The reinvention of economics after the crash

Economics is searching for its third act.

Economics is searching for its third act.

Over the past few decades, the field had become more self-assured, harnessed more mathematics, and moved further away from social sciences such as psychology in the direction of hard sciences such as physics. Macroeconomists, who are concerned with understanding the economy in its broadest sense, were in a self-congratulatory mood.

That is, until 2008. The financial crisis ruptured the profession and exposed deep flaws in its models for understanding the world.

The 10 years since the global financial crisis have been plagued with increasing anxiety about inequality and economic security. The brutal and far-reaching economic collapse, deep recession, and slow recovery have puzzled economists. Macroeconomists have been fending off criticism for not foreseeing a financial crisis of such epic scale.

This is part of Remaking Economics, a series exploring foundational changes to a field that shapes how we understand the world. Read the other parts about the re-education of Economics 101 and the dismal cost of the profession’s lack of diversity.

During the 20th century, the West suffered from two major economic crises. Each of these brought about a major revolution in economic thinking. After the 2008 financial crisis, no such shift has taken place. Economists are still using many of the same tools built to address the same questions as before. When is the revolution?

The crises of the last century provoked two notable shifts in thought when the nature of those economic emergencies revealed defects in the prevailing economic theory. The first was in the 1930s after the Great Depression. High levels of unemployment—a quarter of the US population and even higher in some other countries—and sustained low output couldn’t be explained by Marshallian economics, the status quo at the time. The consequential figure then was the towering—in both height (6’ 7”) and influence—British economist John Maynard Keynes, who for all intents and purposes invented modern macroeconomics.

Over the next few decades, Keynesian economics developed, involving a new general equilibrium IS-LM (investment-savings, liquidity-money) model, which showed how different types of markets—labor, goods, money—interacted with each other. The inner workings of this model don’t matter for the purposes of this story, but what’s important is that for several decades Keynesian economics was used to guide economic policymaking, which hinged on fiscal policy and the role of government intervention. The economy performed well, for a while.

In the 1970s, there was an unexpected inversion of the usual relationship between economic growth and inflation. Following a recession, the US and some other industrialized nations were hit by a period of “stagflation,” in which inflation climbed while economic growth stagnated and unemployment rose. Keynesian economic models broke down, especially relating to the behavior of prices.

Thus began economics’ second act, which took place at the University of Chicago, an institution that has employed more economics Nobel prize winners than any other. By the middle of the 1970s, American economist Milton Friedman rose to prominence by espousing belief in free markets, a focus on money supply, and advocacy of less government intervention. This paved the way for the policy of inflation-targeting at central banks, downgrading the importance of fiscal policy in favor of monetary policy.

In 1976, the same year Friedman won the Nobel prize, another economist of the “Chicago School” was also leveling criticism at the prevailing macroeconomic orthodoxy, particularly Keynesian economics. Robert Lucas, who would win a Nobel prize 19 years later, argued that it was naive to predict the effects of a change in policy entirely on the basis of past observations. What has since become known as the Lucas Critique is that an economic model isn’t good enough if it ignores the fact that agents’ behavior changes when policy changes.

This criticism has led to the development of so-called microfoundations in macroeconomics. This means that economic models should be built as an aggregation of microeconomic models that account for changes in individuals’ behavior. These individuals—consumers and firms—are forward-looking, optimizing agents who have rational expectations given the information available to them. Microfoundations help form the basis of dynamic stochastic general equilibrium (DSGE) models, which have become more popular in central banks and used in macroeconomics and policymaking at time of the global financial crisis.

In 2003, when Lucas was the president of the American Economic Association, he struck a triumphant note about the state of the field. “Its central problem of depression prevention has been solved, for all practical purposes, and has in fact been solved for many decades,” he said. This proclamation proved premature. Within a few years, the global economy abruptly sank into the worst recession since the Great Depression.

What went wrong for economics was that a key sector of the economy wasn’t given the scrutiny it deserved: finance. The models used at the time by central bankers and other policymakers not only didn’t foresee the crisis, they couldn’t even conceive of such a shock emanating from the banking sector. The models didn’t properly consider financial institutions as agents in the economy, with their own unique incentives and risks.

“The shock of how important finance could be to the real economy hit all macroeconomists,” says Elizabeth Bogan, a senior lecturer in economics at Princeton. “Many of them now claim they saw it coming, but don’t believe that. We didn’t.”

