China’s electric-car explosion is creating infrastructure headaches

China already sells most EVs in the world, and it’s likely to maintain its hold at the top for the foreseeable future. One of the ways the Chinese government has driven up demand for EVs at home is through car-registration restrictions.

China already sells most EVs in the world, and it’s likely to maintain its hold at the top for the foreseeable future. One of the ways the Chinese government has driven up demand for EVs at home is through car-registration restrictions.

All owners of new cars have to register for a license plate before they can take them to the road. In big cities, the demand for fossil-fuel cars far outstrips the number of licenses available for them.

In Beijing, the only option is to apply to a lottery, where chances of winning can be as low as 0.2%. In Shanghai, citizens can put in a bid for a limited number of licenses; in recent years, the average winning bid has been about 88,000 yuan ($12,800). Until 2017, the demand for electric cars or plug-in hybrids was not much more than the supply of available license plates. In 2017, the demand for EVs shot up. Current estimates suggest that 2017 EV plate applicants will have to wait up to eight years before their applications are accepted.

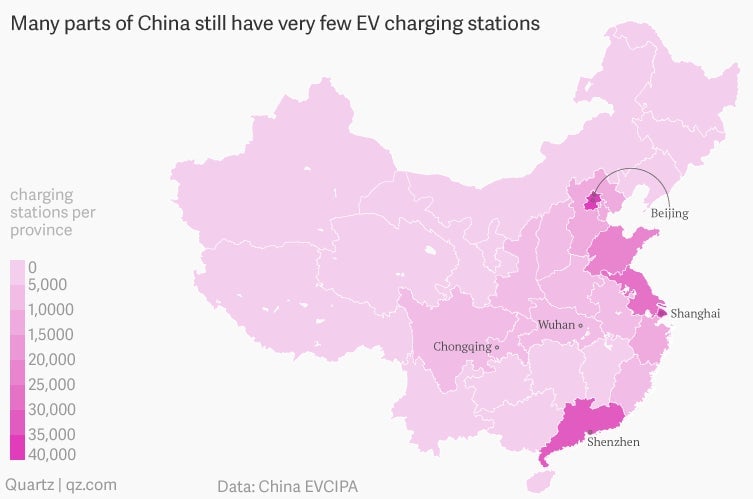

There are other infrastructure challenges that have resulted from China’s EV explosion. The central government has said it wants the country to have one charging station for each EV by 2020, but right now, new EVs are far outpacing new charging stations.

As of October, the country has around 700,000 charging stations, according to data from China Electric Vehicle Charging Infrastructure Promotion Alliance, a non-governmental organization. But there are huge swaths of China where there are few or even no charging stations. For example, the South China Morning Post recently reported that there are currently no charging stations 300 km (185 miles) west of Beijing. Since that’s the typical range of a compact EV, that means you can’t EVs to travel too far in that direction.

In fact, the western part of China in general is a charging-station wasteland; the majority of charging stations are in the east. But even in eastern China, there are huge stationless gaps, like those between Shanghai and Wuhan, and Wuhan and Chongqing, to name two examples.

That might seem odd to Americans used to, perhaps, driving the 380 miles between Los Angeles and San Francisco, or the 440 miles between Boston and DC. In China, most are acclimated to taking (often high-speed) trains when traveling between cities or provinces.

One alternative solution to charging stations is battery-swapping stations. BJEV, one of China’s largest EV manufacturers, is shifting to battery-swapping technology. BJEV has plans to build battery-swapping stations in inland areas of China, like Xinjiang province, where charging stations are few and far between.

Battery swapping has the added benefit of eliminating the long charging times battery EVs currently require. A battery-swap is faster than refilling at a gas station.

If battery-swapping technology becomes widespread, it would put further pressure on China’s lithium-ion battery production industry. Already, China has by far the world’s largest lithium-ion battery manufacturing capacity. But it has plans to more than double it to keep up with demand.

All those batteries are also going to need a lot of raw materials. According to Yano Research Institute, China has been amassing access to them and now controls between 50% and 77% of the global market for the four components that make up a battery: anode, cathode, separator, and electrolyte.

