The investment of the future is… wood

You can hear the cries echoing out over Wall Street: “Timmmmmbbberrrrrr!”

You can hear the cries echoing out over Wall Street: “Timmmmmbbberrrrrr!”

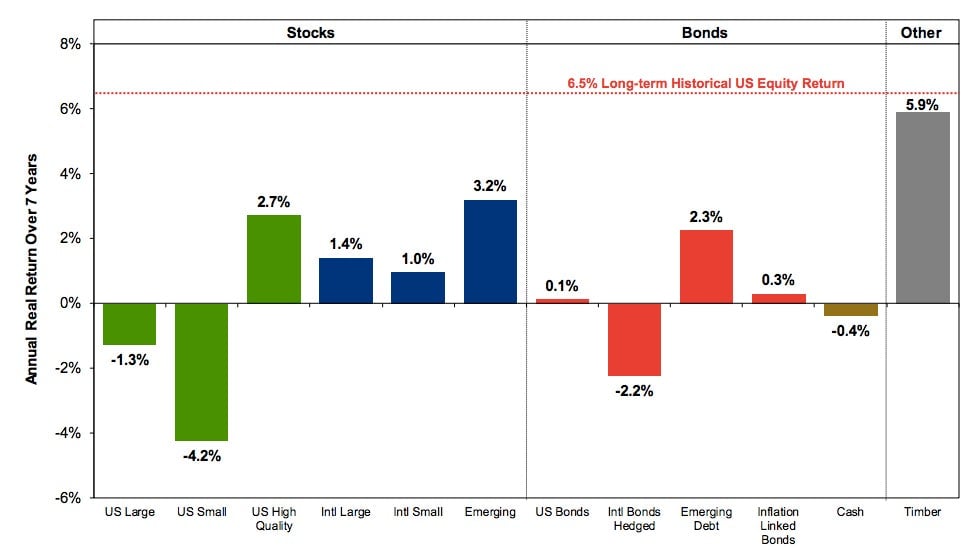

Ok, maybe not. But the investment fund GMO says it’s the asset the fund expects to have the best return over the next seven years. Run by investor Jeremy Grantham, GMO manages $112 billion, and its team is bearish about the US stock market’s recent heights because its strategy is based on reversion to the mean. Grantham is unimpressed with stimulus and the Federal Reserve’s bond-buying, but timber is a winning buy thanks to China’s interest in the commodity and hopes of more housing growth in the US. Buying up forest is not without its caveats, according to GMO’s Ben Inker, largely because you have to actually, er, buy up a forest:

Timber is one of the least liquid assets you can find, and that’s part of the reason why it has generally been priced to give pretty good returns. You can’t own timber in a really liquid way. Timber REITs [real estate investment trusts, which are vehicles for investing in real estate that offer tax breaks] aren’t a wonderful expression of timber. Timber companies turn out to be a lousy expression of timber. If you want to own timber, you really have to own the trees or structure it as a limited partnership that is going to actually make money as the trees are harvested. That means you are talking about a minimum of a 10- to 15-year holding period. So if you buy timber, you are going to be stuck there for awhile. You lose the ability to move to different asset classes if pricing changes. So that 5.9% forecast looks pretty today. But I wouldn’t stick tons of my portfolio in timber, because maybe a year from now there are going to be some assets classes that are priced to deliver better than 5.9%.

So much for dreams of fast wood-fueled riches. But Grantham and his company have an uncanny record of long-term foresight.