Since the crisis, vast amounts of research has been dedicated to better incorporating the financial industry into economic models. This work is ongoing, but there has been progress. Nonetheless, the spectacular failure to foresee the crisis focused minds on other underlying problems in economics, namely that it treats people as infallible rational actors, puts too much in trust in the self-correcting nature of markets, and maintains a monoculture that suffocates outside ideas and theories.

Economic growth, particularly when measured by gross domestic product, hasn’t produced materially higher levels of happiness. Inequality still rises even as global poverty is reduced. Meanwhile, we’re hurtling towards a climate-change crisis that capitalism appears incapable of avoiding (if anything, it’s making the problem worse). These are also failures of economics. Where are the solutions? Ten years after the financial crisis, economists rightfully wonder how they can address these challenges with models that originated in the 1970s and have already failed them once before.

David Vines, a professor of economics at the University of Oxford, is at the forefront of the search for his field’s third act.

“As a result of the global financial crisis we are no longer clear what macroeconomic theory should look like, or what to teach the next generation of students,” Vines wrote, with fellow economist Samuel Wills. “We are still looking for the kind of constructive response to this crisis that Keynes produced in the 1930s.”

To guide their search, Vines and Wills asked a group of esteemed economists, including Nobel laureates Joseph Stiglitz and Paul Krugman, and former IMF chief economist Olivier Blanchard, to write papers that answer a series of questions about the state of macroeconomics. They wanted to get to the bottom of what is wrong with current models and identify a path forward for macroeconomic theory. The responses were pulled together into a single issue of the Oxford Review of Economic Policy (OxREP) published in January, which featured 14 papers under the title “Rebuilding macroeconomic theory.” The first question was, directly, “Is the benchmark DSGE model fit for purpose?”

Eighteen economists authored papers in the journal, and disagreements abound. But one point unites them: DSGE models need an overhaul. There are four key changes needed to the core model: a stronger appreciation for the costs and risks inherent in the financial system, less reliance on the assumption of rational expectations, the inclusion of more heterogeneous (diverse) agents, and better ways to incorporate microfoundations.

The shortcomings of DSGE models aren’t abstract problems that concern only economic wonks. These models are used increasingly by central banks, including the US Federal Reserve, whose monetary policy influences the entire global economy. If the insights economists derive from popular models are deficient, it ultimately affects us all.

The area where most economists believe the most progress has been made—the incorporation of the financial sector into models—still has a long way to go.

When critics question the advances of economics, its defenders often say, “well, what about physics?” There is a feeling that if physics isn’t judged against its inability to solve the mysteries of the universe, then why should economics be held to such an unfairly high standard? Physicists still haven’t resolved the contradictions between general relativity and quantum mechanics, so why should economists be expected to seamlessly integrate finance with macroeconomic theory?

“There isn’t a ready ‘finance’ to sprinkle in your ‘macro’ soup,” says John Cochrane, a senior fellow of the Hoover Institution at Stanford University. In fact, finance and macroeconomics are still debating their own basic questions, he explains. Finance is at odds over what constitutes a crisis, the nature of “frictions” in the system, and why don’t people take more steps to get around them. Macroeconomists, meanwhile, are puzzling over the source of inflation and the effectiveness of the emergency asset-buying programs in response to the 2008 crisis.

“We have spent 10 years making models of the crisis, and that effort seems to be running in to declining marginal product, like every other investment,” Cochrane says. “The event is passing into economic history, and people are getting a bit bored with rehashing it over and over again.”

The other field economics is regularly compared to is medicine. Doctors are expected to diagnose their patients but could be forgiven for not predicting every detail of their symptoms. As Hélène Rey, an economist at the London Business School, puts it: “If you ask the doctor if you have measles to predict the number of spots you’re going to have, the doctor is not going to tell you. At the same time, they will more or less know what’s good for you to treat your measles.” She says that the failure of economic forecasting had been conflated with a failure in economics as a whole.

Many economists would be relieved to abandon the expectation that their tools can predict financial crises. This isn’t an attempt to evade responsibility. If people knew a recession was starting tomorrow, they would stop spending and investing and the recession would happen today. Instead of “magic models,” the focus should be on creating a system that is more resilient and less prone to crises. Banks should be funding themselves using equity and not short-term debt. “That would cure crises in a heartbeat,” says Cochrane.

