For stock investors, it was a bumpy year, rough fourth quarter, and brutal December

If you bought into the Dow index of blue-chip US stocks at the start of 2018, you were sitting pretty nine months later, with a gain of around 8%.

If you bought into the Dow index of blue-chip US stocks at the start of 2018, you were sitting pretty nine months later, with a gain of around 8%.

Then the bottom fell out.

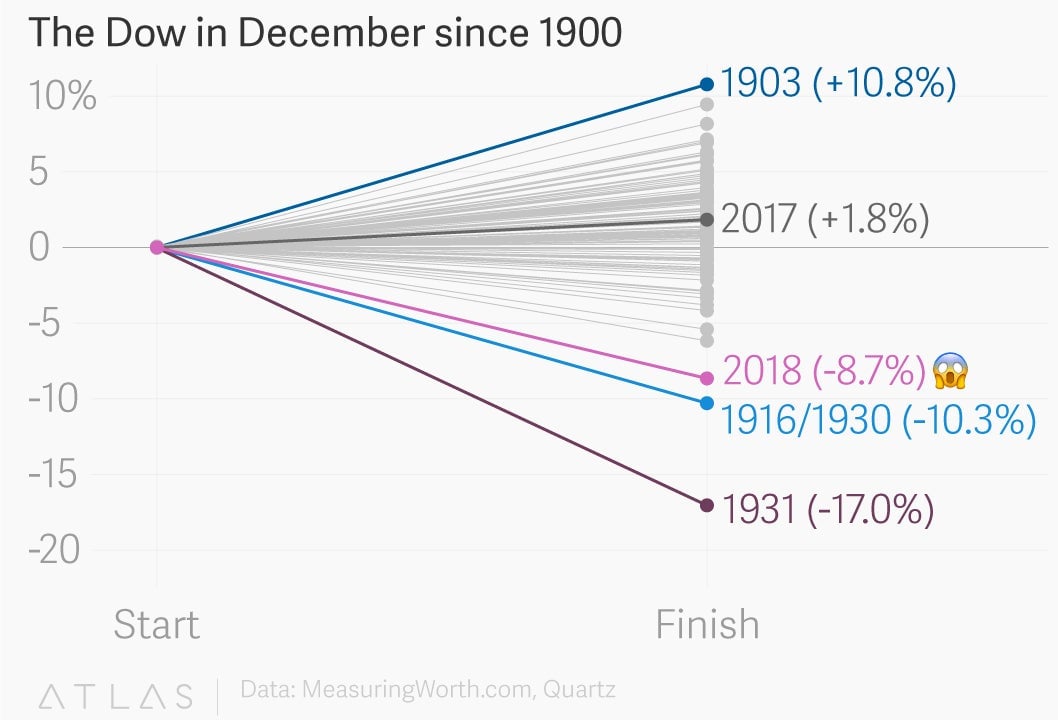

Amid wrenching volatility, the market tumbled in the fourth quarter, with the declines particularly pronounced in December. (Happy holidays!) In fact, the Dow’s 8.7% decline in December ranked as the fourth-worst since 1900, beat only by 1916 (-10.3%), 1930 (-10.3%), and 1931 (-17%). It’s never a good sign when you’re comparing things to WWI and the Great Depression.

