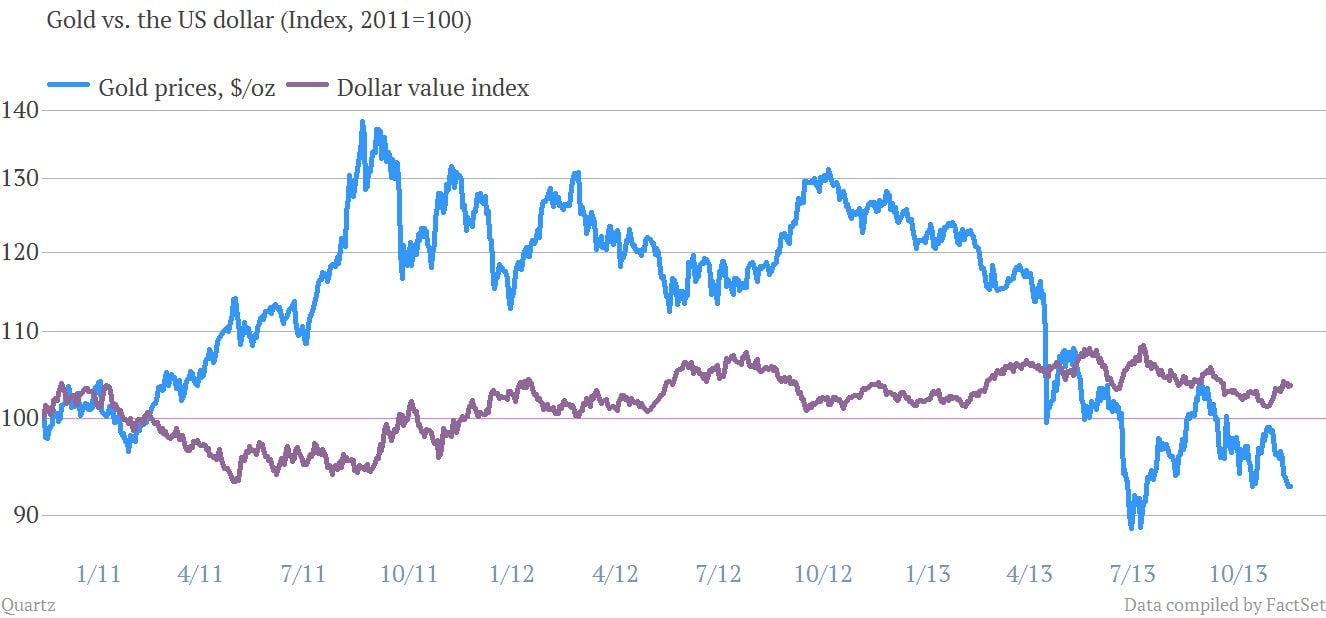

This chart shows why basing the dollar on gold isn’t a great idea

Senator Dean Heller had a simple question for Janet Yellen at her confirmation hearing to become the chair of the US Federal Reserve: “Do you believe there’s any indicator behind the rise and fall of gold prices?”

Senator Dean Heller had a simple question for Janet Yellen at her confirmation hearing to become the chair of the US Federal Reserve: “Do you believe there’s any indicator behind the rise and fall of gold prices?”

Heller is one of many Republicans in Washington who have touted gold as part of their mistrust of the government and the Federal Reserve’s unprecedented efforts to right the economy after the financial crisis. The party’s 2012 platform called for a consideration of “a metallic basis for US currency.” Fifty-two lawmakers support legislation that would track the dollar relative to gold, an idea that economists think is downright crazy—in fact, the Fed goes out of its way to leave volatile commodities out of its price analysis. Influential conservatives like Senators Ted Cruz and Rand Paul have proposed allowing gold and silver to serve as alternative currencies to the dollar.

The chart above shows why that’s not such a good idea: The purple series tracks ICE’s US dollar value index. Since 2011 it has stayed more or less stable relative to other currencies, appreciating or depreciating less than ten percent relative to its initial value. The blue series tracks the price of gold, has been extremely volatile, shooting up almost 40% to its peak price in 2011, and oscillating fairly wildly for eighteen months before beginning its recent plunge.

While it’s not a perfect counter-factual by any means, if the dollar had made similar swings, US exports would have been crushed in 2011 as they would have been wildly expensive to the rest of the world. Today, the dollar would buy less than it did three years ago. In between, your wealth might have increased or decreased by 15% in a matter of months. That’s not the kind of certainty you can build an vibrant economy around.

Yellen’s responded diplomatically to Heller on Thursday, saying that there is no good model to value gold, except “when there is financial market turbulence, often we see gold prices rise as people flee into them.”