China is officially over American soybeans

China did not import a single US soybean in November, the first time sales to the country have dropped to zero since US president Donald Trump initiated a trade war with the country earlier this year.

China did not import a single US soybean in November, the first time sales to the country have dropped to zero since US president Donald Trump initiated a trade war with the country earlier this year.

In place of American soybeans, China bought more than five million metric tons of the seeds from Brazil last month, nearly twice the 2.76 million metric tons it purchased from Brazilian farmers a year earlier, Reuters reported, citing data from the General Administration of Customs.

Chinese leader Xi Jinping imposed a 25% tariff on US imports last July in response to those placed on Chinese goods by president Trump. China accounted for roughly 60% of US soybean exports during the USDA’s 2017 marketing year, which runs from September to September, in deals worth more than $12 billion. In 2016, soybean exports to China topped $14 billion.

On December 1, president Trump and China agreed not to impose any new tariffs for 90 days. However, the existing tariffs on US imports remain in place. Beijing has made a couple of purchases of US soybeans since—1.13 million metric tons on December 13 and 1.19 metric tons on December 19. However Jason Hafemeister, the USDA’s acting deputy undersecretary for trade and affairs, cautioned that these are based on signed contracts, with export numbers only confirmed after shipping. The situation has prompted American farmers to look to buyers in other regions, including Europe, the Middle East, North Africa, and other parts of Asia, according to the Wall Street Journal.

And although Beijing has made a couple of purchases of US soybeans since—1.13 million metric tons on December 13 and 1.19 metric tons on December 19—American farmers are looking to buyers in other regions, including Europe, the Middle East, North Africa, and other parts of Asia, according to the Wall Street Journal.

“It’s far from a guarantee it will work,” US Soybean Export Council head Jim Sutter told the newspaper.

China accounts for the top 10 largest single purchases of US soybeans since record keeping started in 1977, with the biggest one, for 2,923,000 metric tons, occurring in February 2012. In January, USDA trade counsel Jason Hafemeister said, “China offers our best opportunity for major export growth in the future.”

Hafemeister did not immediately respond to a request for comment.

The USDA has promised $12 billion in aid to US farmers hurt by the tariffs. Still, using money that could be better spent elsewhere is a short-term fix for an avoidable problem. Farmers “want to trade. They want to sell their products,” said senator Heidi Heitkamp (D-ND) over the summer. “They don’t want to just get a check from the government.”

The American soybean market currently has “extra capacity” to increase exports, according to the US Soybean Export Council. (Read: a glut.) Pakistan is a potential bright spot for US soy exporters in the absence of a viable Chinese market, it says.

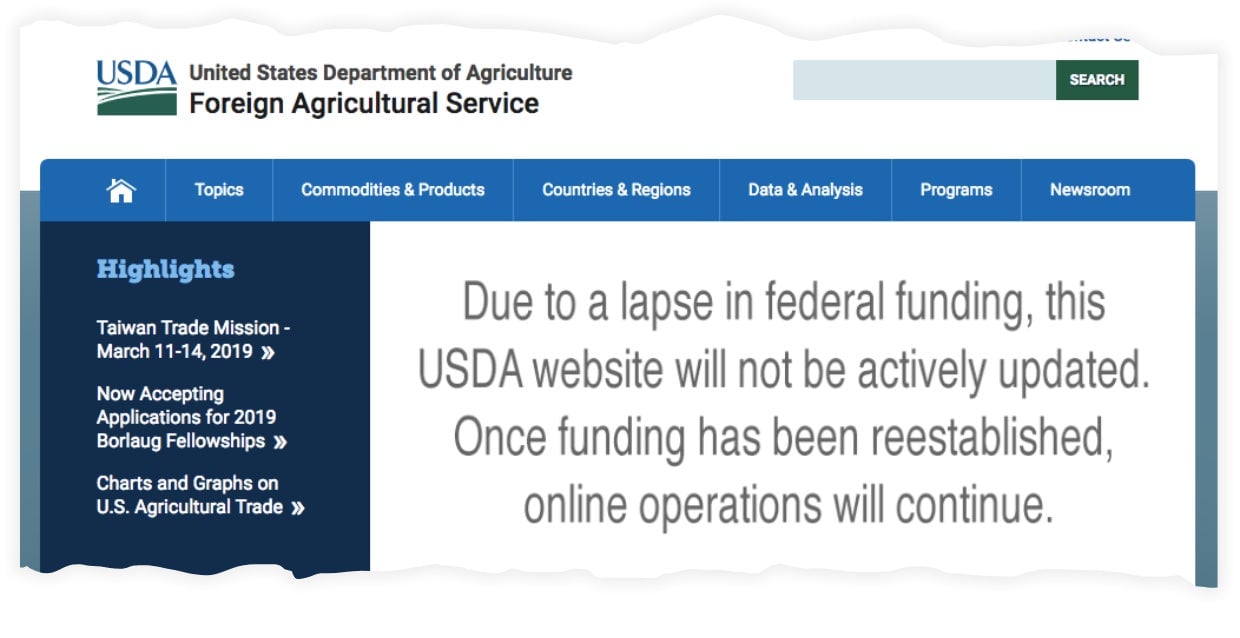

USDA export data is not available during the US government shutdown, which began just after midnight Friday when president Trump did not get funding for his signature border wall.

This story was updated to clarify December’s soybean orders are based on signed contracts, not confirmed deliveries.