Why Facebook just had a blowout quarter

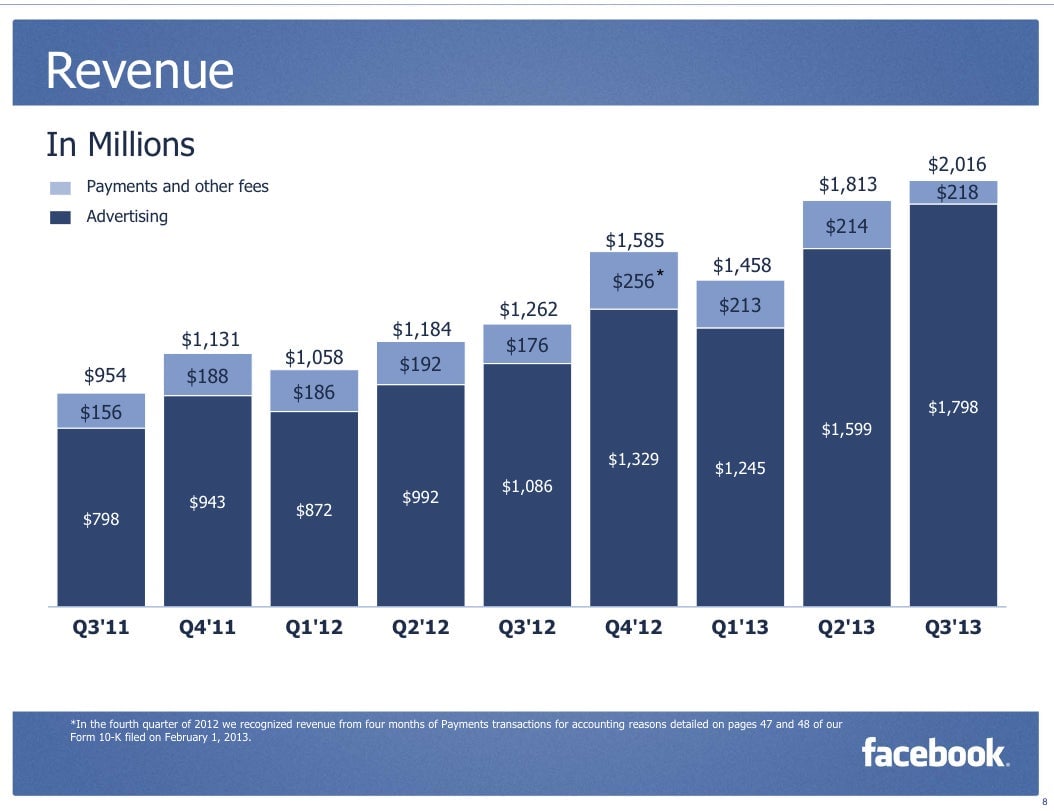

Facebook just beat the pants off of analyst’s expectations for the company’s revenue and profit, leading to a 10% jump in the company’s share price after markets closed. The world’s most-used site after Google brought home $0.25 per share when analysts expected just $0.19 per share. Revenue came in at $2.02 billion; analysts expected $1.91 billion.

Facebook just beat the pants off of analyst’s expectations for the company’s revenue and profit, leading to a 10% jump in the company’s share price after markets closed. The world’s most-used site after Google brought home $0.25 per share when analysts expected just $0.19 per share. Revenue came in at $2.02 billion; analysts expected $1.91 billion.

Some analysts are saying Facebook’s stock could go to $65 a share in the near future.

The reason is simple: Despite dire reports that Facebook’s advertising isn’t all that effective, companies are buying more of it than ever, and way more than anyone expected at this stage in the game.

