Economists have identified a link between genetics and wealth inequality

When professors venture out of the ivory tower and encounter successful people, they are sometimes asked, “If you’re so smart, why aren’t you rich?” The best retort, which legend traces to economist Larry Summers, is, “If you’re so rich, why aren’t you smart?”

When professors venture out of the ivory tower and encounter successful people, they are sometimes asked, “If you’re so smart, why aren’t you rich?” The best retort, which legend traces to economist Larry Summers, is, “If you’re so rich, why aren’t you smart?”

A group of economists has tried to answer those questions. There has always been evidence that certain genetic traits are associated with entrepreneurship and wealth. But it was never clear how much could be credited to nature (an entrepreneur gene) and how much to nurture (growing up in an environment that encourages entrepreneurship or having rich parents who pass down their wealth).

A new research paper by Daniel Barth, Nicholas Papageorge, and Kevin Thom, attempts to separate out nature and nurture by measuring the contribution of genetics to wealth. Specifically, they focus on a genetic measure that indicates an affinity for educational attainment.

The economists constructed a weighted average of genetic markers based on estimates from earlier studies that measured the relationship between genes and education. This gives them an educational attainment (EA) score: the higher the score, the more genetically predisposed someone is to education. They also had data on income, wealth, and education for a sample of around 5,700 Americans.

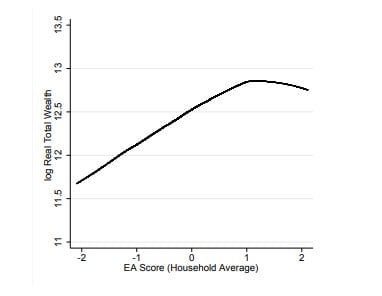

The researchers measured how EA scores correlated with wealth at retirement, after controlling for income and education. They estimated that a one-standard-deviation increase in EA score is associated with around 14% greater wealth. They found it pays to be smart, but not too smart. There are diminishing—even negative—returns to academic ability. The researchers plotted the relationship in the chart below, where the X-axis is EA score and the Y-axis is a measure of wealth at retirement.

The authors explored different reasons why a higher EA score is generally correlated with more wealth. They estimated that households with higher scores were more likely to have received an inheritance. EA scores are based on genetics, so if you have a high EA score, odds are your parents did too and they also had more wealth to bequeath to you.

Higher EA scores don’t appear to translate into higher saving rates. But they are correlated with a willingness to take risks (measured by two survey questions about risk tolerance). Taking more risks is critical to getting rich. The economists found that high-scoring EA respondents were more likely to own stock, have a history of entrepreneurship, and can better tolerate ambiguity. All of these characteristics add up to more wealth.

The authors of the study speculate that moving from a defined benefit pension regime, where employers invest retirement assets for you and bear all the risk, to a defined contribution system, where people make their own investment choices, will exacerbate wealth inequality. People with high EA scores already earn more in their jobs and also make better investment choices. A pension regime that requires people invest for themselves will worsen inequality by favoring those with high EA scores.

Alas, it is still not clear why there are diminishing returns to the highest EA scores. Thom says:

There very well may be diminishing marginal returns to the genetic endowments measured by the EA score. For example, after a certain point, households might be avoiding the costliest mistakes, and making largely sound financial choices, so that adding more of the endowments measured by the EA score might not make as much of a difference. However, this is purely speculation, and hopefully follow-up studies will shed more light on the mechanisms driving this pattern.

Perhaps one day professors will have more a statistically robust—if less witty—retort when people ask why they aren’t richer.