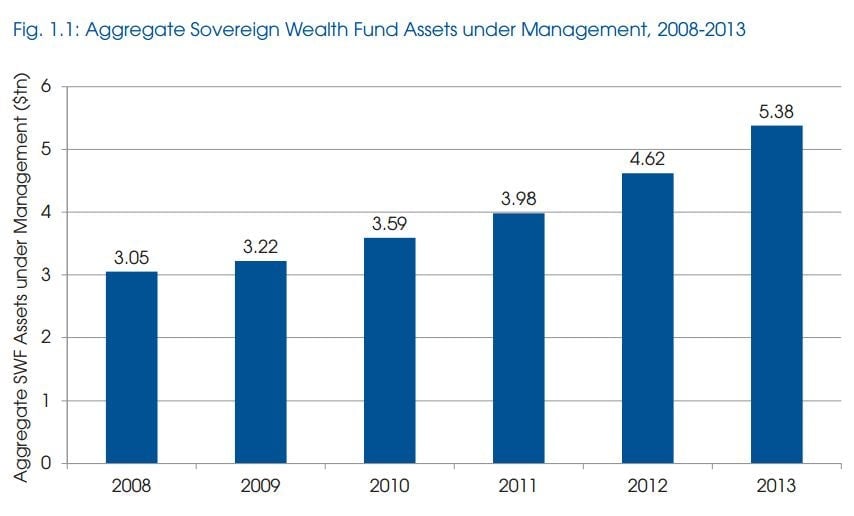

Sovereign wealth funds just had their biggest ever annual increase, to $5.38 trillion

Sovereign wealth funds are booming. Their total value of assets under management worldwide rose from $4.62 trillion in 2012 to $5.38 trillion in 2013, estimates a report released today (pdf) by Preqin, a firm that does analysis of the alternative-asset market (the market for assets beyond stocks, bonds, and cash). That’s the largest increase in assets the industry has seen on an annual basis since Preqin started tracking these funds in 2007.

Sovereign wealth funds are booming. Their total value of assets under management worldwide rose from $4.62 trillion in 2012 to $5.38 trillion in 2013, estimates a report released today (pdf) by Preqin, a firm that does analysis of the alternative-asset market (the market for assets beyond stocks, bonds, and cash). That’s the largest increase in assets the industry has seen on an annual basis since Preqin started tracking these funds in 2007.

Not only are these funds doing reasonably well–63% made money in the last year–but more funds are launching all the time. Preqin’s data evaluated 72 sovereign wealth funds this year, 10 more than last year.

Sovereign wealth funds are clearly becoming bigger players in the investment world. As Preqin points out, their assets under management roughly equal the size of the entire alternative assets industry. This has typically been considered a good thing for the markets. Sovereign wealth funds can take large stable positions, and are better able to sit out recessions than other investors because there’s no date when they will have to call in their money. In late 2007 and 2008, for example, some countries used their sovereign wealth funds to inject money into systemically important financial institutions.

But as they get bigger, they may also have to be more careful. A group of scientists at Monash University and Florida State University found that sovereign wealth funds could be destabilizing to the firms they targeted. And while they had a stabilizing effect during the financial crisis, IMF economists Tao Sun and Heiko Hesse point out that with “large and often opaque positions, sovereign wealth funds—like other large institutional investors—have the potential to cause market disturbances.”