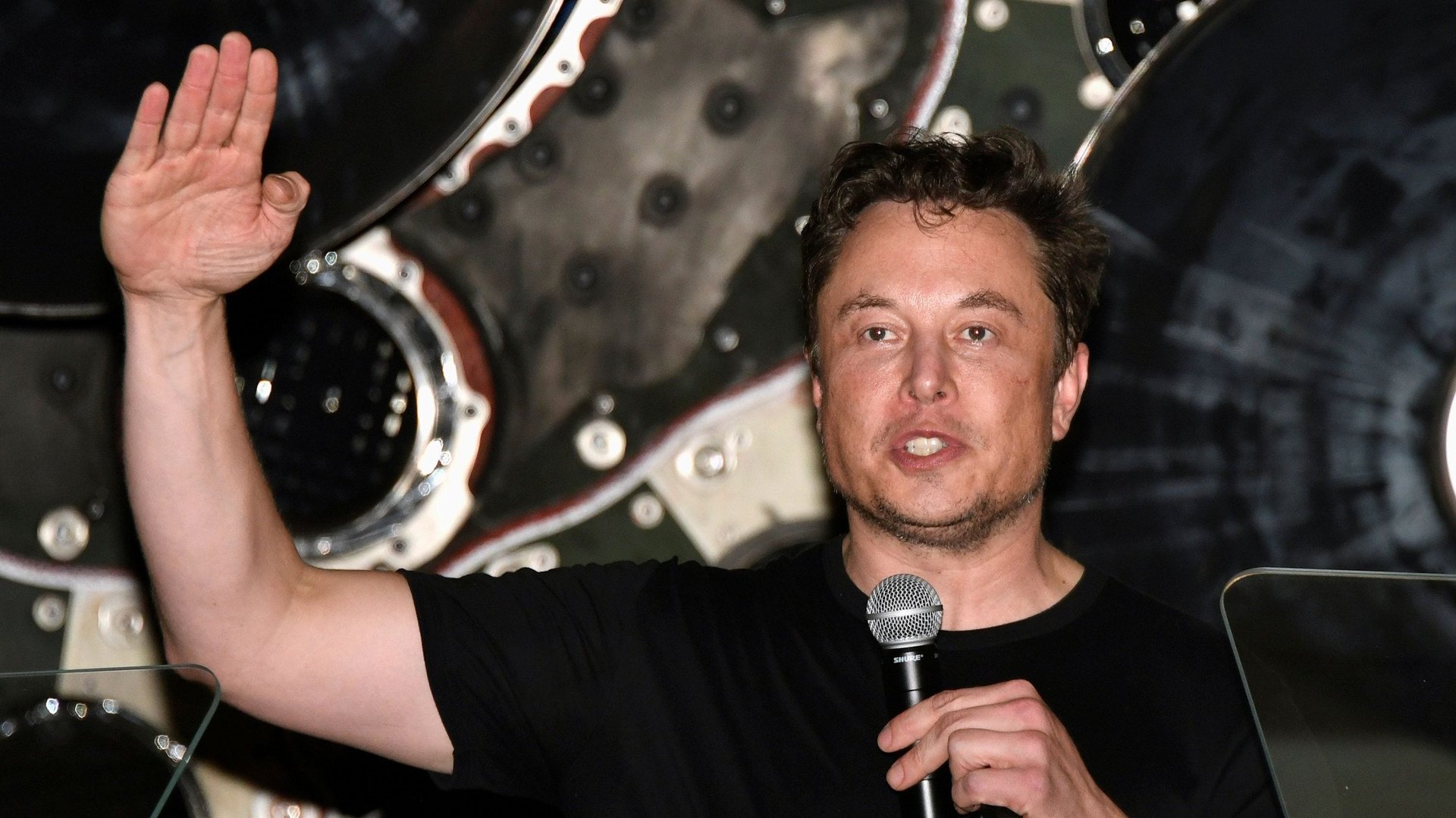

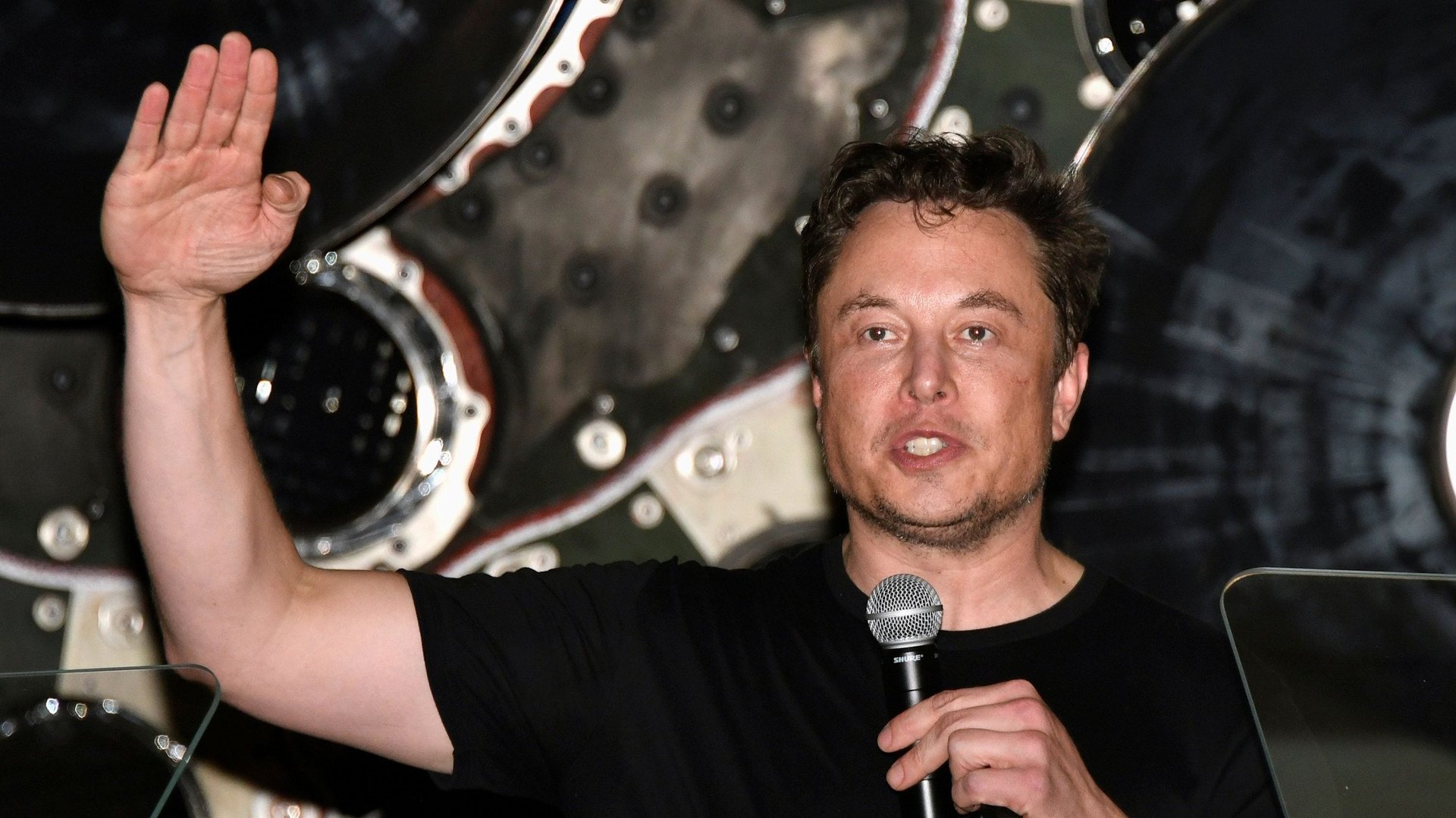

Elon Musk says Tesla “probably” won’t take Saudi money anymore

For the past two years, Elon Musk has been fielding calls from “the Saudis” about the possibility of Tesla going private, he says. In August, the kingdom’s sovereign wealth fund, known as the Public Investment Fund, finally bit, buying an approximately 5% stake in the electric car maker, worth as much as $3.2 billion.

For the past two years, Elon Musk has been fielding calls from “the Saudis” about the possibility of Tesla going private, he says. In August, the kingdom’s sovereign wealth fund, known as the Public Investment Fund, finally bit, buying an approximately 5% stake in the electric car maker, worth as much as $3.2 billion.

Now, after the slaying of Saudi dissident Jamal Khashoggi—murdered on government orders, many believe—Musk is wavering about future Saudi investment.

In a Recode interview published today (Nov. 2), Musk said that Tesla “probably would not” take Saudi government money now, and characterized the killing of Khashoggi as sounding “pretty bad. That is not good. That is bad.”

But he took pains to differentiate between the kingdom’s government and its citizens, leaving room for investment from other Saudi nationals: “There are a lot of good people in Saudi Arabia, and Saudis who are outside of Saudi Arabia. So I think you cannot paint an entire country with one brush.”

Whether this will make much difference to the Saudi government remains to be seen. Musk said he did not know whether the PIF still had its Tesla stock (“They might have sold it, I don’t know.”). Either way, Saudi Arabia is keeping its options open. In September, the kingdom said it had invested $1 billion in California-based Lucid Motors, a Tesla competitor as an electric-car maker.

As Jack Stewart reports for Wired, Tesla and Saudi Arabia might appear to be “strange bedfellows,” with one at the very heart of Big Oil and the other hell-bent on making sustainable energy a present-day norm. But the Saudi government investment in electric cars is part of a larger move away from fossil fuels. The kingdom’s plan, known as Vision 2030, aims to reduce Saudi Arabia’s dependence on oil, diversify its economy, boost trade and tourism, and develop better healthcare, education, and infrastructure. Investing in Tesla—and its rivals—is a small but significant part of that plan.