In search of clean energy, investments in nuclear-fusion startups are heating up

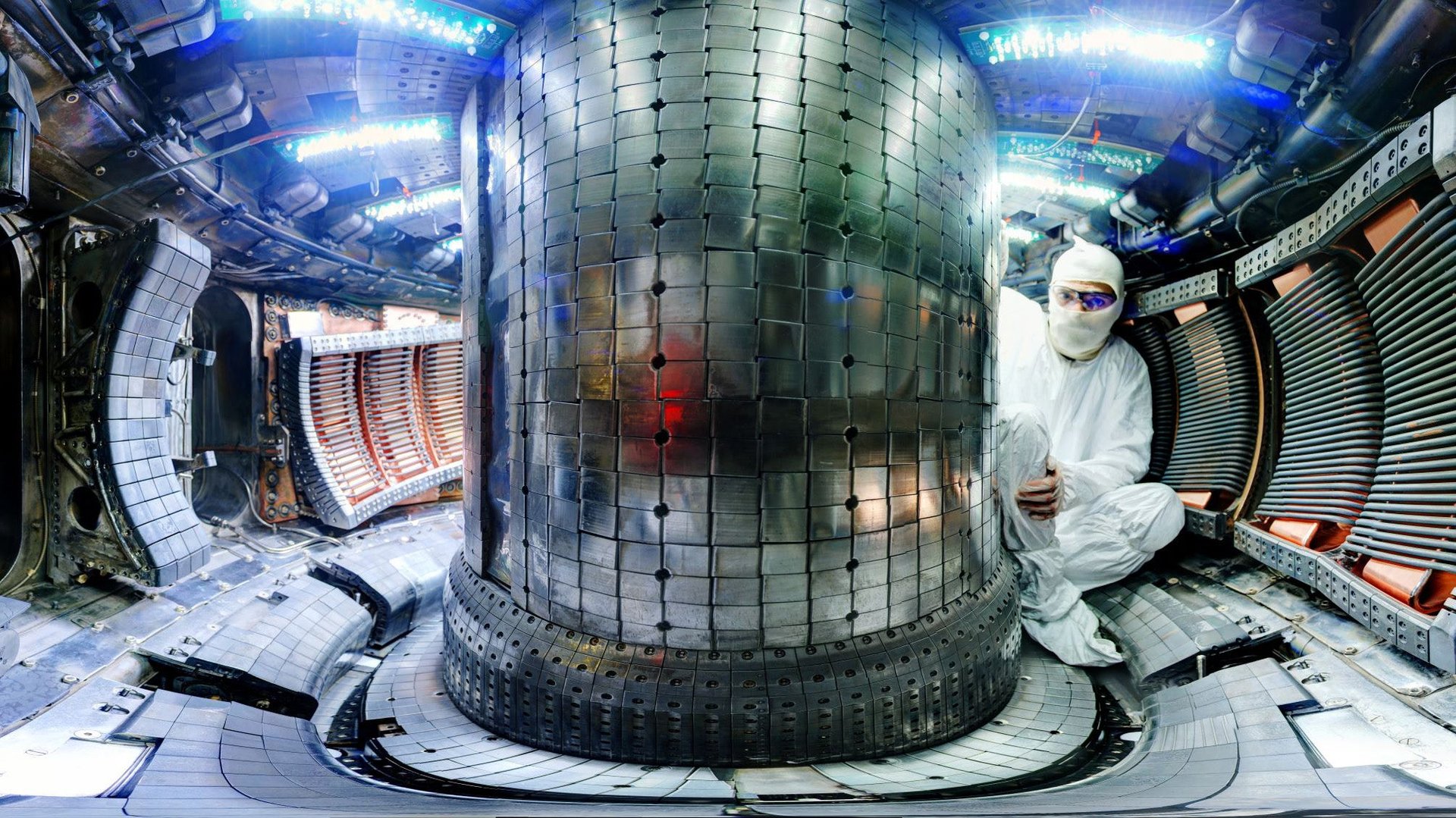

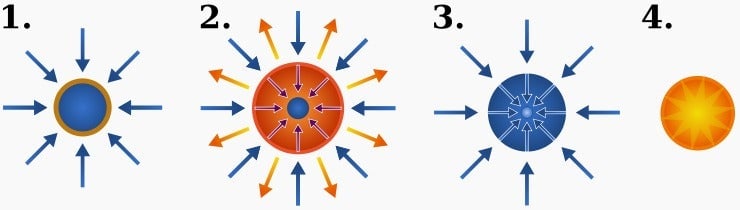

For the last 25 years, researchers at the Massachusetts Institute of Technology have been quietly creating and studying a piece of the sun, barely half a mile from the Charles River between Boston and Cambridge. Every so often, for merely two seconds at a time, a specialized reactor owned by MIT uses huge amounts of electricity—enough to power all of the city of Cambridge—to heat gases inside a protected chamber to near 100 million °C. The researchers’ goal is to master nuclear fusion, the process that gives the sun all its energy.

