Looking for income in an incomeless world

The search for income is getting harder, and there’s no shortage of suggestions on where to get a little bit more. But what about the cost? We think that focusing on creating a better return sequence can help investors access more efficient income.

The search for income is getting harder, and there’s no shortage of suggestions on where to get a little bit more. But what about the cost? We think that focusing on creating a better return sequence can help investors access more efficient income.

The baby boomer generation continues to move from its peak earning years into the retirement phase. As it does, it’s become much more income hungry. This appetite is having a big impact on the demand for income-generating allocations. In target-date solutions, for instance, bond allocations for peak earners are typically in single-digit percentages; for retirement-age investors, bonds can make up as much as half of their overall portfolio.

LOOKING FOR INCOME IN AN INCOMELESS WORLD

But the search for income is a challenge today, and isn’t getting any easier. More and more baby boomers will be demanding income-generating bonds, and the income from those bonds is now lower, thanks to years of Federal Reserve quantitative easing, which has shrunk the market and reduced yields.

At the same time, risks inside income-oriented indices are rising. The duration, or interest-rate sensitivity, of bond indices has grown by 30% since 2008. And with the US late in the credit cycle, credit quality is declining. On the equity side, dividend-paying stocks, based on price-to-earnings ratios, are trading at a valuation of 24.8 times earnings.

There’s no shortage of ideas and suggestions on where to squeeze out a little more income today, but there’s not much talk about the cost of that extra income. Many of the areas that people point to for an income boost face large drawdowns if things go wrong. Preferred stocks are a good example: over the past 10 years, the average drawdown in Morningstar’s Preferred Stock category was 8%, and the biggest was about 44%.

It’s clear that simply piling into higher-income trades isn’t the answer.

THE “PERFECT” INCOME SOLUTION

The logical question is: What’s the perfect income-generating solution?

The answer is… it depends. First and foremost, to identify the best solution, every investor has to determine the appropriate trade-off between generating income and the potential principal cost from losses. That’s because staying the course is by far the most important element.

Other factors matter, too. Taxes are often part of the equation, so you’ll have to decide how important pre-tax income is versus after-tax income. Inflation is a consideration, and so is liquidity—how accessible do you want your savings to be as they generate income? And in today’s world, the income/growth mix is key: do you want pure income or income with an option for capital growth?

THE GREATEST HITS: FOUR KEY ROLES FOR INCOME

The “perfect” income solution doesn’t live on an island—it has to be considered in the context of its role in a broader portfolio.

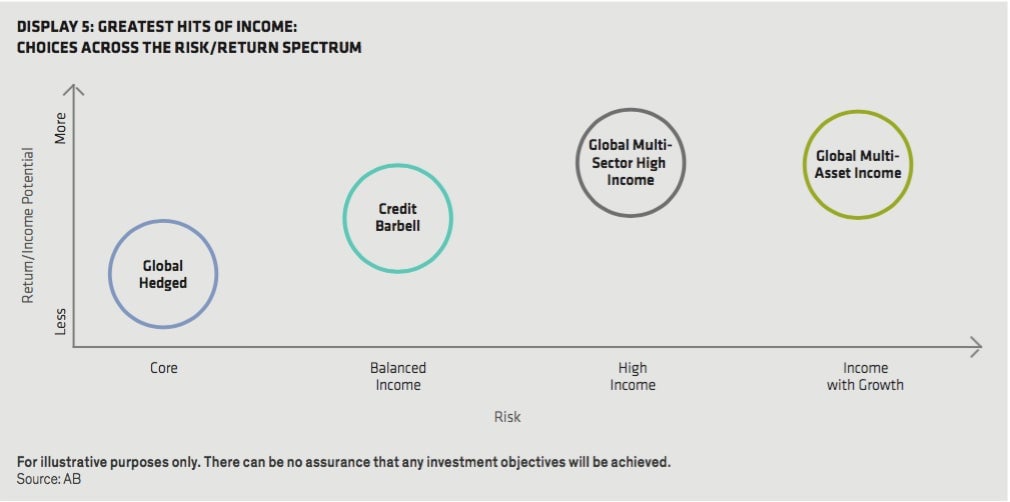

We see four key roles for income: core, balanced income, high income and income with growth. Here are our suggested “greatest hits” solutions for each:

- Core Income: This role is the classic high-quality anchor for a diversified portfolio—the 60/40 stock/bond portfolio—where bonds offset equity volatility. Our greatest hit? A high-quality global bond portfolio that actively pursues income across the developed world. It’s designed to provide solid income and relatively low volatility. The key is to hedge currency exposure—building a better beta. Currency hedging can reduce annualized volatility to about 4%, and it has historically produced better up/down capture than a US-only aggregate portfolio.

- Balanced Income: For investors looking to squeeze a bit more income out of their allocation, a balanced strategy can be a good choice. In our view, the best way to do this is to combine allocations to both high-quality and high-yield bonds in a ”barbell” strategy that balances interest-rate and credit exposure. Think back to the efficient-structure principle of building a better path—as we see it, this is one of the most efficient income structures in capital markets.

- High Income: The next step outward on the income/risk spectrum is a pure high-income solution. In keeping with the building a better path concept, our “greatest hit” uses a straightforward, much more efficient structure that diversifies across regions and sectors. Instead of investing only in developed-market corporate high-yield bonds, this approach integrates EM bonds denominated in both local currencies and major developed-market currencies.

- Income with Growth: In today’s low-yield world, some investors want an option for growth along with income. To do this requires extending the universe to different betas beyond bonds, each of which has different balances of income and growth potential. Other income generators, such as dividend-paying stocks, inject some growth potential into the mix, and nontraditional sources of income for diversification. The high-income solution is mostly income-driven; the multi-asset solution tilts a bit more toward principal growth.

So there’s a lot of flexibility in creating income solutions to fill diverse roles in investors’ portfolios. But good design is critical. Simply investing in broad indices or bolting together different components is inefficient—and can leave portfolios vulnerable to unintended risks.

Well-designed income solutions should reflect the principles of building a better path, with a sequence of returns that aligns with investors’ specific goals and risk tolerances. That requires accessing better beta sources and combining them in more efficient ways. It also means using active management to target higher-probability alpha opportunities and manage risk.

To learn more about responsible investing, visit

AB (AllianceBernstein)

or read

the whitepaper.

This article was produced by AB and not by the Quartz editorial staff.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.