The global rise of corporate titans is forcing us all to pay more for the same old stuff

Big business just keeps getting bigger. And the US government’s de facto green-lighting of AT&T’s purchase of Time Warner last week is a sign of more corporate engorgement to come.

Big business just keeps getting bigger. And the US government’s de facto green-lighting of AT&T’s purchase of Time Warner last week is a sign of more corporate engorgement to come.

It’s not just an American problem, though: This Gilded Age reboot has gone global.

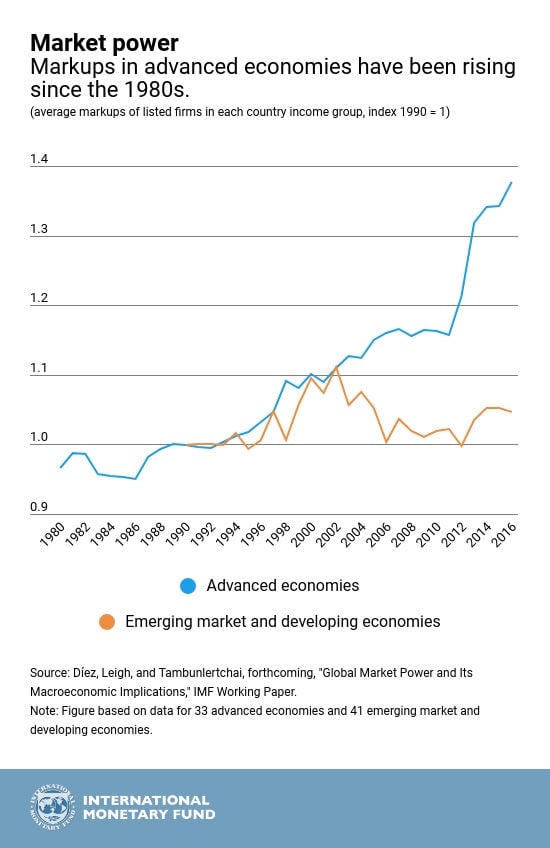

Or at least, it has among rich countries, according to new research by the International Monetary Fund (it’s a working paper, which means it hasn’t been peer-reviewed). To measure changes in market power, the paper looks at corporate markups—the ratio of the price a company charges for a product, and the cost to produce that thing. Among publicly traded firms in advanced economies, markups have surged an average of 43% since the 1980s, explain the authors in a recent blog post. (In poorer countries, by contrast, they’ve barely budged.) What’s more, the pace has accelerated since the mid-2000s.

Why are companies charging so much more than they did 30 years ago? It could be that they need to recoup past investments. (That, for instance, is an argument you frequently hear in defense of the huge markups charged by pharmaceutical companies.)

That doesn’t seem to be the case, however. Instead, the authors found a link between higher markups and both firm profitability and industry concentration (that is, the share of sales that a company has in a given sector). What’s more, as firms increase their market power, they tend to invest less in expanding their productive capacity. Consistent with findings of past studies, the IMF research found a link between rising markups and slumping rates of investment and innovation.

Tech behemoths like Facebook and Google are the poster children for this phenomenon. But the pattern played out in all sectors, according to the study.

What that all adds up to is that corporations are charging customers more simply because they can.

Why this is happening is harder to say; the IMF study didn’t look into causes. However, one clue might lie how the trend varies between countries and regions. For instance, average markups for public firms in the US and Canada have risen much more sharply than for those in Japan. As for Europe, the trend has really only picked up since the mid-2000s.

That variation hints that institutions, particularly government regulation, are factors. This stands to reason; higher markups can be spent lobbying authorities to hike up entry barriers—regulations, licenses, and patent lengths, for example. That’s what economist Luigi Zingales calls the “Medici Vicious Circle” (pdf). He’s referring to Italy in the Middle Ages, when powerful families hijacked democratic institutions, running nation-states as extensions of their commercial dynasties.

Whatever the case, evidence suggests that Big Business isn’t actually good for business—or the long-term growth of living standards. Sobering analysis of American small businesses by David Leonhardt of the New York Times offers a glimpse of how the rise of the corporate titans hurts workers. In 1989, about a third of US workers had jobs at firms with fewer than 50 employees. By 2014, that share had dropped to 27%. Meanwhile, the share of workers employed by huge companies grew.

Diminished industry competition often implies that workers have fewer job alternatives and less leverage to increase their earning power. That is, since businesses don’t have to worry that their employees will be snatched up by competitors, they can afford to pay less.

Sure enough, the IMF study found that as market power rose, the share of income claimed by workers fell. That lost income instead goes to shareholders, who tend to already be wealthy. (In the US, for instance, around half of households own any stocks at all.) The gap in wealth and income widens as a result.

And here’s the final twist of the knife: workers are, of course, consumers too. As their earning power has eroded, so has their purchasing power. The wages they’re foregoing and extra money they’re spending? Both go into corporate shareholders’ pockets—keeping that Medici Vicious Circle awhirl.