Is Jamie Dimon worth the trouble? JP Morgan’s stock price doesn’t argue for it

Why do JP Morgan’s investors allow Jamie Dimon to stick around? Reports suggest the bank will pay $13 billion–the largest fine ever levied on a US company–to settle a civil case related to its sales of mortgage bonds during the financial crisis. But Dimon is still walking on air. A shareholder proposal that would have split Dimon’s titles of CEO and chairman into two separate roles failed miserably in May. By all accounts, regulators and prominent investors, including Warren Buffett, have no desire to see Dimon go.

Why do JP Morgan’s investors allow Jamie Dimon to stick around? Reports suggest the bank will pay $13 billion–the largest fine ever levied on a US company–to settle a civil case related to its sales of mortgage bonds during the financial crisis. But Dimon is still walking on air. A shareholder proposal that would have split Dimon’s titles of CEO and chairman into two separate roles failed miserably in May. By all accounts, regulators and prominent investors, including Warren Buffett, have no desire to see Dimon go.

Most of these notables argue that Dimon is a gifted leader and steered the bank through the financial crisis with flying colors. Indeed, he led the bank through the crisis without a loss.

“On Wall Street, he’s perceived as Ironman because shareholders have done very well staying with Jamie Dimon. The stock price under his [stewardship as CEO] is better than pretty much any other bank CEO,” CLSA analyst Mike Mayo said in an interview with Bloomberg TV today.

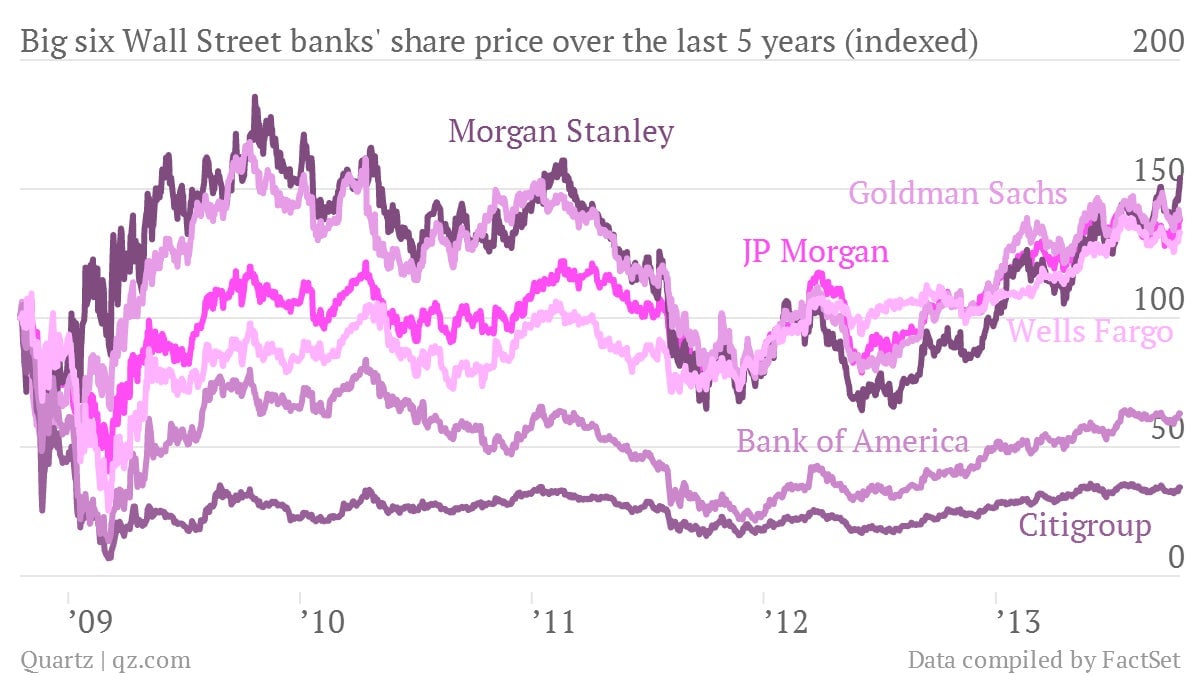

But a closer look at the numbers suggests Dimon’s performance isn’t all it’s cracked up to be. Over the last five years, JP Morgan has done well in comparison to other banks, but it hasn’t been a standout. In the last five years, shares of JP Morgan have risen 38%. Then again, shares of Morgan Stanley, Goldman Sachs, and Wells Fargo are up 58%, 39%, and 33%, respectively.

The value of Dimon’s leadership is even less clear if you look at the bank’s performance in 2013. JP Morgan has actually been the worst-performing major US investment bank this year, though it doesn’t lag by much.

True, JP Morgan is still considered one of the strongest banks on Wall Street–stronger than Morgan Stanley, which saw the most improvement in its share price by both measures. But those tempted to wipe JP Morgan’s legal troubles aside because of the bank’s stock market performance might want to rethink their argument.