Thomas Edison thought gold would be worthless, and other money predictions from the past

If you were to put money on predicting the future of currencies, it’d likely be a losing bet. Just 120 years ago, credit and debit cards were so remote that they were literally science fiction. Luminary Thomas Edison erroneously believed gold was on its way out in the early 1900s. But other predictions about the future of cash have been more on the money, including concerns about data misuse long before the age of electronic transactions.

If you were to put money on predicting the future of currencies, it’d likely be a losing bet. Just 120 years ago, credit and debit cards were so remote that they were literally science fiction. Luminary Thomas Edison erroneously believed gold was on its way out in the early 1900s. But other predictions about the future of cash have been more on the money, including concerns about data misuse long before the age of electronic transactions.

As part of What Happens Next, our special project exploring the far-off future of the global economy, we looked at how the thinkers of the past thought we’d be paying for the purchases of today. Their predictions remind us that the future is not as certain as we think.

1888 (for 2000) / Free cash

At least 50 years before credit or debit cards were conceived of, science-fiction writer Edward Bellamy described a cashless society in his novel Looking Backward. He wrote that these cards would “totally obviate” normal business transactions, the passing of money between customers, and shopkeepers. Unlike contemporary banking systems where, in the words of businessman Robert Kiyosaki, people “live from credit-card payment to credit-card payment,” Bellamy’s fictional state gave everyone a generous allowance to spend.

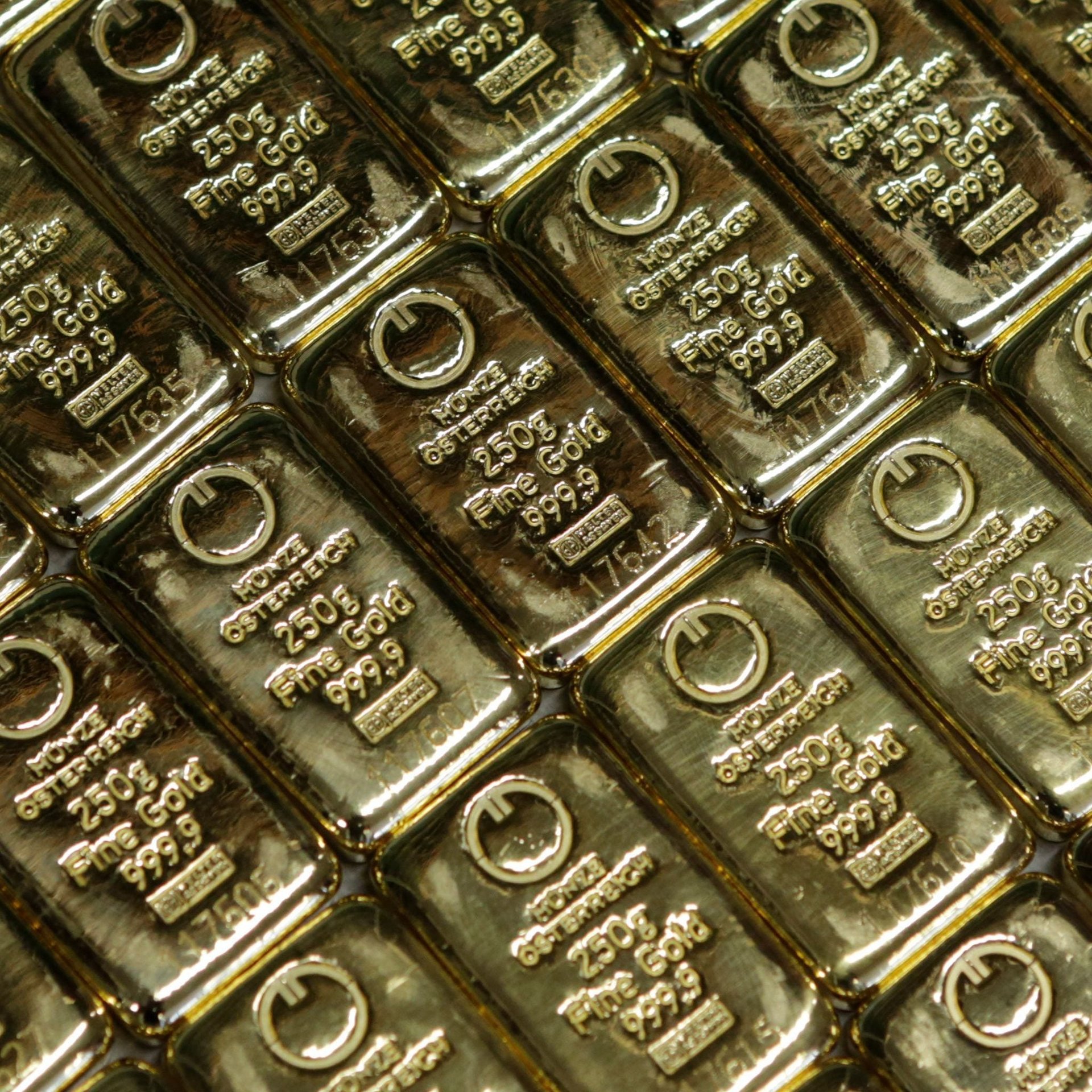

1911 (for 2011) / Not worth its weight

In one of his dimmer moments, Thomas Edison declared gold was on its way out. “The day is near when bars of it will be as common and as cheap as bars of iron or blocks of steel,” he claimed. The reason? A chemical philosopher’s stone—“the secret of transmuting metals”—was close at hand, and soon “it will be an easy matter to convert a truck load of iron bars into as many bars of virgin gold.” As crazy as it sounds, Edison’s vision of a gilded world of golden taxicabs and ocean liners is still a remote possibility: Scientists can now turn one metal into another, but it’s expensive, energy-consuming, and produces tiny quantities at very high cost. Meanwhile, though gold still has a steady store of value, in recent months it has lost favor with investors, leading to its price falling.

1950 (for 1970) / Haves and have-nots

Diners Club card president Alfred Bloomingdale foresaw a cultural and socioeconomic divide across two classes of people: those with credit cards, and those without. When that chasm emerges, “there’s going to be one hell of a split in society,” he said. Debit cards have somewhat bridged that divide—though the rise of cashless establishments that rely entirely on card systems are beginning to put a strain on people who are unable to open bank accounts.

1968 / Privacy protector

Fifty years ago, few people could foresee what a cashless society might look like. But when Paul Armer of the RAND Corporation testified on the topic, he tried to warn a flummoxed US senate subcommittee about the privacy concerns that might come with it. Armer foresaw that a whole lot of data on how people spent their money would be created as a byproduct of transactions going digital—and that this information would be ripe for misuse. “The payoff to successful snooping is much greater when all the facts are stored in one place,” he said, referring to the control banks could have. He called for proper governmental safeguards to be put in place and for a promise to protect citizens’ privacy. That promise never came, but for those who share Armer’s fears, cryptocurrencies are being used to subvert the centralization of this kind of monetary power.

1976 / Tokenism

The British economist Friedrich August von Hayek suggested an alternative to present-day coins and notes in his book Denationalisation of Money: The Argument Refined. Rather than clinking currency, he suggested “plastic or similar tokens with electronic markings which every cash register and slot machine would be able to sort out, and the ‘signature’ of which would be legally protected against forgery.” While modern currency innovations do have electronic signatures of sorts, we’ve bypassed von Hayek’s physical “tokens” all together, leapfrogging straight to cryptocurrency’s virtual tokens.

What do the experts of today think the money of tomorrow will look like? Read some current predictions about the Future of Money.