For the last 25 years, researchers at the Massachusetts Institute of Technology have been quietly creating and studying a piece of the sun, barely half a mile from the Charles River between Boston and Cambridge. Every so often, for merely two seconds at a time, a specialized reactor owned by MIT uses huge amounts of electricity—enough to power all of the city of Cambridge—to heat gases inside a protected chamber to near 100 million °C. The researchers’ goal is to master nuclear fusion, the process that gives the sun all its energy.

Wielding the power of an artificial star on Earth to generate electricity has great advantages over our current sources of energy: it produces no carbon, sulfur, or nitrogen emissions; we have enough of the fuel used in the process—istopes of hydrogen—in the world’s oceans to run fusion power plants for billions of years; it is energy dense, so it takes up just a fraction of the space of, say, a solar farm producing the same amount of energy; it can be turned on whenever energy is needed (unlike wind and solar power, which are intermittent); and there is no possibility of a meltdown like the one that occurred in Fukushima in Japan in 2011. It has some downsides: it needs water for cooling (a problem at a time when water is becoming a scarce resource), and it will produce low-level radioactive waste (though it will be less dangerous than the highly radioactive waste produced in current nuclear power plants).

It mostly sounds too good to be true, and so far it has remained so.

These MIT researchers are the latest in a long line of scientists who have worked on the fusion problem since the 1930s. Over that time, governments around the world have poured billions of dollars into the endeavor. If the history of fusion science were to be summed up in one word, it would be “hubris.” Many great minds working in various decades have declared that fusion would be achieved in 10 to 20 years—then had to admit failure. Those failings have been so constant it’s become a joke: Nuclear fusion is the energy of the future and will always be.

And, yet, the dreamers haven’t given up. If anything, the field is heating up. Over the last 10 years, the number of privately funded startups working on nuclear fusion has ballooned from just a handful to 20, and many are doing quite well. TAE Technologies, for instance, has raised nearly $800 million, according to Pitchbook, and many others have raised tens to hundreds of millions of dollars. Meanwhile, ongoing publicly funded projects like the $22 billion International Thermonuclear Experimental Reactor (ITER) are helping that private money go even farther.

One of the most promising of those startups is Commonwealth Fusion Systems (CFS), the Boston-based startup run by the MIT researchers working near the banks of the Charles River, which believes it can bring fusion power to market in 15 years. Though there are other companies pursuing fusion technology, CFS has a number of advantages over its competitors. One—which Quartz can now report for the first time—is that it’s funded, in part, by Breakthrough Energy Ventures led by a group of billionaires, including Bill Gates, Jeff Bezos, Jack Ma, Mukesh Ambani, and Richard Branson.

The fund is closely watched by others in the industry—not just because of the names behind it, but also because of the technical team that runs it and the bold vision it has set out to fight climate change. Its investment in CFS signals to others that a breakthrough in fusion may be closer than most think. The company that first develops financially feasible nuclear fusion won’t just give the world a new source of carbon-free energy, but can also expect to make billions.

Look to the stars

Every nuclear power plant in the world today runs on fission reactions, triggered by firing high-energy neutrons at a large atom, such as uranium. The splitting of the large atom releases lots of energy, which can be used to heat water and run steam turbines to produce electricity. The reaction also spits out more neutrons, which can go on to break apart other uranium atoms and so on.

Fusion is harder. It involves bringing together two small atoms, typically different isotopes of hydrogen (called deuterium and tritium). The positively charged nuclei of these two atoms naturally repel each other—just like the north poles of two magnets would. The fusion reaction must overcome the electrostatic force of repulsion before the atoms can combine to form a helium atom and in the process release energy in the form of high-energy neutrons.

The sun achieves fusion by wielding the force of gravity. The sun’s mass causes matter to compact to the point where hydrogen atoms are forced to fuse and release energy. That energy, in turn, pushes the matter back out away from the sun’s center of gravity. The sun, in effect, is a ball of matter that is being stopped from falling into itself by the trillions of fusion reactions occurring inside it every second.

