Hedge funds are jubilant after performing only 30% worse than the S&P 500

Can hedge funds get their mojo back? Even though they’re still under-performing major US stock indices, the third quarter could have been a whole lot worse.

Can hedge funds get their mojo back? Even though they’re still under-performing major US stock indices, the third quarter could have been a whole lot worse.

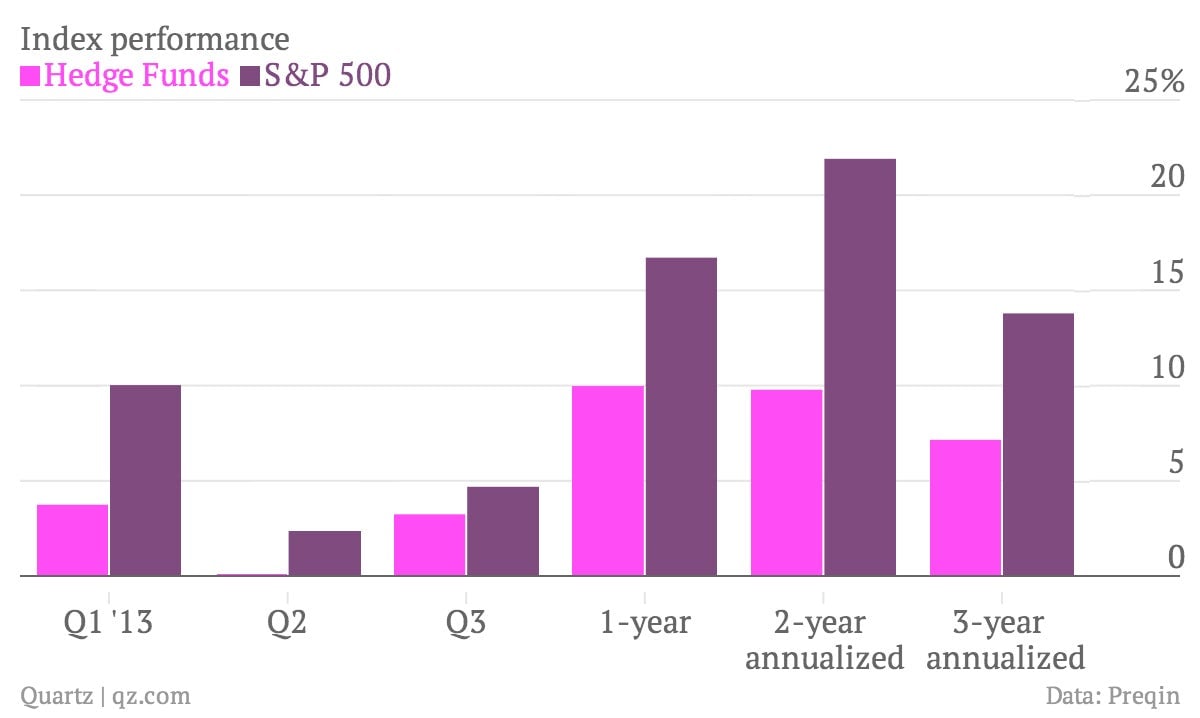

New data show hedge funds averaged a 3.24% return (pdf) in the third quarter, after struggling to return 0.06% in the second quarter. “Hedge funds enjoyed a robust recovery from a subpar Q2 2013, with single-manager funds eclipsing their near-neutral second-quarter returns by more than three percentage points,” wrote analysts from Preqin Ltd., which compiles data from hedge funds.

While hedge funds’ third-quarter performance is a clear improvement, it leaves out one simple fact: a hedge fund’s investors still would have earned more if they had invested in a basic S&P 500 index. In the third quarter, the S&P rose by 4.69%. And over the last year, the S&P 500 has earned 16.72%, while hedge funds averaged 9.98% over that period.

Interestingly, however, the industry is still experiencing a revival in investor interest. Hedge fund inflows hit a five-year high in September, and a total of $95.3 billion for 2013. Even the Man Group, which hasn’t seen net inflows in two years, saw net $700 million (paywall) in the third quarter.