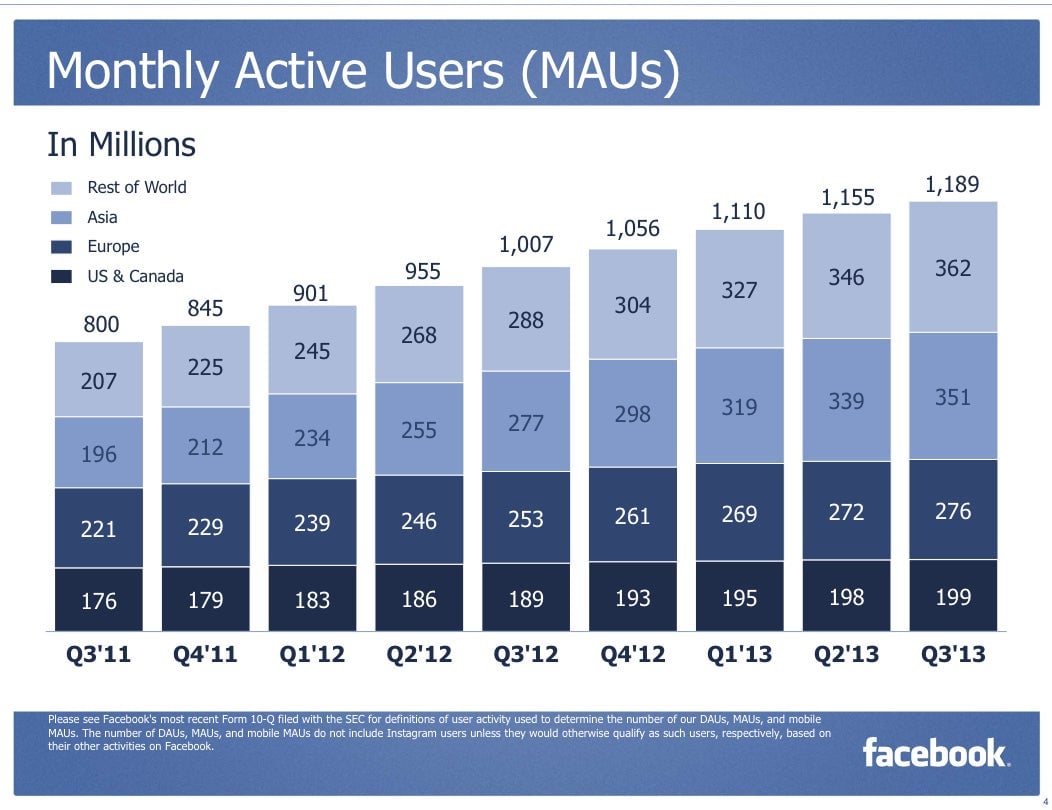

Mobile advertising is now 49% of Facebook’s revenue, despite the fact that it’s harder to make money off of mobile users. Three-quarters of Facebook’s users (73.44%) are now accessing the site on mobile devices.

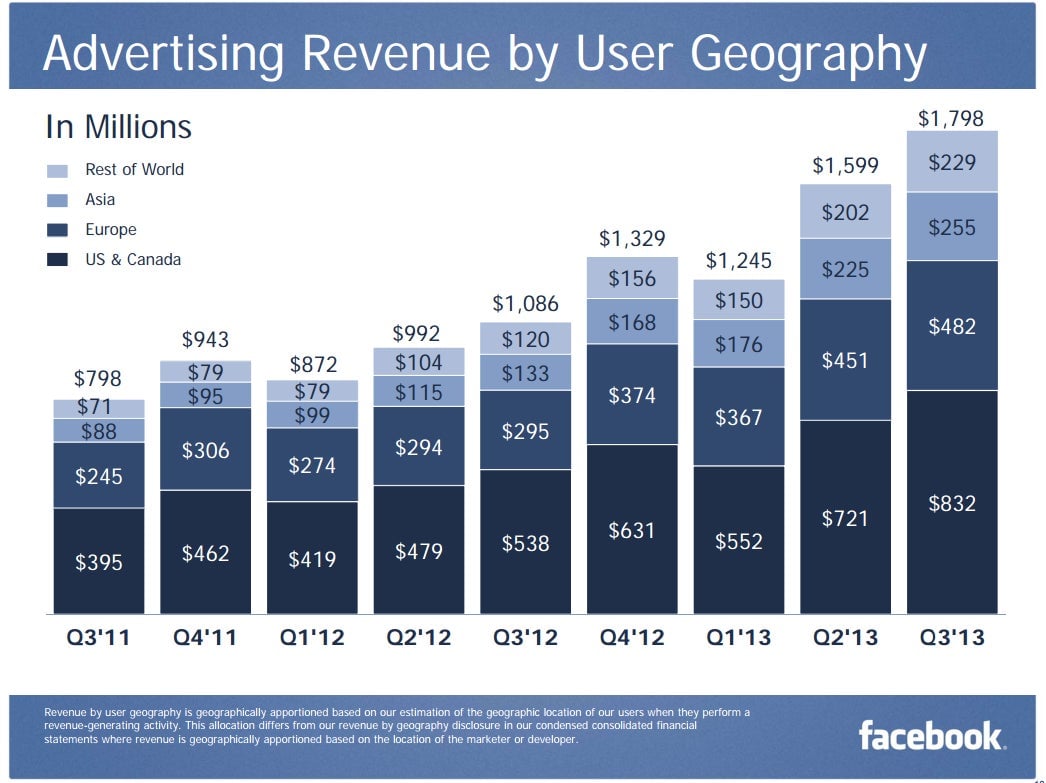

Facebook’s user base in the US and Canada grew less than at any point in Facebook’s history—by just 1 million users (or %0.5) this quarter, and Europe didn’t fare much better. All of Facebook’s additional reach happened in Asia and the rest of the world. Facebook’s revenue = advertising dollars per user x users, and since most of Facebook’s growth is now happening in parts of the world in which it’s hard for Facebook to make money, the company is increasing revenue the only way it can—by increasing how much it makes on users in rich countries.