How the rise of modern regulation is changing the finance industry

Increased regulation isn’t just a temporary challenge for global financial institutions–it’s the new reality.

Increased regulation isn’t just a temporary challenge for global financial institutions–it’s the new reality.

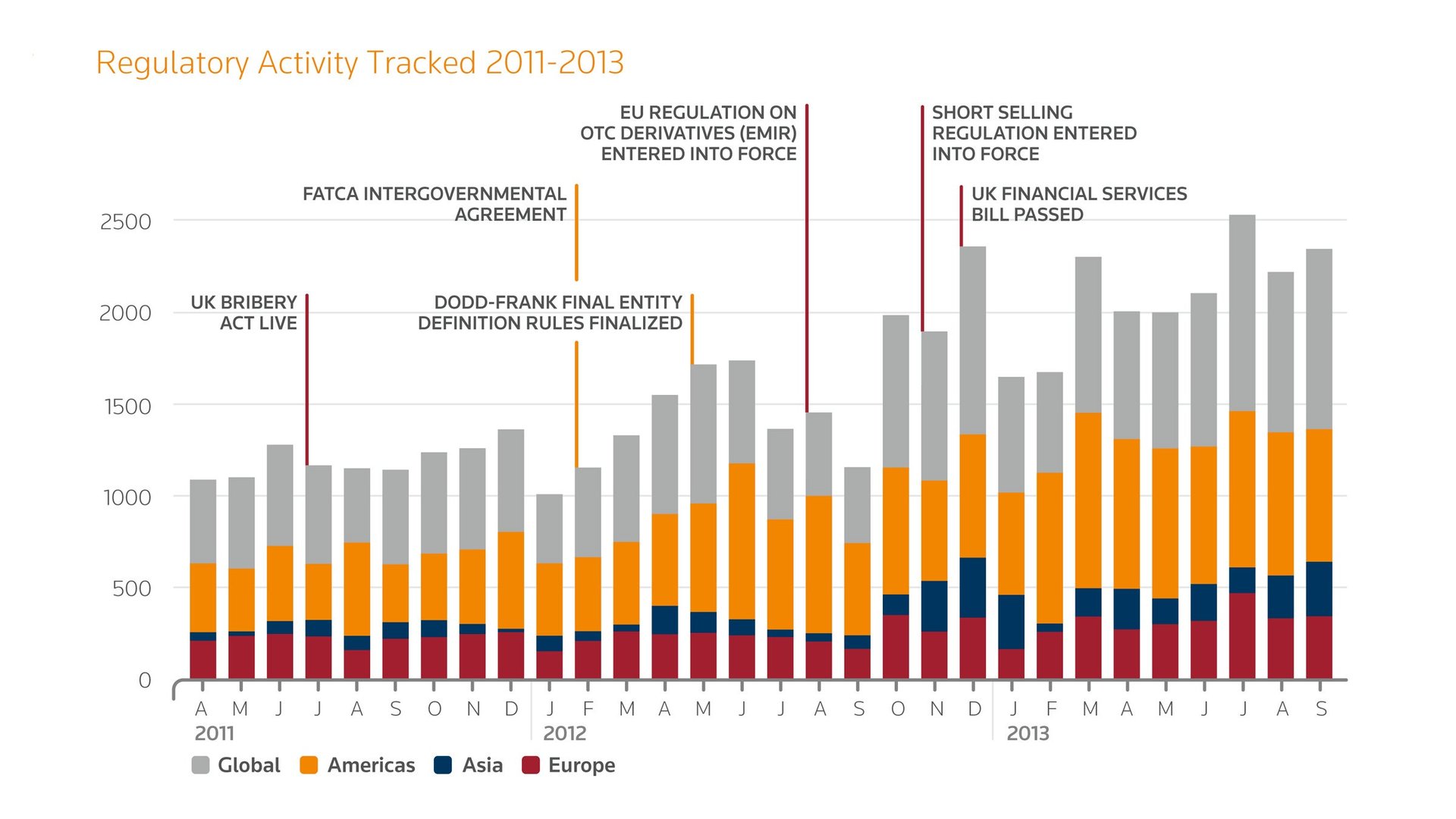

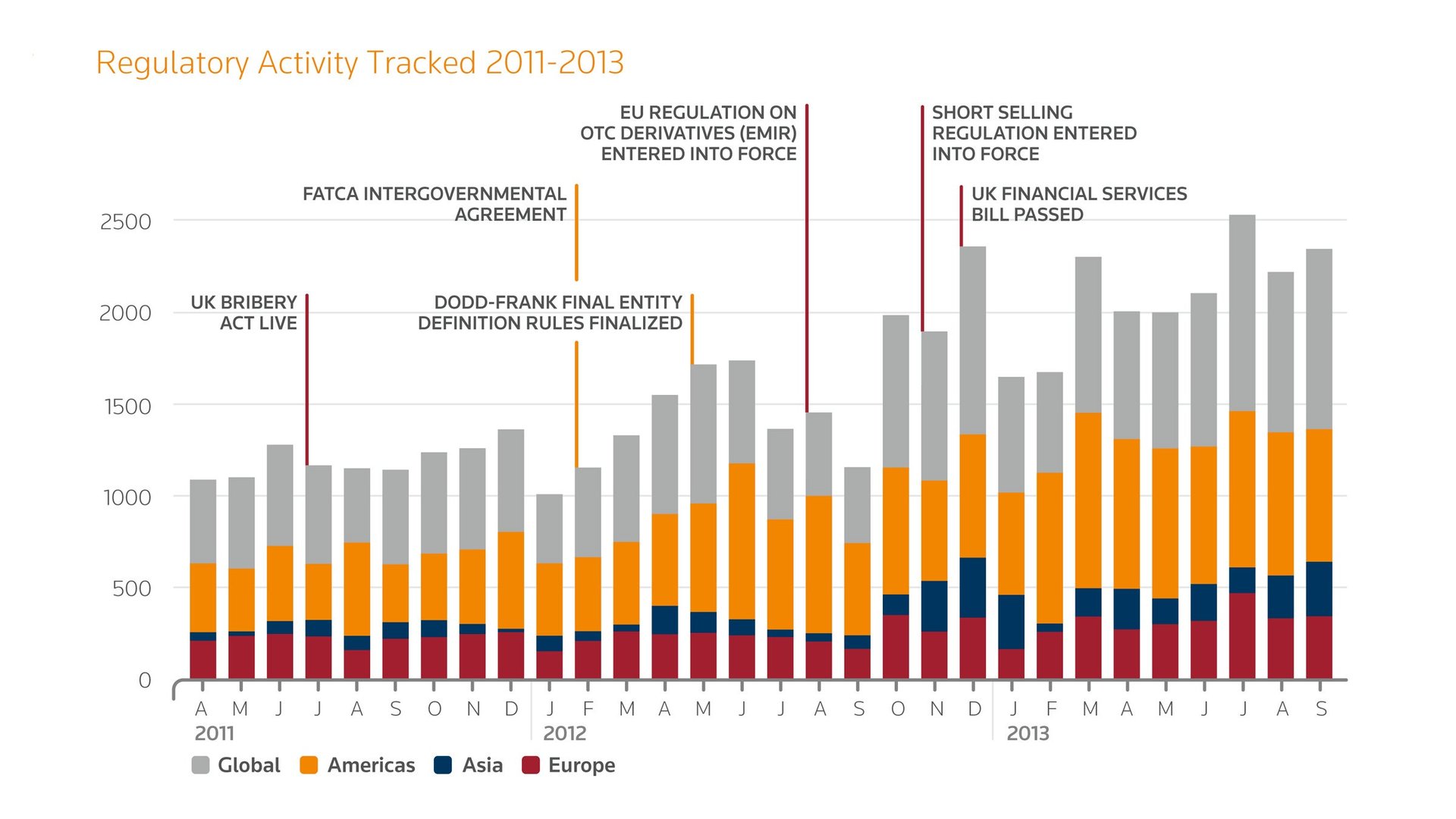

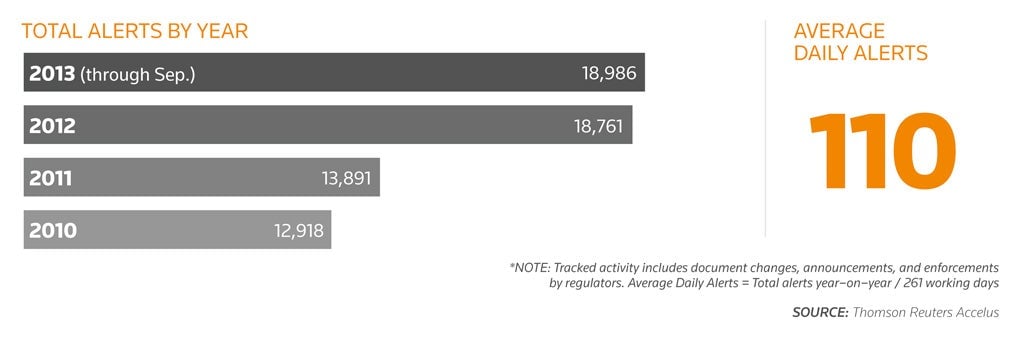

New research from Thomson Reuters published in its Q3 TRust Index shows that the global uptick in financial regulation continued to gain momentum during the third quarter of 2013. Thomson Reuters Accelus tracked an average of 110 regulatory changes every day in the third quarter of 2013, about double the daily updates the tool recorded during the same period in 2010. Through September, the number of tracked regulatory alerts this year has already reached an all-time high of 18,986.

While post-financial-crisis increased regulations are aimed at reducing risk in financial markets around the world, such changes come with significant and widespread implications for financial institutions.

“People used to talk about regulation in terms of a tsunami that would wreak havoc and then go,” said Scott McCleskey, the global head of regulatory intelligence at Thomson Reuters. “This is more like global warming, in that the tide just continues to rise.”

According to McCleskey, institutions must think of the costs of new rules in terms of both the capital they will need to keep on hand, rather than investing, and the people and automated systems they must add to comply with regulations. In the third quarter, as many as 10,000 jobs were added in the financial sector, most of which were roles related to compliance, risk, or regulatory-related functions.

And in a recent Thomson Reuters survey of compliance officers, over 80% responded that they expected future increases in the amount of regulatory information they must monitor. “We don’t see any appreciable abatement to the amount of work for financial institutions,” McCleskey said, adding that even if the passage of new regulation around the world were to slow, banks would still need to adjust in order to keep up with already-enacted measures.

McCleskey also pointed to another cost of regulation–the cost of non-compliance.

In the United States, Bank of America and JP Morgan have recently been fined for malfeasance, with JP Morgan tentatively facing a record $13 billion settlement with the U.S. government for wrongdoing relating to its mortgage-backed securities business.

That said, while regulations might cause financial institutions to scale back certain business or reduce exposure in some countries, it is likely too soon to predict what this new regulatory environment will mean for markets in the long term.

“Banks have less money to make a profit, but you also have to weigh that the net result is meant to be a safer industry,” McCleskey said.

Find out more about the Index’s findings on what media sentiment analysis tells us about the top global financial institutions and read the full Q3 Trust Index report here.

This article was written on behalf of Thomson Reuters by the Quartz marketing team and not by the Quartz editorial staff.