And so, as much as there is a consensus on a need to advance macroeconomics into a new era, there is still much hand-wringing over what to do next. “What we don’t yet have is any new idea of how to do things,” says Vines.

Some argue that a completely new way of thinking already exists: agent-based modeling.

The easiest way to understand agent-based modeling is to imagine a big computer simulation. Something like the video game The Sims, but the characters make their own decisions. The model is programmed to act out how all the players behave and interact with each other. The players, or agents, perceive and react to their environment, and the decisions they make can change the environment, which makes other agents respond to the changes. While not used too often for economics, these models are increasingly popular in other scientific fields, such as mapping the spread of disease, weather systems, and traffic patterns.

Richard Bookstaber believes that agent-based models are just the thing for economics, especially when it comes to predicting and managing crises. In theory, they would help economics achieve a better understanding the granular structure of the economy and the countless interactions between every agent in it. Bookstaber spent most of his career working in financial risk management for banks and hedge funds, such as Morgan Stanley and Bridgewater Associates. In recent years, he’s put his faith in agent-based modelling into practice at the $120 billion pension and endowment fund of the University of California, where he is chief risk officer.

In the years after the crisis, Bookstaber worked for the US Securities and Exchange Commission on designing and implementing the Volcker Rule, a key piece of financial regulation implemented to stop banks from taking excessive risks. (Now, the Federal Reserve is looking for ways to loosen it.) He then went to the US Treasury department to develop ways to identify systemic risks in the US financial system and see if an agent-based model could be built to this end. “After 2008 everybody knew there was something missing with standard risk management, and this is filling that need,” he says.

Approaching economics from the world of finance, he sees fundamental flaws in the profession’s approach on some key issues, which he ominously dubs “the four horsemen of the econocalypse.”

The first is computational irreducibility, a fancy way of saying that the system—in this case, the economy—can’t be understood through simplification. This is a big problem for economists, since simplification is the raison d’etre of economic models. The second is radical uncertainty, which reflects that we, as humans, can’t totally understand the world because there are always new and unpredictable things taking place. The third is emergence, which is the theory that the whole is greater than the sum of its parts—the system as a whole has properties that individual agents don’t, which emerges because of the interactions between those agents. It’s why a bunch of individually reasonable actions can lead to an unexpected or undesirable result, like a traffic jam.

The final flaw, or horseman, as Bookstaber puts it, is ergodicity. This is a combination of the previous three that suggests we do not live in an ergodic world: one in which characteristics and behavior don’t change over time. “The whole notion of using econometrics and history to look at what’s going to happen is going to fail and the time you see that so obviously is with the crisis,” Bookstaber says. “One of the problems with risk management is that you look at the risks in the past, which is great 95% of the time but doesn’t work when it really matters.”

All of these issues can be solved using agent-based models, Bookstaber argues throughout his recent book, boldly titled The End of Theory. It’s a book that makes grim reading for economists. Bookstaber’s argument is that the economy is too complex for the economic models popular today. Instead, modeling a simulation of the world is better. “It’s just a foundational attack on economic methods,” he says. “It doesn’t have the attraction that economists like, doesn’t have equations, you don’t get a solution at the end.”

For all of their promise, agent-based models aren’t ready to take over economics in the way that they have proved useful by natural scientists. Agent-level behavior can’t be known to the same level of accuracy, because humans do not act according to fundamental laws of nature that govern their movement like, for example, particles.

While, economics is criticized for a reliance on rational expectations—essentially, assuming humans are smarter than they really are—discarding it entirely is just as problematic. People may not be perfectly rational but it’s just as unlikely that they are systematically irrational. They learn from experience.

Doyne Farmer, a professor of mathematics at the University of Oxford, is a long-time advocate of agent-based models but acknowledges that these models are far less developed than others. His back-of-the-envelope calculation is that DSGE and other economic models have had 30,000 person years of work go into developing them, compared with a mere 500 person years for agent-based models.

Even so, agent-based models are met with enthusiasm because their adoption by economics is a sign that the field is opening up to lessons from other sciences. And not before time, given that there are now new challenges that make a broader view more appealing. Economists need to understand the impact of artificial intelligence on jobs, the way financial systems adapt in response to regulation, and the consequences of climate change, to name just a few.

Enter the Rebuilding Macroeconomics Network, a four-year research initiative to fund innovation in economics paid for the by the UK’s Economics and Social Research Council. Farmer sits on the group’s five-person management board.

