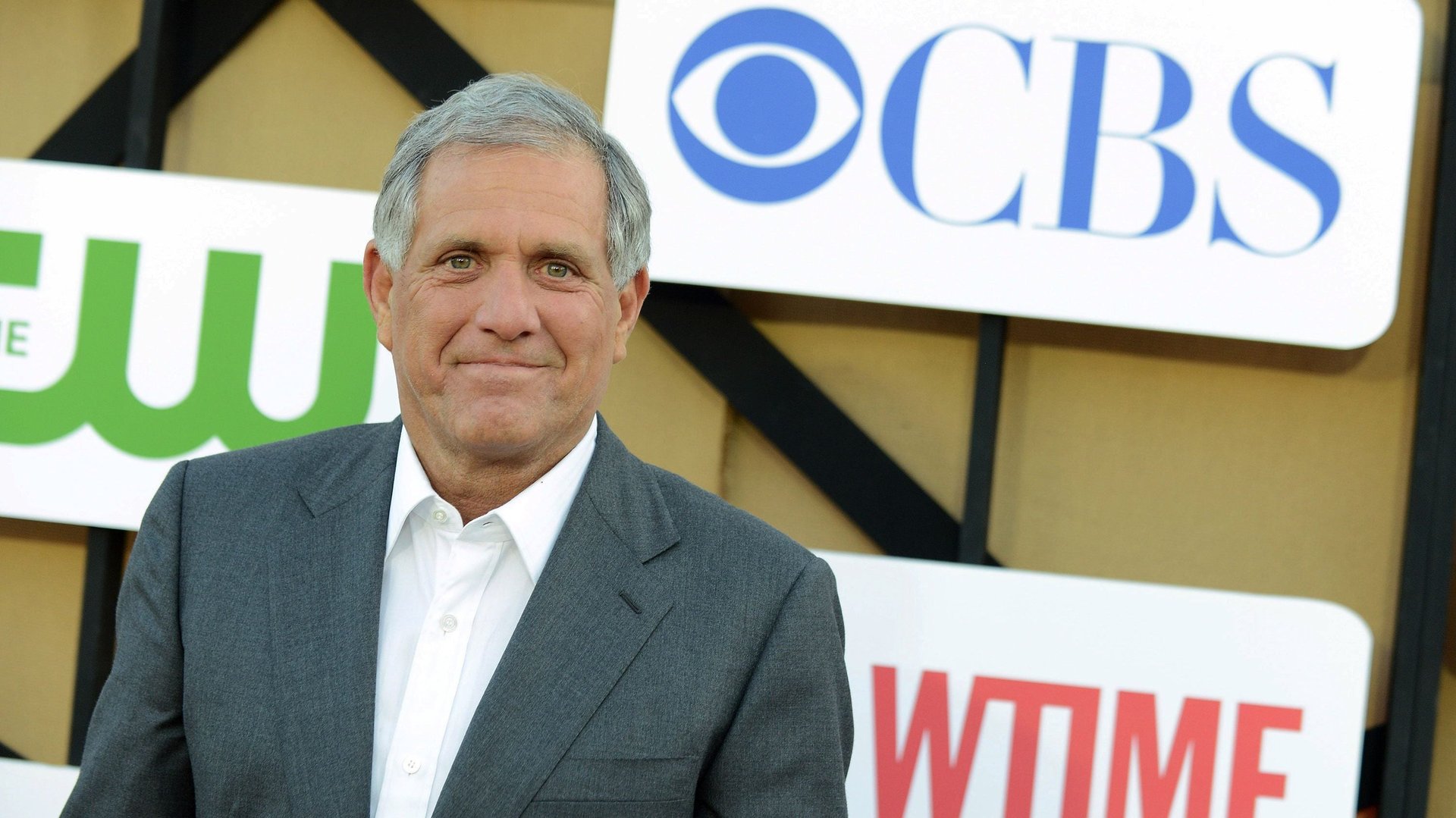

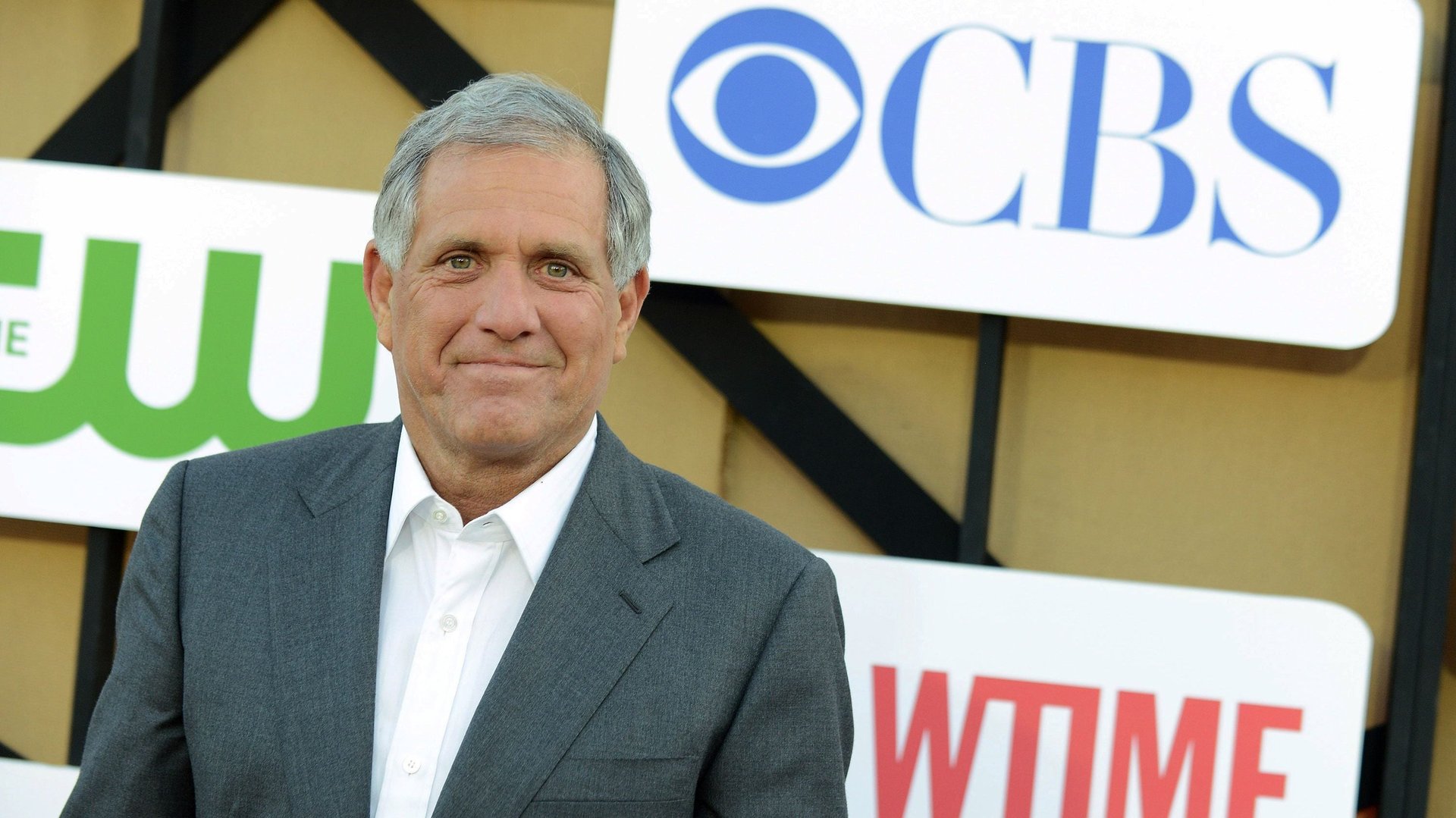

No one on the CBS earnings call asked Les Moonves about sexual harassment

“Thanks so much, guys. Great results.” Those are the kinds of hard-hitting remarks CBS analysts had for CEO Les Moonves on his company’s earnings call on Thursday (Aug. 2).

“Thanks so much, guys. Great results.” Those are the kinds of hard-hitting remarks CBS analysts had for CEO Les Moonves on his company’s earnings call on Thursday (Aug. 2).

Did any of the eight analysts who spoke during the call have questions about the sexual misconduct allegations against Moonves that sent the company’s stock down 11% during the first two trading days of the week, and how they might impact the business? If so, they didn’t ask. They also didn’t ask about Moonves’ legal battle with majority shareholder Shari Redstone—and Moonves didn’t address the issues in his prepared remarks, either.

Moonves was reportedly preparing this week to take potentially uncomfortable questions from analysts. But an investor relations officer advised participants at the start of the call that, on the advice of counsel, the company would only be taking questions related to the CBS’s quarterly results, which came in just above analysts’ expectations for profit and revenue.

Surely, the fact that six women have come forward with allegations of sexual harassment and intimidation (paywall) by Moonves could impact the company’s future financial results. But instead of pressing for information, the analysts who spoke on the call described CBS as building its own internal Netflix, “but better,” and asked questions about the company’s streaming and production strategies, and how the legalization of sports betting might impact the advertising business.

Moonves must have breathed a sigh of relief when the call concluded just before 5:30pm US eastern time. Shares of his company were down about 1% then in after-hours trading, but there was little to answer for.