Some big investors can’t get enough of Europe’s toxic assets

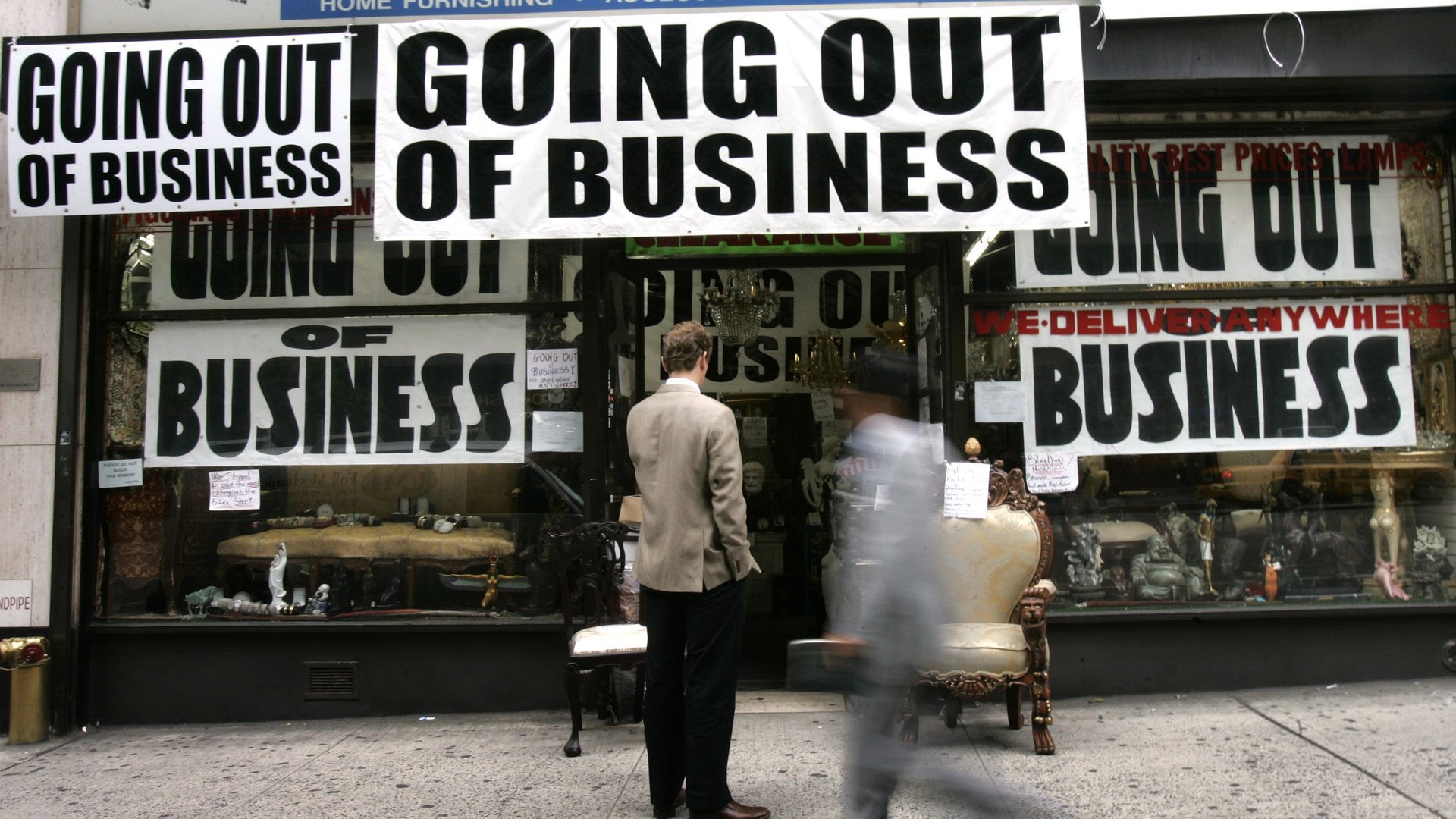

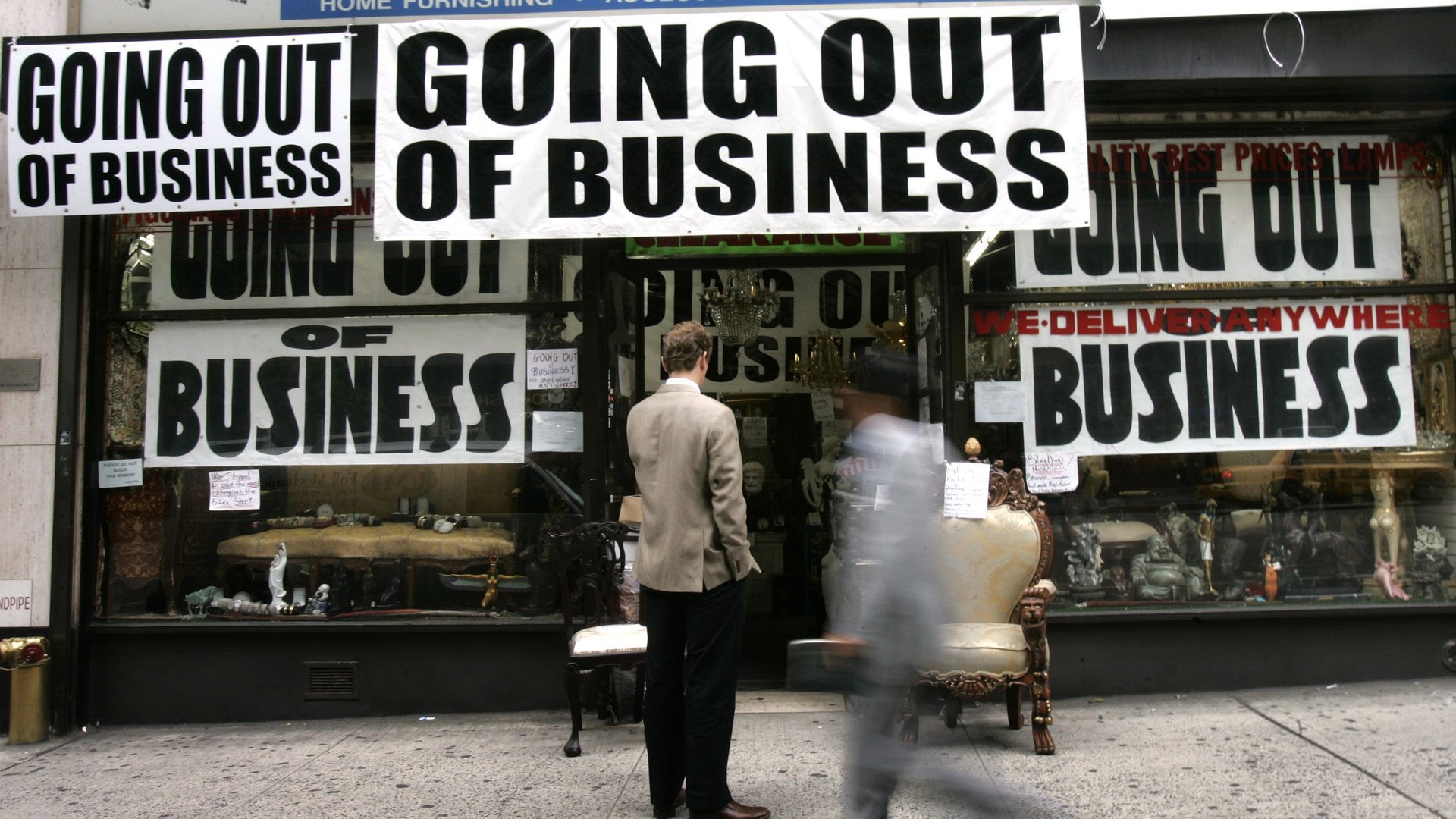

Fortune favors the brave. The past few days have seen a number of bold investments in some of the most troubled corners of the euro zone. The shrewd money always spots opportunities in adversity, but judge for yourself whether these recent moves signal a bottom in the market or foretell burnt fingers:

Fortune favors the brave. The past few days have seen a number of bold investments in some of the most troubled corners of the euro zone. The shrewd money always spots opportunities in adversity, but judge for yourself whether these recent moves signal a bottom in the market or foretell burnt fingers:

Greek banks. Once bywords for toxic debt, Greece’s part-nationalized banks have caught the eye of American hedge fund managers, including John Paulson. But with a third bailout for Greece reportedly in the works, the encouraging signs for the country’s battered economy remain more hope than reality. Greek bank stocks are down by 30% so far this year, but this masks huge volatility in which a well-timed trade can double your money one week and erase all the gain the next. It takes a strong stomach and the courage of your convictions to bet on these shares.

Italian banks. Monte dei Paschi di Siena, Italy’s third-largest bank, revised its restructuring plan in return for a €4 billion ($5.4 billion) state bailout. Among other measures, it pledges to raise €2.5 billion in fresh capital, which is roughly the same as its current market capitalization. Normally the threat of such severe dilution would send shareholders running for the exits, but the bank’s share price