When it comes to your money, bank loans are a risky business

Bank loans have delivered attractive returns so far this year, and there are times when it makes sense to include them in a diversified portfolio. But now is not one of those times. The way we see it, many investors have rushed into loans without understanding the risks.

Bank loans have delivered attractive returns so far this year, and there are times when it makes sense to include them in a diversified portfolio. But now is not one of those times. The way we see it, many investors have rushed into loans without understanding the risks.

When it comes to protecting investors against rising interest rates, floating-rate bank loans have over promised and under delivered. As a long-term income generator, they’ve been a poor substitute for other types of credit exposure. Perhaps most importantly, the loans being extended to companies today are riskier than ever.

To make better portfolio decisions, it’s critical that investors get to know the whole story. Both high-yield bank loans and bonds offer investors potentially high income returns in exchange for the risk of lending to firms with low credit ratings. But bank loans have two key features that make them different from bonds:

- Floating rates: Loan coupons adjust periodically based on changes in short-term interest rates. So, when the Federal Reserve raises rates, the income that loans produce goes up as well. This lowers bank loans’ sensitivity to interest-rate changes.

- Seniority in capital structure: Loans are secured by borrowers’ collateral, which gives loans seniority over unsecured bonds and investors an extra layer of credit protection.

These two features appear to protect bank loans from interest-rate risk and credit risk. But the reality is quite different.

First, bank loans don’t always behave as floating-rate instruments should because they are callable. And lately they’ve been called back in massive numbers.

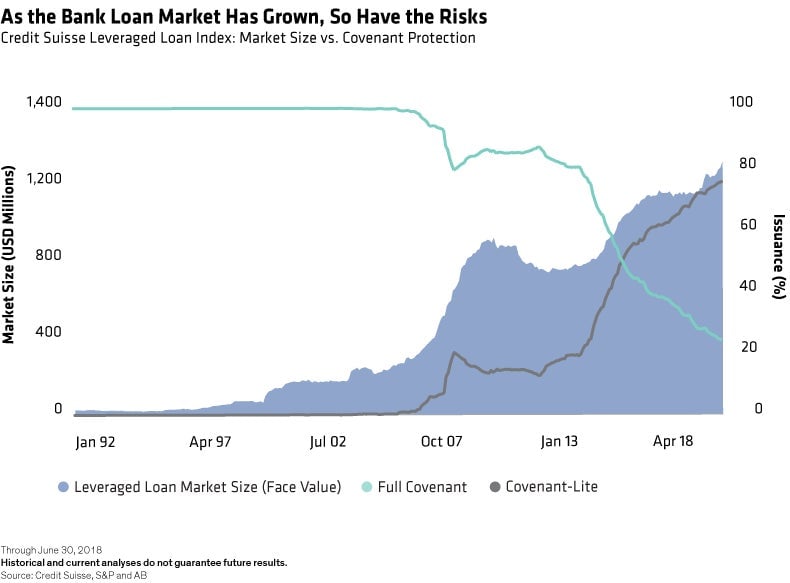

Second, the quality of today’s bank loans has declined. Lately, borrowers have been offering less covenant protection for lenders.

Bank loans are also the most popular way to finance leveraged buyouts—the riskiest type of corporate takeover. This trend indicates that default risk is a lot higher than many investors realize.

Prices matter more than interest rates

Should investors simply buy high-yield bonds instead? Not necessarily. Both segments are expensive today and have a small cushion against future losses. Since the US is in the late stages of one of the longest credit expansions on record, both bank loans and bonds are likely to underperform when the cycle turns.

But we think bank loans will underperform more severely than bonds. High demand has driven up the average bank-loan price. And research shows that average price has historically been a better predictor of performance than interest rates.

Do bank loans ever deserve a place in a well-diversified portfolio? Sure—but only at the right price and in the right conditions. That’s usually when rates are already falling, growth has already slowed, and the average bank loan price is well below bar. But even in these scenarios, investors would be better off taking their credit risk in bonds, not loans.

A more balanced approach

We think investors should focus less on rising interest rates and more on credit risk. As rates continue to rise, investors should gradually tilt their portfolios toward interest rate-sensitive assets, such as US Treasuries and other high-quality government debt. Once the economy slows, they should then start shifting back to credit.

The best way to do this is to use a “barbell” strategy. This means anchoring the credit side of the portfolio with high-yield bonds and anchoring the interest-rate side with Treasuries.

For a high-income alternative, investors can look into high-yield bonds, emerging-market debt, and credit risk-sharing transactions. These are riskier and are vulnerable to drawdowns during economic downturn and market correction, so diversifying across multiple sectors and regions is key.

Summing it up

Will there be times when bank loans deliver strong returns? Absolutely. But over the long run, we think they’re likely to bring investors more risk than they bargained for while generating low returns. With credit assets looking expensive and the US credit cycle in its twilight stage—now is not the time to bet on bank loans.

To learn more about responsible investing, visit AB (AllianceBernstein) or read the whitepaper.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.