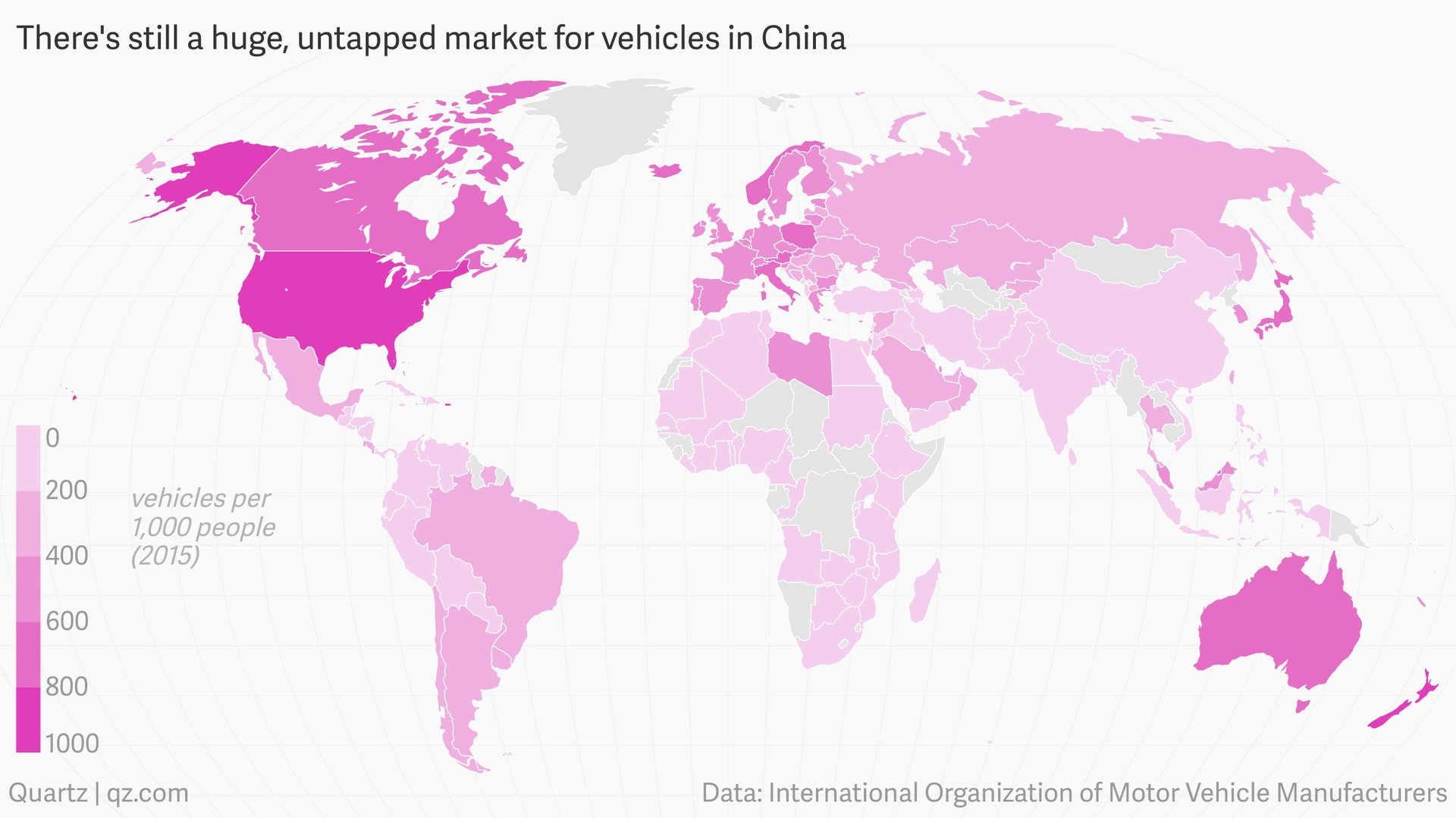

What’s especially striking about all of these charts is that they don’t show the potential of China’s vehicle market. Relative to North America and Europe, and even much of Southeast Asia, South America, and the Middle East, vehicle penetration is quite low in China. As of 2015 (the most recent year for which data are available), there were less than 0.2 cars per person; in the US, there were over 0.8. Considering there are 1.4 billion people living in China today, even doubling the per capita car rate to 0.4 would add some 280 million new cars to the roads—almost as many as are in the entire US today.