surged this morning before settling nearly 2% higher on the day. Investors were similarly nonplussed during Italy’s latest bout of political instability, but if Monte Paschi is unable to raise enough fresh equity on its own, nationalization will wipe out shareholders and pile more debt onto Italy’s already strained balance sheet.

Spanish bonds. The yield on Spanish government bonds has rapidly closed the gap with their Italian counterparts in recent weeks, and with less volatility than US Treasurys to boot. Today the Spanish announced plans for a 30-year bond, its first of that length since 2009, to take advantage of the demand for its securities. Officials have even mooted a potential 50-year issue, which would truly test investors’ faith in an economy struggling with a 26% unemployment rate.

The euro bailout fund. The European Stability Mechanism (ESM), a pooled fund for euro zone rescue operations, saw huge demand for its inaugural bond issue today. The oversubscribed five-year bond was boosted from its initial target of €5 billion to €7 billion, paying an interest rate of only 1.29%. This is hardly a “toxic” asset, in that it carries a AAA rating from Fitch and has only committed €109 billion of its €500 billion in lending capacity (to Spain and Cyprus). Still, there is something ironic about investors so enthusiastically piling into a vehicle associated with economic disaster. In a way, this makes sense in the context of the riskier bets mentioned above. If the ESM fund is not called into further service, it means that things haven’t taken a turn for the worse, with money in the fund not put at risk. Under that scenario, brave bets in troubled markets elsewhere have a better chance of coming good.