An irony-impaired US government report lectures Germany on how to manage its finances

Twice a year, the US Treasury department produces a report for Congress on the exchange-rate policies of America’s big trading partners. It’s become something of a ritual each time to speculate on whether the US will dub China a “currency manipulator” for how it manages the value of the yuan. The latest report, released late yesterday, once again stops short of this rebuke (though it contains the usual gripes about how the artificially low value of the yuan distorts global trade), but the real news is some unexpectedly sharp language about Germany.

Twice a year, the US Treasury department produces a report for Congress on the exchange-rate policies of America’s big trading partners. It’s become something of a ritual each time to speculate on whether the US will dub China a “currency manipulator” for how it manages the value of the yuan. The latest report, released late yesterday, once again stops short of this rebuke (though it contains the usual gripes about how the artificially low value of the yuan distorts global trade), but the real news is some unexpectedly sharp language about Germany.

In the report’s “Key Findings”, the Treasury takes a swipe at German economic policy even before it gets to the usual complaints about China:

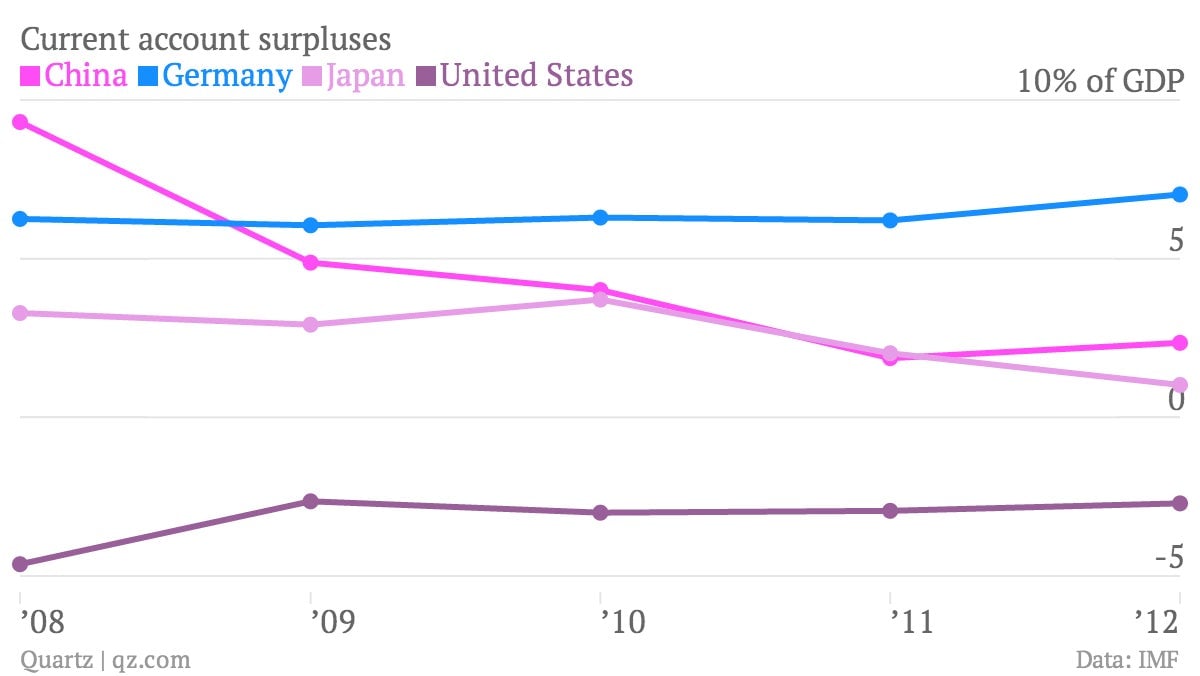

Within the euro area, countries with large and persistent surpluses need to take action to boost domestic demand growth and shrink their surpluses … Germany’s anemic pace of domestic demand growth and dependence on exports have hampered rebalancing at a time when many other euro-area countries have been under severe pressure to curb demand and compress imports in order to promote adjustment.

This is not a novel observation, but the Treasury’s candor in airing it caught many by surprise. In previous editions of the report, criticism of Germany’s large trade surplus was more oblique and buried much further down in the text. If German consumers spend more freely, not least on imports from the weaker members of the euro zone, the region’s grinding recovery would receive a boost.

The US is keen on a more vibrant euro zone, which as a block vies with Canada and China as America’s largest trading partner. The Treasury report suggests, as do many analysts, that rebalancing Germany’s economy away from exports and boosting domestic demand will do as much for the euro zone’s recovery as trimming the debt and deficits in countries like Spain, Italy and others in the beleaguered “periphery”.

Washington’s criticism of Berlin comes at an awkward time; on the day of the report’s release, Germany dispatched a delegation to the US to investigate allegations that chancellor Angela Merkel’s mobile phone was tapped by America’s spy agencies. What’s more, the US Congress, now a byword for fiscal dysfunction, is hardly well placed to offer advice on prudent economic policymaking.