A record number of US companies say they’re looking at a bad third quarter

It’s just a week until third-quarter earnings season for US companies kicks off in earnest, and so far the numbers don’t look pretty. The number of companies that have already said they’re looking at a bad third quarter is at a record high, according to Factset (pdf), which has tracked earnings guidance since 2006. Meanwhile, according to Thomson Reuters data, during the last two quarters companies have slashed their earnings expectations more than at any point since 2001.

It’s just a week until third-quarter earnings season for US companies kicks off in earnest, and so far the numbers don’t look pretty. The number of companies that have already said they’re looking at a bad third quarter is at a record high, according to Factset (pdf), which has tracked earnings guidance since 2006. Meanwhile, according to Thomson Reuters data, during the last two quarters companies have slashed their earnings expectations more than at any point since 2001.

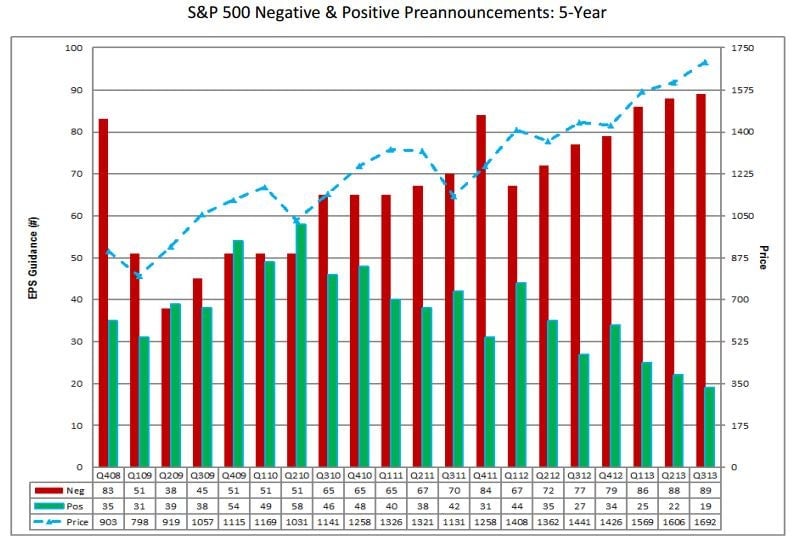

Factset reports that 89 companies—or 82% of those that have made early statements about how their earnings will look—have said that they’re likely to report earnings per share (EPS) that are worse than they expected. Just 19 companies say they’re looking at a better-than-expected third quarter. When it comes to revenues, this is the fourth consecutive quarter in which more than 70% have scaled back their expectations. As the chart above shows, companies’ earnings guidance has been getting consistently more negative for nearly two years.

Much of the unhappy outlook this time comes from IT companies and those that rely on discretionary consumer spending. The latter shouldn’t be too surprising, since US consumer sentiment has been falling over the last few months.

Then again, the S&P 500 has been on a tear over the last few years, regardless of how many companies scale back their earnings expectations. So why the increasing negative talk?

John Butters, the author of Factset’s report, attributes it partly to the fact that companies saw record returns as they bounced back from the recession. They were able to grow earnings more easily and at higher levels in 2010 and 2011 after weak earnings in 2008 and 2009, leading investors to think the good times would continue. But “[i]t is a challenge for companies to grow record earnings on top of record earnings, given the modest economic growth in the U.S., lack of growth in Europe, and slower growth in emerging markets relative to a few year ago,” Butters explained in an email.

So talking down future earnings may be a way to cool investor expectations, and that may explain why the negative outlooks have multiplied even as the market continues to rise. However, the companies’ caution could also be a sign that the economy is in fact weaker than everyone thought.