Watch out, Puerto Rico—the hedge funds are here to save you

Puerto Rico is in a world of hurt. Not only is it impoverished, it’s finding it ever harder to borrow money from financial markets. But fear not, frail Puerto Rico: Speculators are coming to your rescue!

Puerto Rico is in a world of hurt. Not only is it impoverished, it’s finding it ever harder to borrow money from financial markets. But fear not, frail Puerto Rico: Speculators are coming to your rescue!

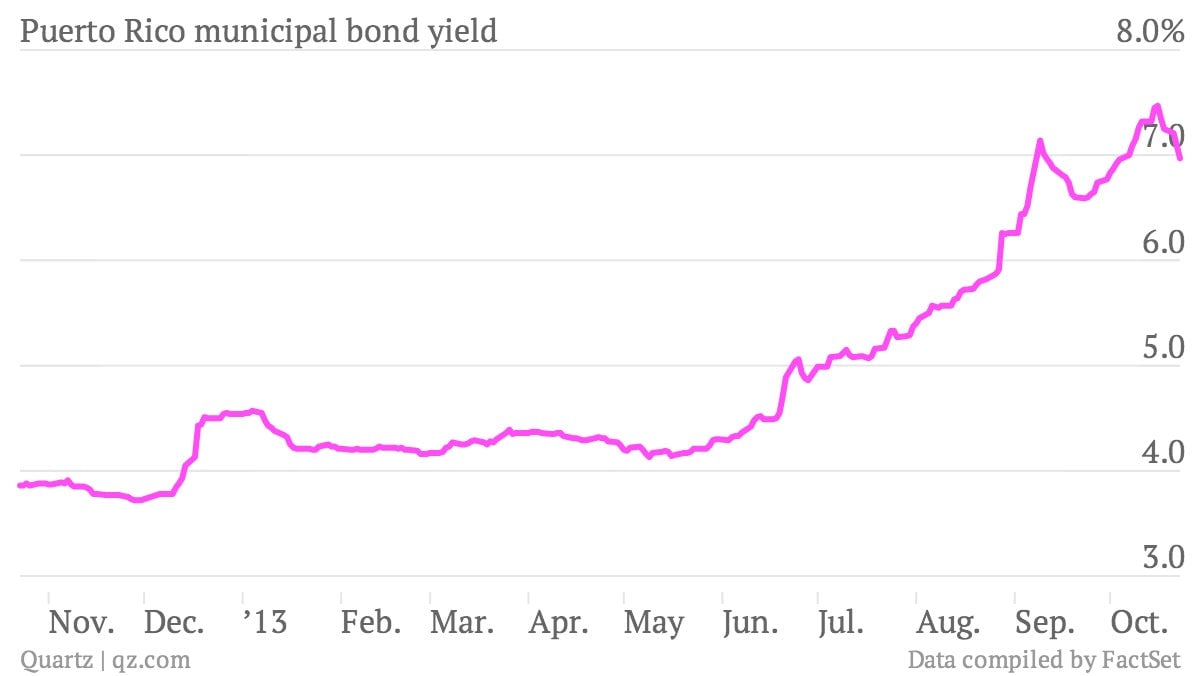

When we first wrote about the US Caribbean territory last month, the yield on Puerto Rico’s municipal bonds—the price of its borrowing—had topped 7%. In Europe, that was seen as the danger level for government debt, when debt-servicing costs start to run out of control. We were particularly concerned about mutual funds, many of which had a lot of money tied up in Puerto Rican debt and stood to get hit hard if the territory defaulted.

But now there’s an influx of new investors. Bloomberg reports that Maglan Capital, MeehanCombs, and Marathon Asset Management have all been buying up Puerto Rican debt—and they’re probably just the tip of the iceberg. Trading in the bonds has soared, from an average of $3-5 billion traded per month to $20 billion in September according to Citigroup analysts, reports the Financial Times (paywall).

“Crossover investors”—hedge funds and distressed debt investors—are willing to take on more risk than Puerto Rico’s former investors: mutual funds. That could save the island’s bacon, at least temporarily. But hedge funds are are also more fickle than mutual funds; although some may be betting that the Puerto Rican government can make structural reforms that will return the territory to growth, others are just in for a good short-term deal. Hedge funds also infiltrated Greece and Argentina ahead of their defaults.

For now, at least, it’s a good deal for the funds. “Many traditional mutual funds have been selling the securities at a discount, and given several entities in Puerto Rico sell bonds, liquidity is good. That is not usual in the muni market,” an unnamed hedge fund manager told the FT. Not to mention that Puerto Rico’s debt has the added perk of being “triple-tax-free,” exempt from federal, state, and local taxes. But easy come, easy go.