On Earth, we can’t use gravity because our planet doesn’t have anything near the mass of the sun. So scientists use other forms of energy to bring hydrogen atoms as close as possible to each other. Heating the hydrogen gas using radio waves, for instance, forces the atoms to travel at incredible speeds, collide, and, on occasion, fuse. The easiest way to quantify the heat energy added to the system using radio waves is to measure the temperature of the gas. Experiments have shown that fusion can occur above temperatures of 100 million °C, many times higher than that at the center of the sun.

No known material can withstand (and thus contain) such an incredibly hot gas. But without containing the gases, the fusion reactor would be like a pool table without rails: the balls are more likely to simply fall off the edges than they are to collide and stay on the table.

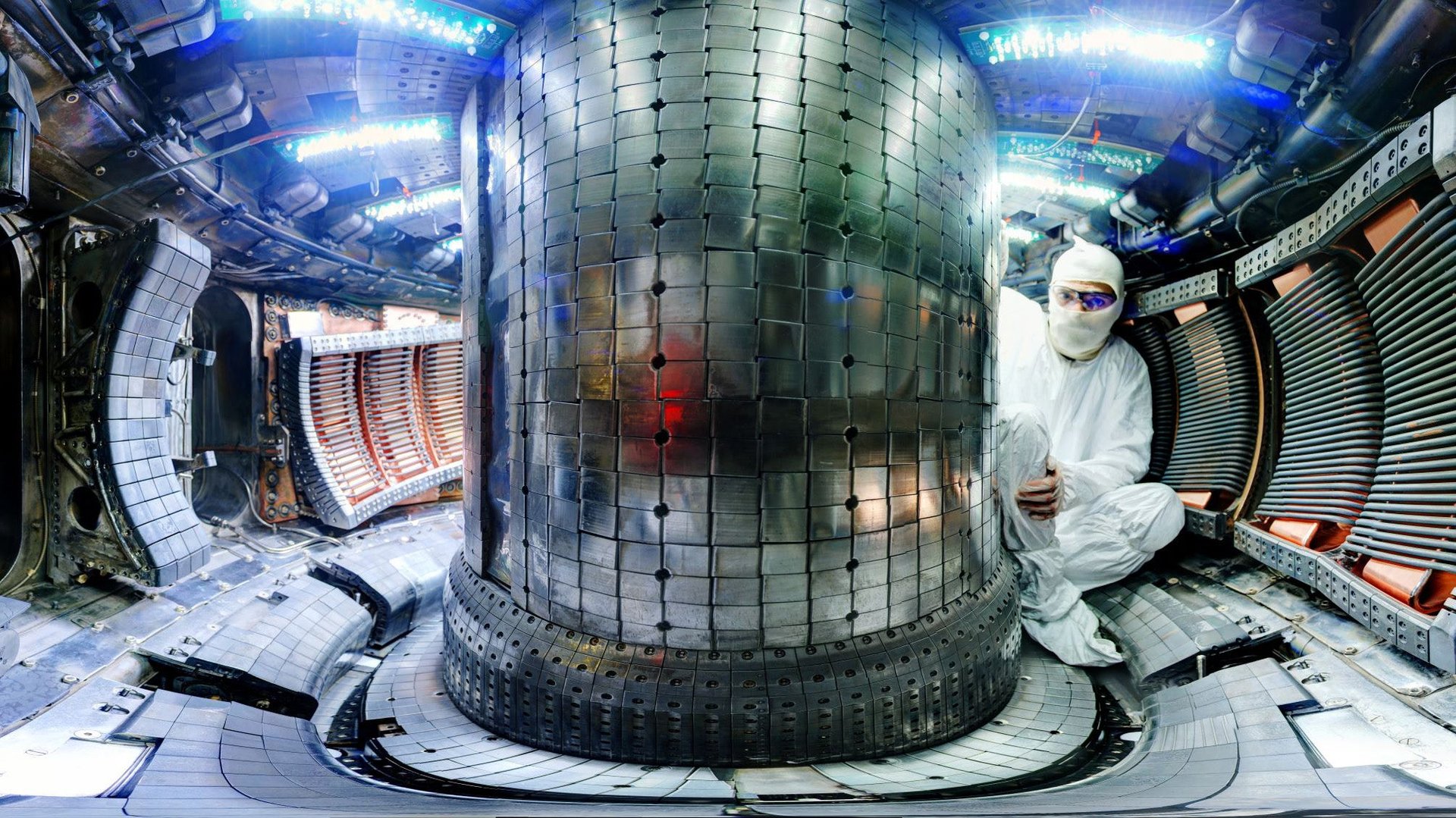

Over the decades, scientists have found nifty ways to overcome the material constraint of containing extremely hot gases. The two most common methods are magnetic confinement and inertial confinement.

