How Iraq could flood the global oil market and become a new Saudi Arabia

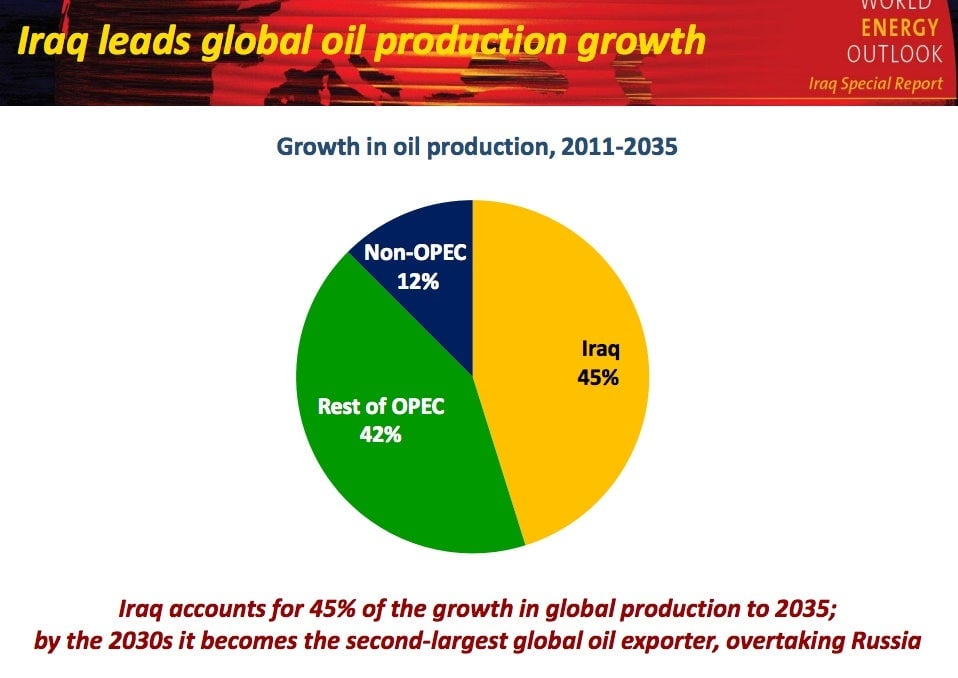

Much is made of the stunning growth of North American petroleum supplies, but a new report says that for the next two decades, Iraq will account for 45% of global supply growth, and literally become a new Saudi Arabia.

Much is made of the stunning growth of North American petroleum supplies, but a new report says that for the next two decades, Iraq will account for 45% of global supply growth, and literally become a new Saudi Arabia.

The downside is that Iraq will not produce 15 million barrels of oil a day by 2020, the volume implied by current contracts in place, says a new report by the International Energy Agency. But Iraqi exports are likely to almost triple to more than 6 million barrels a day by 2035 from 2.6 million barrels a day today, surpassing Russia and making the country the second-largest oil supplier to the rest of the world. Iraq also could become the sixth-largest exporter of natural gas, surpassing Qatar, the current world leader, the IEA says. From these exports, Iraq could be earning almost $300 billion a year by 2035, and have the per capita GDP of Saudi Arabia today.

Numerous recent reports have placed North America including the United States at the center of a global surge in oil production. But the IEA report says that eventually, it is Iraq’s volumes that would help to stabilize global markets by providing a new cushion of spare production supply in addition to the sole current holder of shut-in capacity, Saudi Arabia. “There is a strong alignment between the needs of the global market for growth in Iraq’s production and the needs of Iraq for revenue to build the foundations of a modern and prosperous economy,” the IEA said in the report. “Building such an economy and turning the country into a global energy powerhouse will not be an easy task, but this is a prize within the reach of the people of Iraq.”

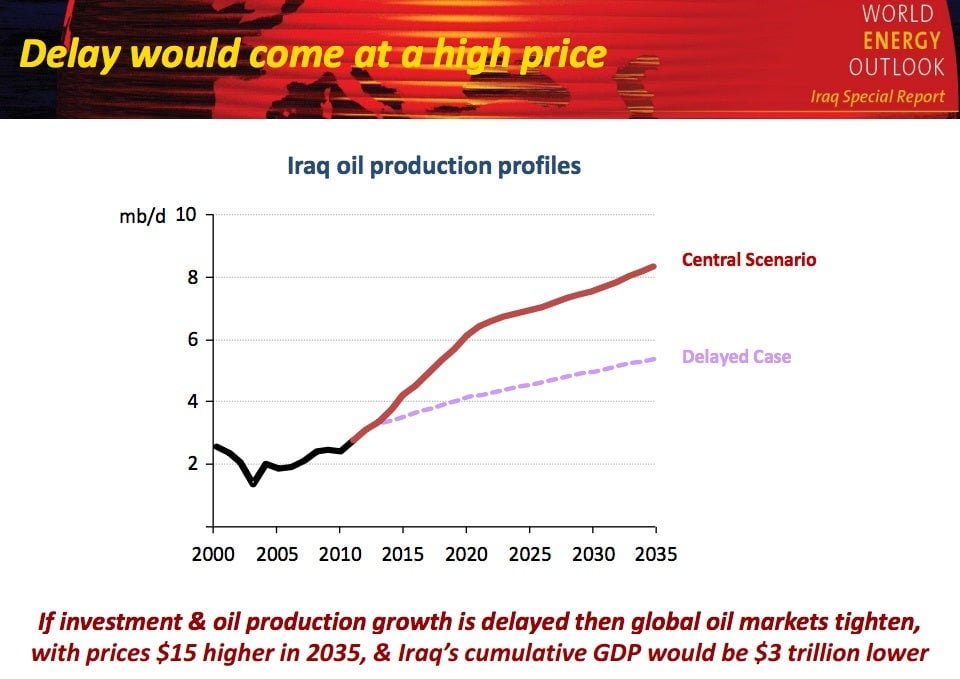

Much would have to go right in what is now among the most chaotic and violent countries on the planet, one whose citizens get electricity just eight hours a day on average. For example, eight million barrels a day of water would need to be transported inland from the Persian Gulf to southern Iraqi oilfields, the agency says. Oilfield investment would have to triple to more than $25 billion a year through 2035 from about $9 billion last year. If all that is done, the IEA says that, including volumes kept for domestic use and not exported, Iraq’s oil production is likely to reach 6.1 million barrels a day by 2020 and 8.3 million barrels a day by 2035.

If this scenario does not play out, and development is slower, global energy markets will be severely strained, pushing projected oil prices up to $140 a barrel, or $15 more than currently foreseen, the IEA says. The IEA defines this case as Iraq producing just four million barrels a day by 2020, or one-third more than today, and 5.3 million barrels a day by 2035. Rather than $5 trillion in cumulative revenue, Iraq could earn as little as $2 trillion.

“Developments in Iraq’s energy sector are critical for the country’s prospects and also for the health of the global economy,” said IEA Chief Economist Fatih Birol, the report’s chief author. “But success is not assured, and failure to achieve the anticipated increase in Iraq’s oil supply would put global oil markets on course for troubled waters.”