Bankers will walk away from the IPO boom smiling—even if investors don’t

It’s been noted time and time again that IPOs are in full bloom in the US, and considering Twitter’s high-profile public offering Nov. 7, the momentum only appears to be building. While some consider this to be a sign of a brightening US economy, others view the flurry of IPOs with eye-watering valuations as a sign of a frothy market.

It’s been noted time and time again that IPOs are in full bloom in the US, and considering Twitter’s high-profile public offering Nov. 7, the momentum only appears to be building. While some consider this to be a sign of a brightening US economy, others view the flurry of IPOs with eye-watering valuations as a sign of a frothy market.

Another bubble could end in tears for investors, but if it did, it would be no sweat off the backs of the bankers who are helping to shepherd through the deals—and making a tidy profit doing so. Take a look:

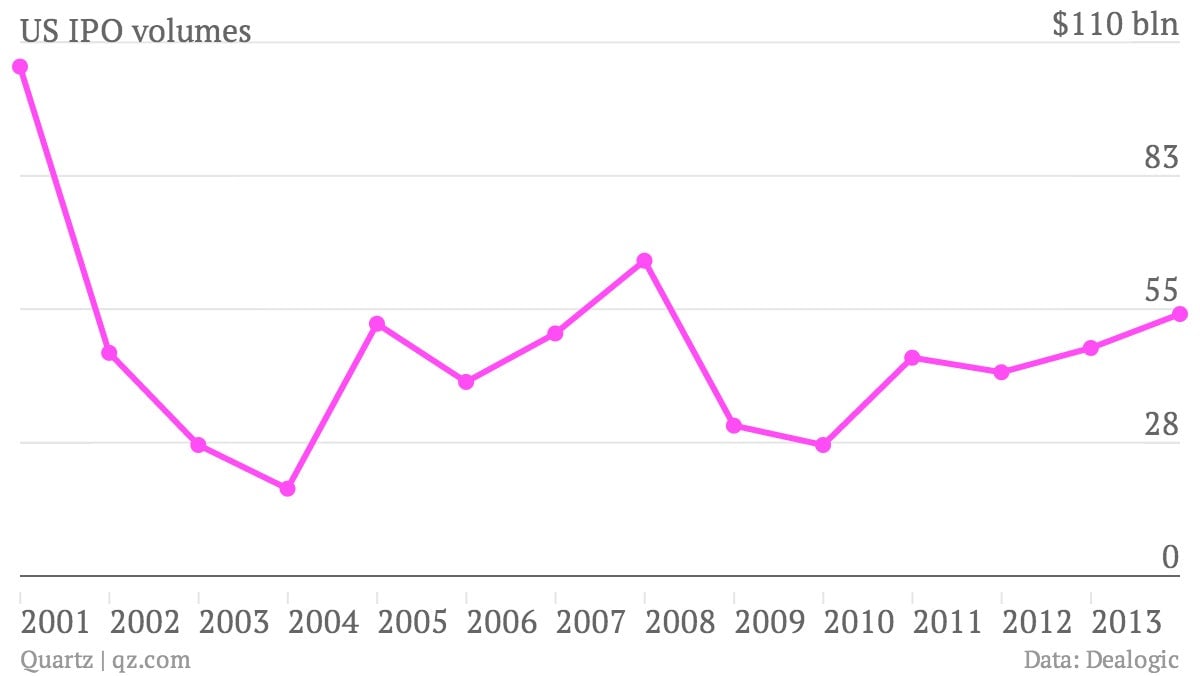

According to the latest data from Dealogic, the amount of money that has been raised through IPOs this year in the US has already surpassed $53 billion, the most raised since 2007 (that year a total of $62.8 billion was raised).

IPOs generate fees for bankers, new product for brokers and analysts to pitch to their clients, and a new investment option for fund managers. What’s more, sellers in an IPO—be they a private equity firm or venture capital funds—may have an advantage of information over the buyers, because they are intimately familiar with the business being put on the block. In short, the smart money knows when to get out.

Their exit window could be nigh. The last time IPO volume was this high in the US was in 2007, when the subprime crisis first emerged. Before that, 2000 was another huge year for IPOs—the same year the tech bubble 1.0 burst and the S&P500 experienced double digit falls for the subsequent three years.

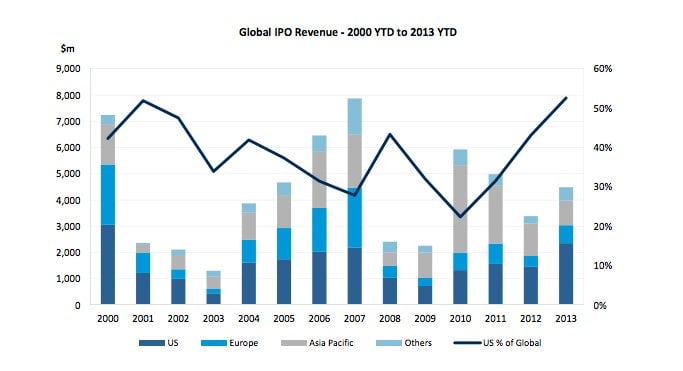

Meanwhile, IPO fees in the US are on track for their best year since at least 2000, according to the below chart from Dealogic, with the US proportion of global fees continuing to rise.