At temperatures over 100 million °C, atoms are stripped of their electrons, creating a soup of charged particles called plasma, which can interact with magnetic forces. By creating a strong magnetic force, you can direct the plasma along a specific pathway—and if the magnetic lines are set up in the right way, the movement of plasma particles can be confined so as to not come in contact with other non-plasma matter. This is magnetic confinement.

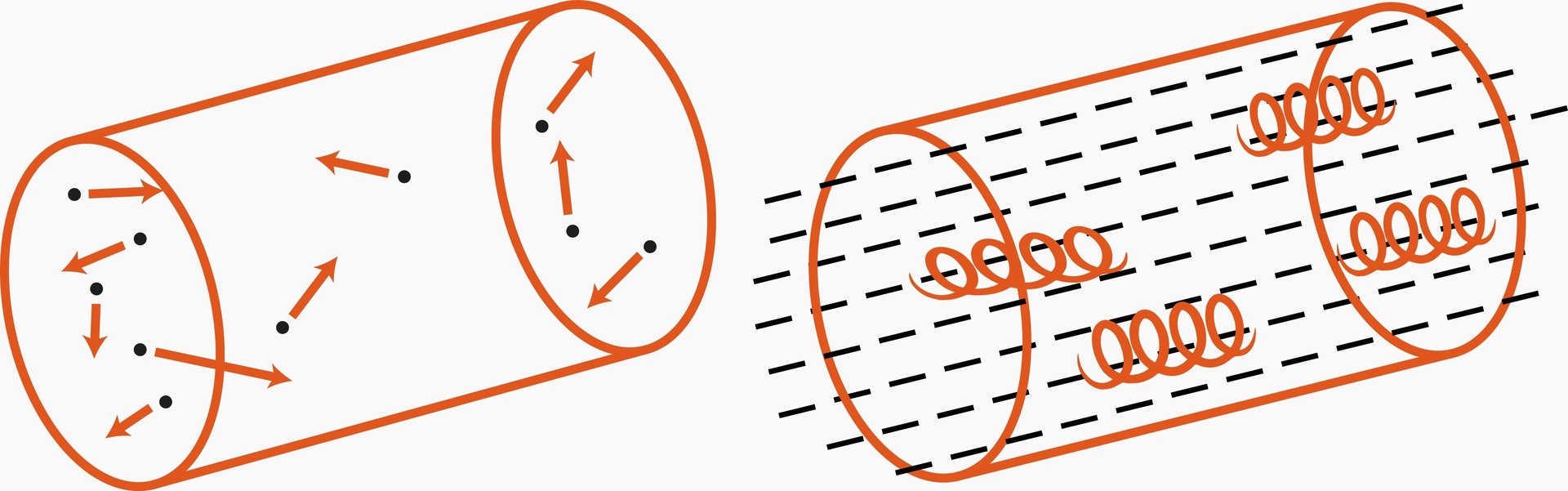

Another trick is to create mini bombs. If you take a frozen pellet of hydrogen (the fuel) and heat it extremely quickly using high-energy lasers, it creates an envelope of plasma on the surface of the pellet (step 1 in the diagram below). As the plasma blows off, it creates rocket-like forces that compress the fuel (step 2). The compression causes the pellet to heat up to 100 million °C (step 3) and the atoms inside the pellet to undergo fusion and explode as it releases lots of high-energy neutrons (step 4).

Net-energy gain

Both these solutions have been used to combine smaller atoms together into larger atoms and release energy in the process. So far, however, the energy put into achieving any form of fusion has been more than the energy that we’ve been able to get out of the system. In fact, most types of nuclear-fusion reactors in the world today require hundreds or even thousands of times the energy than we can get out of the system.

Purely on net-energy gain, the best reactor design we’ve come up with is a tokamak. It’s a donut-shaped chamber surrounded by magnets made of superconductors (materials that can carry electricity without losses), used for magnetic confinement, which forces hydrogen atoms to collide and eventually fuse.

Since the Soviet Union built the first tokamak in the 1960s, more than 170 tokamaks have come online. But they maxed out in 1997, when one of those—the UK’s JET reactor—achieved an energy gain of 0.67, meaning for every unit of energy put into the system, it generated 0.67 units of energy.

The progress has stalled not because tokamaks don’t work, according to Zach Hartwig, a fusion scientist at MIT, but because we haven’t scaled them up to a big enough size: to reach a net-energy gain higher than 1.00, Hartwig says, we need to build a tokamak much larger than any we’ve constructed in the past. A bigger tokamak would allow for a higher number of collisions between plasma particles and thus increase the energy output. That’s exactly what the $22 billion ITER project is trying to do.

But since the ITER was designed in 2001, scientists have made a breakthrough that gives them another option. Tokamaks have so far relied on low-temperature superconductors, which are limited in terms of the power of the magnetic field they can produce. Theoretically, if you ratchet up the magnetic field and tighten the squeeze on the plasma, you could increase the number of fusion reactions and thus the energy generated inside a reactor.

In recent years, scientists have begun experimenting with a new type of superconductor—yttrium barium copper oxide, or YBCO—which can operate at temperatures higher than those close to absolute zero (or –273°C) required by those currently in use. With high-temperature superconductors, a much smaller tokamak could, in theory, achieve the same net-positive energy gain as the much larger ITER can with low-temperature superconductors.

Creating a SPARC

The nuclear-fusion reactor at the heart of CFS, the Breakthrough Energy Ventures-funded startup, began its life in 2014 as a graduate-student project in an MIT class taught by fusion professor Dennis Whyte. The class called it the ARC (affordable, robust, compact) fusion reactor. The estimated cost of an ARC reactor that matched the ITER-predicted performance was only a few billion dollars—as little as a tenth of ITER’s price tag.

