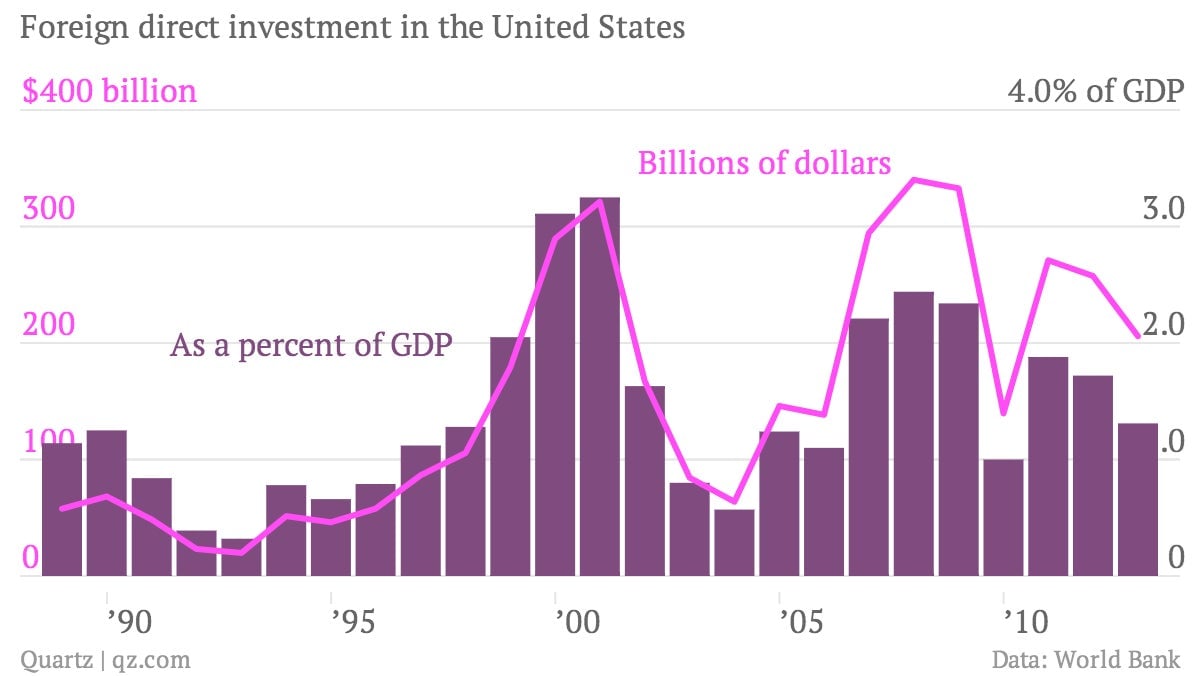

This chart explains why the US is hunting for foreign direct investment

The US is launching a major push for direct investment in US businesses with a national summit this week with the CEOs of major American corporations. The chart above, which shows foreign investment as a share of the US economy and in billions of dollars, shows investment steadily sinking since the 2008 recession, contributing to a stagnant recovery.

The US is launching a major push for direct investment in US businesses with a national summit this week with the CEOs of major American corporations. The chart above, which shows foreign investment as a share of the US economy and in billions of dollars, shows investment steadily sinking since the 2008 recession, contributing to a stagnant recovery.

There are plenty of reasons why: Europe is one of the biggest investors in the US but the recent recession has sapped its resources. Emerging markets have offered, until recently, far more impressive growth. America’s under-investment in infrastructure is a problem for attracting investment—which has now spun into an opportunity thanks to initiatives to attract Chinese investment in retrofits (such as upgrading a bridge or expanding a port) and new development. And then there’s US government gridlock and a tendency to stumble into fiscal crises, which have investors questioning the stability of the country’s public policy.