Five things to watch out for this earnings season

The much anticipated and dreaded US quarterly earnings season begins in earnest again today. And it comes at a key juncture for the global economy and markets. The US government remains in shutdown mode, but stocks are not far away from record highs and most macroeconomic indicators aren’t looking terrible. Corporate earnings could be critical, so here are some things to look out for.

The much anticipated and dreaded US quarterly earnings season begins in earnest again today. And it comes at a key juncture for the global economy and markets. The US government remains in shutdown mode, but stocks are not far away from record highs and most macroeconomic indicators aren’t looking terrible. Corporate earnings could be critical, so here are some things to look out for.

Alcoa gets things moving. Though many no longer consider it a bellwether for the US economy, for as long as just about anyone can remember Alcoa’s results have served as the unofficial starting gun on Wall Street for earnings season. And there’s no reason why this should change simply because the aluminum producer has been kicked out of the Dow. The global nature of Alcoa’s business and the fact that it remains a key supplier to many manufacturing industries means it is still a useful barometer for large parts of the economy and stock market. And to the extent that Alcoa still predicts anything, we could be in for a difficult few weeks, as its results aren’t expected to set the world on fire.

CEOs trash-talk the government. Listening to CEOs’ views on industry conditions is always an important part of earnings season, both for investors in stocks and for economy-watchers. But the ritual takes on added meaning this month as the embarrassing budget stalemate in Washington drags on. AT&T CEO Randall Stephenson, who chairs the Business Roundtable, has already stuck his neck out and criticized Washington. Don’t be surprised if others follow suit.

Unusually high earnings growth. Factset is tipping market-wide earnings growth of 3%. Financials are expected to be the strongest-performing sector; energy, the weakest. But numbers without context can mislead. Barclays Capital equity strategists argue that this will be the easiest quarter for companies to achieve earnings growth since 2010, because they are coming off a low base: Results in the corresponding period last year were “decidedly weak”, Barclays says, and probably the low point of the current economic cycle.

But what about the quality? While earnings growth is important, the quality of that growth is even more important. Earnings driven by rising revenues, or “top line” growth, can portend economic expansion. This is vastly preferable to companies growing or maintaining their earnings by cutting costs, or through one-off factors like releases of bank loan loss provisions. Corporate profit margins in the US are already at all-time highs, so evidence of revenue growth will be critical.

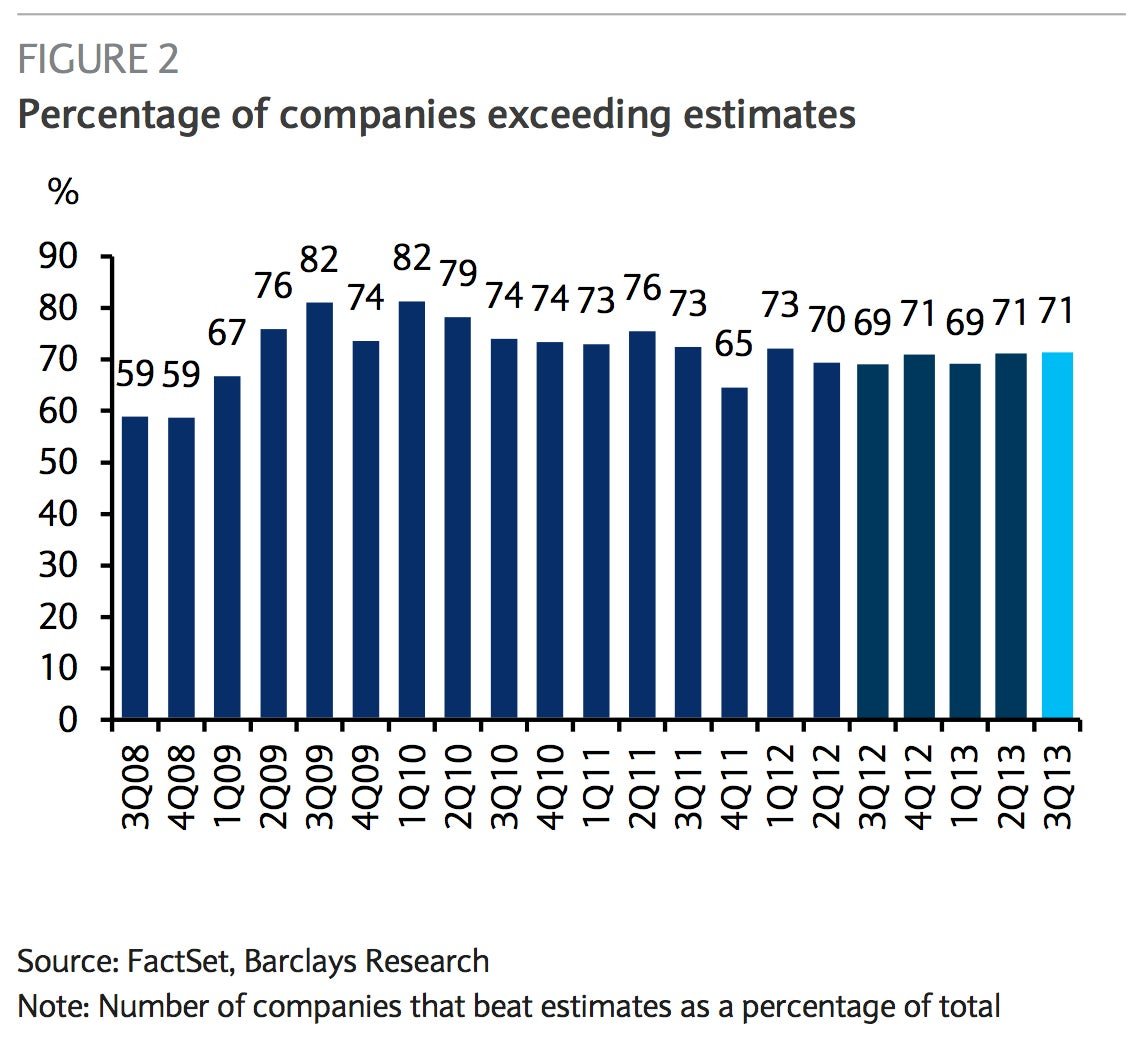

And keep an eye on those outlooks. Hedge fund manager David Einhorn last quarter bemoaned a tendency creeping into corporate America of companies beating their guidance for the reporting period in question, and then cutting their guidance for future periods—thus making it easier to beat forecasts again three months hence. Barclays unfortunately expects this “beat and lower” trend to continue. It’s something to be mindful of, and makes a mockery of companies’ long track record of exceeding forecasts (see chart below).