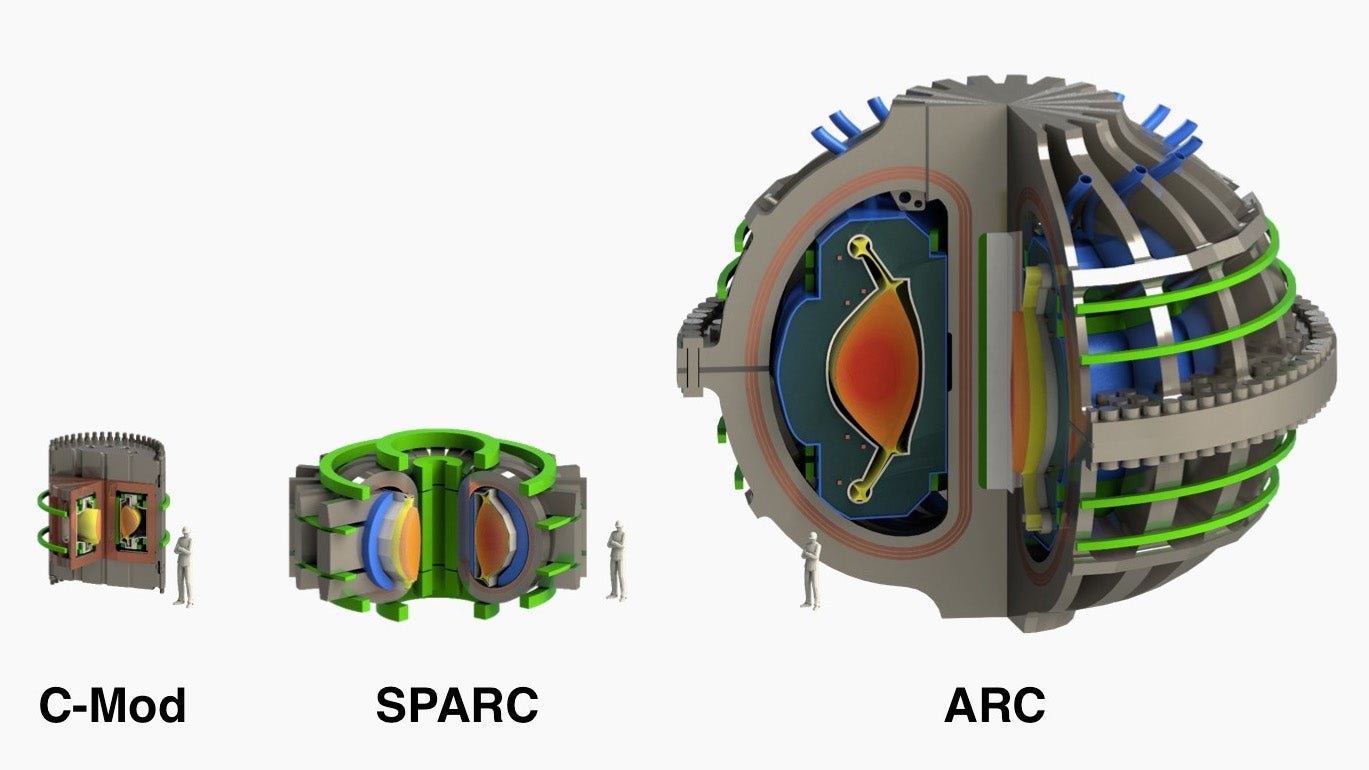

Starting in 1993, MIT has been running a tokamak reactor called C-Mod only for experimental purposes to study fusion. In 2016, the US Department of Energy’s funding for MIT’s own fusion reactor ran out. It was about the same time when Bob Mumgaard, now CEO of CFS, had transitioned away from working on solid-state physics to fusion. With some grad students of Whyte’s fusion class and other fusion scientists, he decided to investigate the feasibility of private funding for their ARC reactor.

Though a few billion dollars is not a lot of money in the fusion world, it’s still a lot for private investors to pony up for tech that may or may not work. So they went back to the drawing board and create the SPARC (which stands for “smallest possible ARC”) fusion reactor. It would cost a few hundred million dollars, and, if it works, would be the world’s first nuclear-fusion reactor to show net-positive energy gain.

The biggest story in the fusion field these days is the growing amount of money pouring in from private investors. It’s a high-risk, high-reward strategy, says Malcolm Handley, who runs Strong Atomics, a US-based fund that only invests in fusion startups. But he insists it’s not foolish. A fusion startup today only needs to show that it has a reactor able to achieve net-positive energy gain—it doesn’t even need to build a full-fledged power plant—to prove itself. The demonstration plant, he thinks, will take somewhere between $50 million and $500 million to build.

Once it succeeds, the startup can go public or sell itself to a large company like General Electric in the US or France’s EDF Energy, which have the know-how to build complete nuclear power plants. The whole process of iterating on the science and building a demonstration plant may only take 10 years, Handley thinks.

“Building a net-energy gain tokamak today is more like the Apollo Project than the war on cancer,” says Mumgaard. That is, he believes it’s more of an engineering challenge rather than a physics problem—there are no fundamental-science hurdles to cross.

Mumgaard makes a compelling case. That’s helped him raise $75 million so far, including $50 million from the Italian oil company Eni. Though it’s not enough to build SPARC, it is plenty to do all the work to ensure that the high-temperature superconductors SPARC relies on are up to scratch.

Breakthrough Energy Ventures won’t share how much it’s actually invested in CFS. But the firm’s meaningful contribution to the latest round of investment in the startup significantly raises CFS’s chance of raising the hundreds of millions of dollars it will need to build SPARC. Mumgaard now has realistic hopes that, by 2025, his company will have built a proof-of-concept facility that will show net-energy gain is possible. Once SPARC proves that the high-temperature superconductors can do their job at scale, CFS’s plan is to build an ARC fusion reactor that will put electricity on to the grid. He thinks it can happen in as little as 15 years from today.

Many in the fusion community are pessimistic about the future of tokamaks. “The pessimists say we’ve simply spent the most time and money on tokamaks and we’re still not there,” says Handley. Among the 20 or so fusion startups, only three are building off the tokamak design.

Moreover, SPARC and ARC rely on the success of YBCO high-temperature superconductors, which are expensive to produce and understudied. “We think that the MIT projection of 15 years to a power plant is very ambitious, if not overly ambitious,” Tim Luce, ITER’s head of operations and science told IEEE. “But we will celebrate any success, and we share the dream of making energy from fusion.”

Handley, who is interested in investing CFS, is less pessimistic. He says Mumgaard has built one of the best nuclear-fusion teams in the world, and he notes that, unlike many other fusion startups, CFS engages deeply with the fusion community and it is genuinely open to criticism and debate. That, he says, is a good sign for anyone trying to solve a tough problem.

Carmichael Roberts, the head of investing at Breakthrough Energy Ventures, was upfront. “We didn’t compare the different types of nuclear-fusion reactors in a bake-off competition before deciding on investing in CFS,” he says. “We knew the team; they had a promising idea; they needed our help.”