Big banks’ bumper profits are powering a “late cycle” stock recovery

What goes down must come up. In the past few trading sessions, stocks have been digging out of the hole they fell into during last week’s nerve-racking tumble.

What goes down must come up. In the past few trading sessions, stocks have been digging out of the hole they fell into during last week’s nerve-racking tumble.

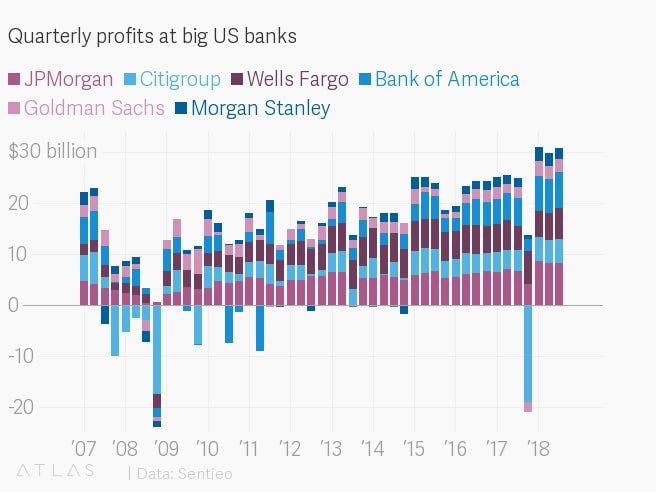

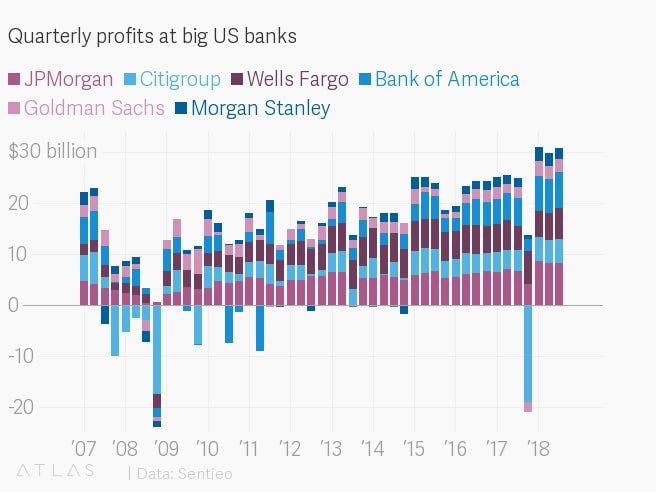

To a large degree, investors can thank the banks. Today (Oct. 16), Goldman Sachs and Morgan Stanley both comfortably beat analyst expectations, rounding out a bumper crop of third-quarter earnings. The six biggest American banks earned a collective $30 billion in the latest quarter, more than 20% ahead of the third quarter last year.

(The big drop in the fourth quarter last year is due to accounting weirdness stemming from the US corporate tax cut—Citigroup is doing just fine, thank you very much.)

So, are we back to cheering on the bull market? As the corporate earnings season gets going, that is the hope among optimists (paywall). So far so good on that front, as the big banks attest.

But all is not well. The same fears that investors cited when they were selling everything in sight last week—trade wars, rate hikes, and the like—haven’t gone away. A long-running survey of fund managers, released today, found that more than 80% of them think that the global economy is in “late cycle,” the highest share to say so since—uh oh—late 2007. The IMF also recently warned that global growth had “plateaued.”

BlackRock, the world’s largest money manager, was one of the few big companies to disappoint analysts today, reporting weaker-than-expected revenue and the lowest inflow of funds in more than two years. Institutional investors pulled a net $25 billion out of their BlackRock accounts in the third quarter, after withdrawing $13 billion the quarter before. Those aren’t necessarily the actions of investors with unshakable confidence in the future.