The future of energy is the past of energy

Today the International Energy Agency released the 2013 World Energy Outlook, an attempt to forecast the next two decades of energy trends. It turns out every step towards reducing emissions in wealthy countries is met by a step back as energy demand soars in emerging markets just hitting their fossil fuels stride.

Today the International Energy Agency released the 2013 World Energy Outlook, an attempt to forecast the next two decades of energy trends. It turns out every step towards reducing emissions in wealthy countries is met by a step back as energy demand soars in emerging markets just hitting their fossil fuels stride.

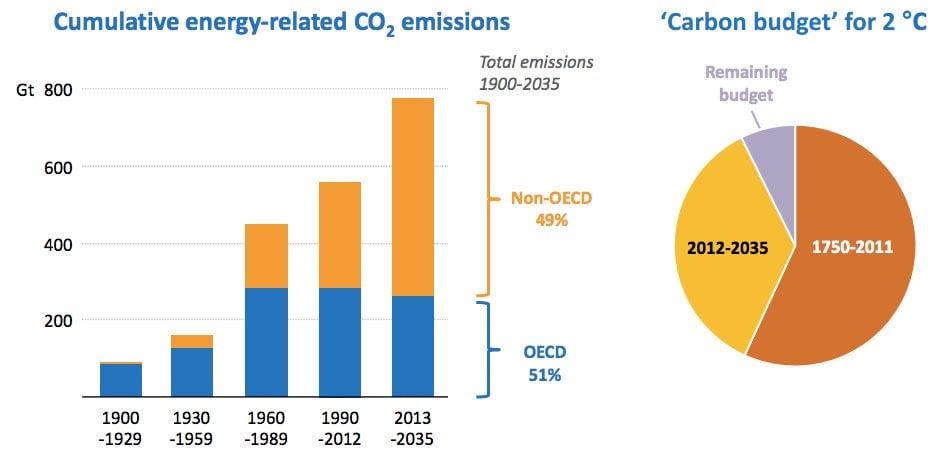

First, the scary chart

Here’s the state of emissions on the left, where any reductions in developed economies are quickly subsumed by expansion in emerging markets. China will be the world’s largest oil importer, and India will be the largest source of energy demand and the world’s largest coal importer by 2035. On the right, you’ve got the “carbon budget”—the amount of carbon that can be emitted before, in the IEA’s view, we’re irrevocably on the path toward a dangerous increase in the world’s temperatures of 2°C, despite predictions like China building more renewable energy plants than the US, EU and Japan combined. That’s a thin margin of error waiting for the world in 2035:

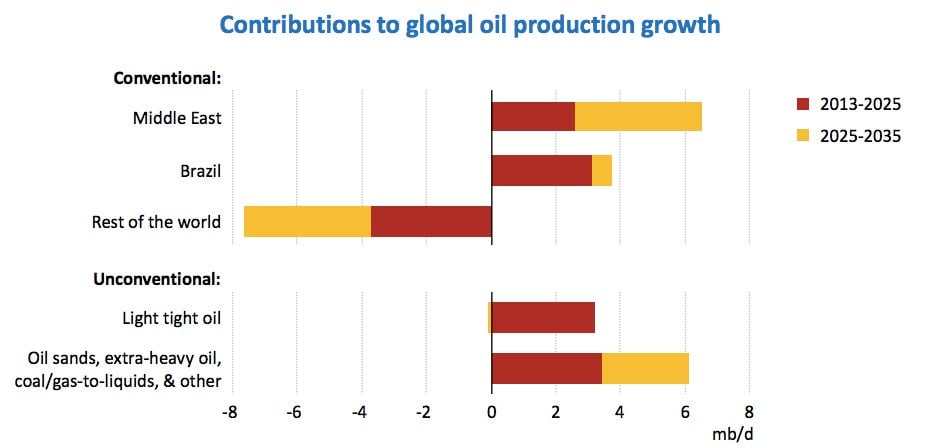

Where will all that carbon come from?

A lot of it will still come from the much-maligned OPEC countries. While the boom in “tight oil” removed from the ground with fracturing techniques will change the game for the next decade, by 2035 it will have subsided. Much of the future production growth will come from the Middle East, where light crude will still be easier to access than tight oil, and from Brazil, with its huge offshore reserves.

Brazil’s unique energy sector

Brazil’s contribution to future oil production is especially intriguing. We’ve told you before about the country’s unique carbon footprint, and the WEO confirms it. In the chart below, you can see that even as the country begins to exploit huge amounts of fossil fuels located offshore, it will still be running a cleaner electricity production sector than most of the world, where renewables still overtake gas as the second-largest source of electricity:

What the fracking slow-down means for US industry

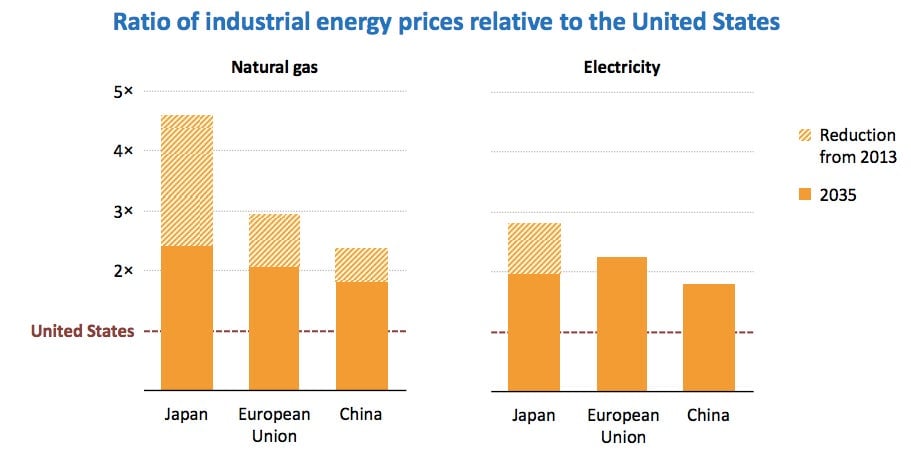

And there’s one more interesting note on the implications of the shrinking impact of fracked oil and natural gas. Right now, the US benefits from cheaper industrial energy prices, one of the few things boosting manufacturing and giving hope to a broader revitalization of industry here. In the next two decades, however, that advantage will decrease—though not disappear—compared to its competitors, forcing American manufacturers to find an edge elsewhere, or not at all: