Beware the looming corporate debt cliff

US corporations are issuing more bonds than ever (paywall), rushing to take advantage of rock bottom interest rates before the Federal Reserve winds back its loose monetary policy. But with every binge comes a hangover, and 2018 could be the year when the real impact of this year’s borrowing bonanza begins to hit home.

US corporations are issuing more bonds than ever (paywall), rushing to take advantage of rock bottom interest rates before the Federal Reserve winds back its loose monetary policy. But with every binge comes a hangover, and 2018 could be the year when the real impact of this year’s borrowing bonanza begins to hit home.

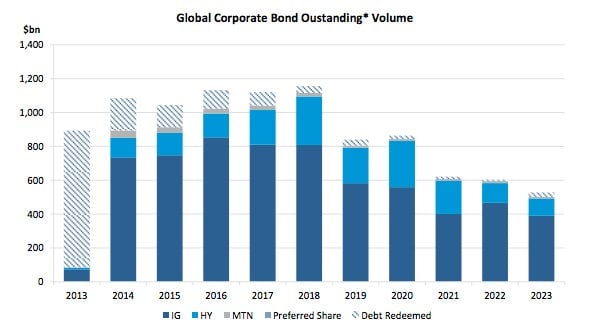

According to Dealogic, a record $1.1 trillion worth of corporate debt is scheduled to mature in 2018. That will also be the third straight year when companies will need to either refinance or pay back more than $1 trillion in borrowings.

Concerns about the “corporate debt cliff” seem to pop up every other year, but they’re usually centered on the riskier high yield market. The debt maturing between 2016 and 2018 is overwhelmingly made up of investment grade debt, or bonds issued by blue chip companies. Those companies don’t typically find it difficult to access finance. But interest rates will almost certainly be higher in 2018, so this time, companies will likely have to pay up for it.

Corporate profit margins in the US are currently at record highs, and one of the factors underpinning the current stock market boom is a belief that this will continue. Carl Icahn is among those who doubt it. This week he described those profits as a “mirage,” telling Reuters ”they are not coming because the companies are well run but because of low interest rates.”

So the real concern when it comes to the corporate debt binge is not about the risk of a wave of defaults to cascade through the economy, but rather, the inevitability that higher interest rates when this debt is refinanced will bring unsustainable profit margins back to earth.