banks can control inflation they can also control unemployment. In 1977, the US Congress amended the Federal Reserve Act, making it the Federal Reserve’s mandate to “achieve both stable prices and maximum sustainable employment.”

The mandate change followed a period in the 1970s that featured high inflation and unemployment simultaneously. It challenged the conventional wisdom. As a result, economists like Ned Phelps and Milton Friedman refined the so-called Philips curve.

They made two major changes. First, instead of inflation moving markets, what matters for unemployment is unexpected inflation: that is, a surprise change in price trends (perhaps engineered by the central bank). Second, it is not just unemployment that matters, but unemployment relative to a “natural rate” that implies full employment. If the natural rate is 4% and current unemployment is 7%, the central bank can let prices rise faster than expected in hopes of nudging unemployment lower. If, by contrast, the natural rate is 4% and current unemployment is 2%, interest-rate hikes are warranted to prevent inflation from spiraling out of control, at the cost of higher unemployment.

The natural rate has become what the Fed targets when it considers its “maximum employment” mandate. It is known as the non-accelerating inflation rate of unemployment, or NAIRU.

A natural mystery

Although no one knows what the NAIRU really is at any given moment, there are ways to estimate it with varying levels of precision. A lot rides on this number, however imprecise it is. At the moment, amid low unemployment, the Fed has been steadily raising interest rates. If it has over-estimated the NAIRU, it risks needlessly crimping economic growth, subjecting people to unnecessary unemployment and depressed wages.

Anyway, it seems like the whole idea of a natural rate might be bunk. Unemployment in the US is low, at 3.9%, which is presumably below the natural rate. At the same time, inflation isn’t much above 2%, which the Fed considers its long-run target. If there is no natural rate, why should the Fed continue to hike interest rates? Maybe it can let the unemployment rate drift down to 2%, or even lower, without the risk of runaway inflation.

Ned Phelps, who won the Nobel Prize for his work on unemployment, argues that the NAIRU is misunderstood. It is not necessarily a constant rate, but can change over time. This is because different factors can cause unemployment. There are demand factors, like businesses not hiring because they sense a limited market for their goods, which is sensitive to inflation and interest rates. And there are also structural factors: people living near where jobs are, skill mismatches, or the wages workers are willing to accept to take a job.

Both demand and structural factors contribute to unemployment. It could be the natural rate is currently lower than it used to be, which is why we are now experiencing both low inflation and low unemployment. Here’s how Phelps explains what is going on:

For me, a compelling hypothesis is that workers, shaken by the 2008 financial crisis and the deep recession that resulted, have grown afraid to demand promotions or to search for better-paying employers – despite the ease of finding work in the recently tight labor market. A corollary hypothesis is that employers, disturbed by the extremely slow growth of productivity, especially in the past ten years, have grown leery of granting pay raises – despite the return of demand to pre-crisis proportions.

I have also argued, based on a model of mine, that as the return of a strong dollar by early 2015 threatened to inundate American markets with imports, firms became scared to supply more output at the same price. Or else they supplied the same output as before at reduced prices. And they refused to raise employees’ wages. In short, more competition created “super-employment” – low unemployment and low inflation.

All this does not mean there is no natural unemployment rate, only that there is nothing natural about it. There never was.

What’s the use?

If the natural unemployment rate is hard to measure and changes over time, it seems like a poor concept to rely on for policymaking purposes. In that case, why not just junk it and push loose monetary policy until inflation properly picks up?

Dropping the natural rate as a guide risks promoting an over-reliance on monetary policy. The big difference between demand and structural unemployment is that demand-driven unemployment can respond to Fed policy. Lowering structural unemployment takes fiscal action, like tax reform, unemployment vouchers, and job training. We let policymakers off too easy when we only rely on one set of tools (that is, interest rates).

Besides, loose monetary policy may sometimes promote lower unemployment, but it also poses other costs to the economy. Low rates can create distortions in financial markets, increasing the risk of a dangerous and destabilizing crisis. Those distortions may be worth the risk if unemployment is high, but less so if the economy is already near full employment. One thing that all economists can agree on is that there are always tradeoffs.