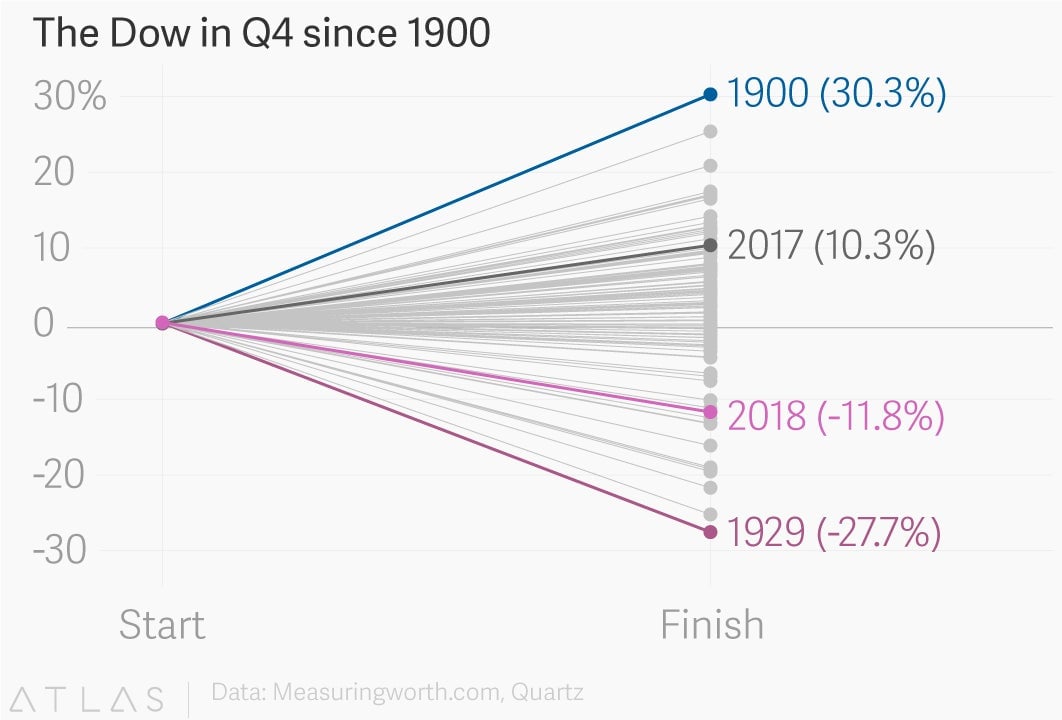

The drop was even worse for the fourth quarter. But historically speaking, that 11.8% decline was only the 10th-worst on record since 1900. So there’s that.

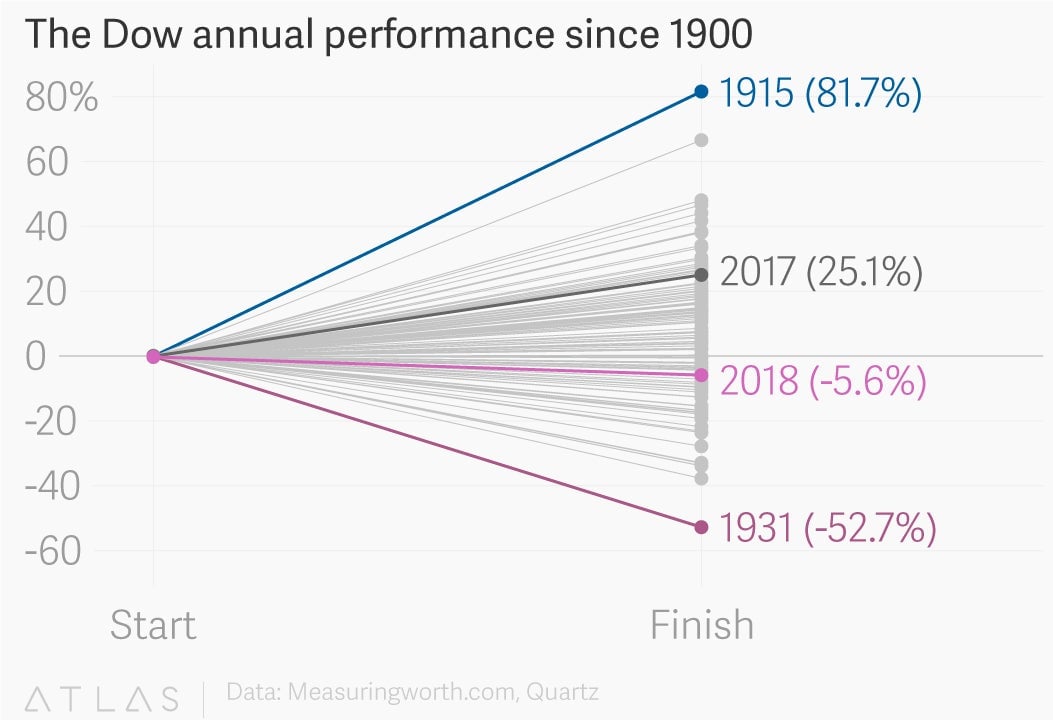

Taking in the entire year, things look up…ish. The Dow’s 5.6% decline in 2018 just barely makes the rankings of the 30 worst years since the turn of the 20th century. It was the poorest market performance since 2008, when the Dow shed a third of its value during the depths of the subprime credit crisis. For what it’s worth, the longest US bull market in history is still intact. And other countries’ markets fared far worse this year (paywall).

Slowing economic growth, rising interest rates, trade tensions, and a host of other worries loom over the markets at the start of 2019, just as they did towards the end of 2018. Looking back over the ups and downs of the past year, it could’ve been worse. Considering the carnage over the past month or so, that’s at least something to celebrate.