Rebuild Macro, which launched about a year ago, questions everything we think of when we think about the economy. It casts its net wide for contributors with new ideas on topics that include globalization, sustainability, the financial system, inequality, and disruptive technology.

The network’s aim is “to transform macroeconomics back into a useful and policy-relevant social science,” it states. This declaration is bolder than it seems on the surface. It’s a direct attack on the direction the field is moving in, which is increasingly mathematical with ambitions of becoming a harder science.

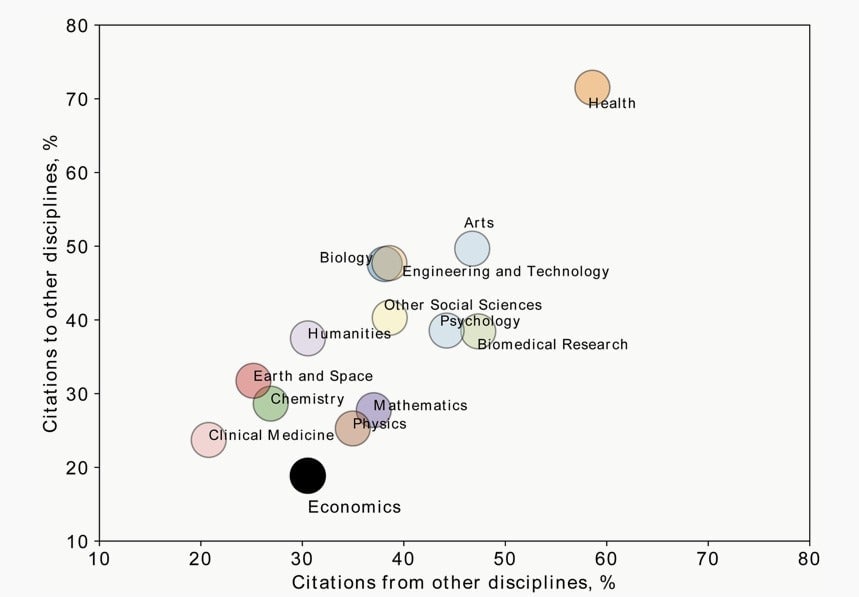

Rebuild Macro rejects the monoculture that marks much of macroeconomics. Research by Richard Van Noorden for the science journal Nature shows how insular economics research has been. For six decades, until 2010, economics papers cited other disciplines far less frequently than other subjects. “Historically, economics has indeed been the least outward-looking social science,” according to another paper. “Our discipline is likely to benefit from explorations further afield.”

This is starting to happen, slowly, thanks to an increase in empirical research. Keeping up this momentum is a key concern of Rebuild Macro, which has installed biologists, anthropologists, and physicists alongside economists and policymakers at the heart of the network.

The director of the Rebuild Macro network is Angus Armstrong, a former head of macroeconomic analysis in the UK Treasury Department, including during the financial crisis. In one area, Armstrong already sees the value in working with people from other professions.

“Fundamental to all the macroeconomic models we have this notion of equilibrium,” he says. “It’s been fascinating to speak to physicists that look at us like we are mad, saying ‘what makes you think it’s stationary?’” He uses the example of a pane of glass. In another form it is sand. It may take millions of years to transition between the two states, but ultimately they have the same molecular structure. “These are examples of how you can have notion of equilibrium but it doesn’t have to be stationary,” he says.

Psychology is also of use. “How do you deal with decision making when you’re faced with genuine ignorance? When you don’t know what the possibilities are until you are there?” Armstrong asks. “Psychologists have very interesting ideas about how human beings respond in that way and it does not involve maximization of the best possible options in the way economists would consider it.”

Armstrong’s main criteria for researchers applying for funding from his group is to think big. “We don’t want to fund things that are just a marginal increase on stuff that’s been done already,” he says. The group is looking to support “things that really address real world, big macroeconomic questions.”

At the end of four years, Rebuild Macro will report to its paymasters which areas it thinks have the potential for a genuine breakthrough in our understanding of the economy. Whether special efforts like Rebuild Macro’s or breakthroughs by the profession’s heavy hitters at the most prestigious institutions get there first, it’s clear that a genuine revolution in economics is afoot—and overdue. But, as Armstrong says, “It’s an enormous task.”