Latin America in six charts: The recession is coming

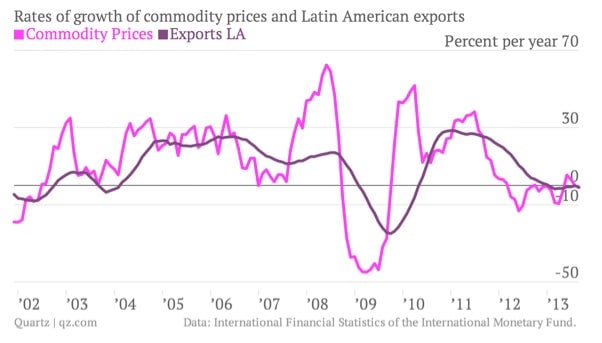

For most of the last 13 years, commodity prices experienced a sustained boom. For most of the same period, Latin American exports grew at very fast rates. Not many people made the connection between these two facts, quite visible in the next graph. Many investors and observers thought that the exports boom and the rapid GDP growth they elicited in their countries were the result of a structural change in the Latin American economies, which had, overnight, increased their productivity and dynamism. This perception lasted even after the 2008-2009 dramatic fall in both commodity prices and exports, which was forgotten once the prices went up again, dragging up the value of exports with them.

For most of the last 13 years, commodity prices experienced a sustained boom. For most of the same period, Latin American exports grew at very fast rates. Not many people made the connection between these two facts, quite visible in the next graph. Many investors and observers thought that the exports boom and the rapid GDP growth they elicited in their countries were the result of a structural change in the Latin American economies, which had, overnight, increased their productivity and dynamism. This perception lasted even after the 2008-2009 dramatic fall in both commodity prices and exports, which was forgotten once the prices went up again, dragging up the value of exports with them.

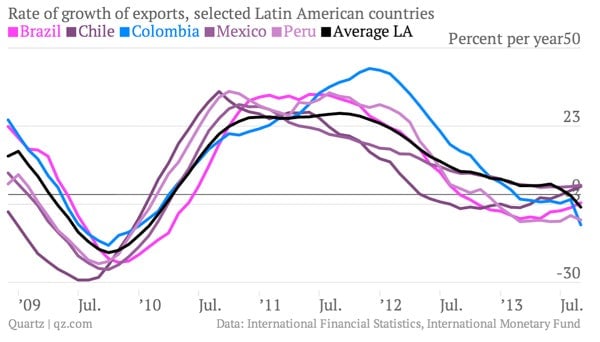

(Exports for the chart above and below are accumulated over the previous 12 months before estimating their growth rate.)

Now, as also visible in the graph, commodity prices have been falling for some time, and, unsurprisingly, exports have gone down as well. The next graph shows the fall in the rates of growth of the total Latin American exports and of some selected Latin countries, focusing on the last five years. In the last 12 months, the Brazilian, Peruvian and Colombian exports have fallen by 2.8%, 6.7% and 10.4%, respectively. Those of Chile and Mexico have grown, but only by 2.7% and 3.1%.

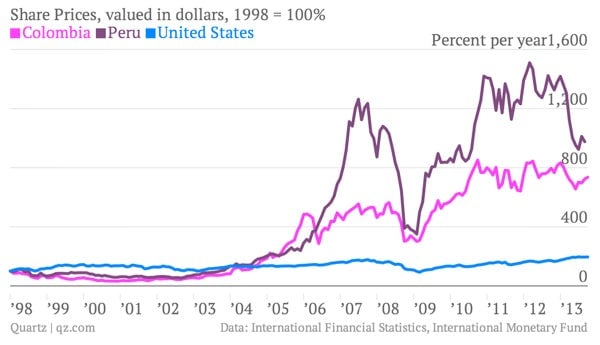

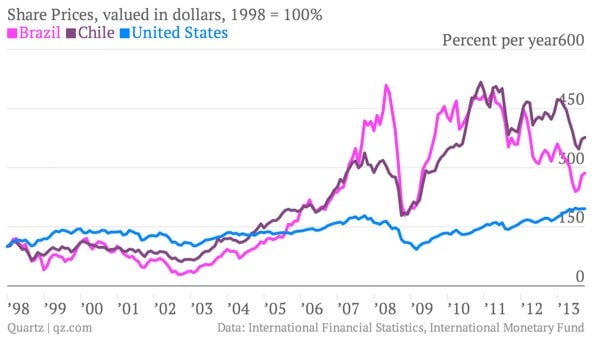

This is bad enough. Reality, however, is worse. The prices of assets are falling in those countries, reversing the trend that elicited large capital inflows in the region. These inflows led to a simultaneous appreciation of the assets and the currencies of these countries, in such a way that the appreciation in dollar terms returned very high yields when valued in dollars. Now that the commodity prices are going down, the value of the assets and the currencies are going down as well, producing highly negative returns in dollar terms. The next graph shows the up and down paths of equity shares, valued in dollars, in Colombia and Peru. The low line represents the current boom in American share prices, which, when compared to the magnitude of the booms in Colombia and Peru, seems to be a minor affair.

The next graph shows the same for Brazil and Chile. The impression left by these graphs about all these countries is that of punctured bubbles in the process of bursting. From March 2012 to September 2013, Colombian shares fell by 11%; the Chilean ones, by 19%; the Brazilian ones by 33% and the Peruvian ones by 35%. This creates a big incentive for capital to leave these countries, which, in turn, creates a depressive pressure (additional to the fall in export revenues) on production and well-being.

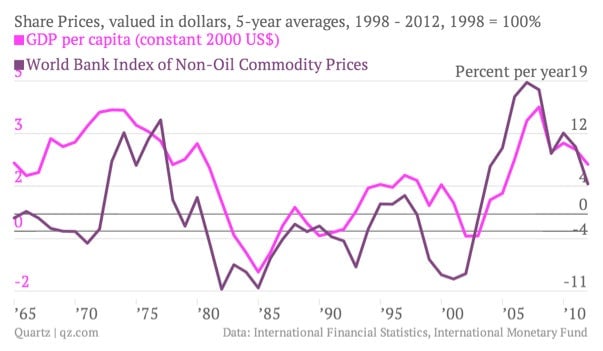

These events suggest that a recession is about to start in most of Latin America as a result of the combined effect of declining exports and capital flight (not all Latin American countries depend on commodities’ exports but most of them do). The recessionary impact of declining commodity prices is not a new development. As shown in the next graph, it has been a constant throughout the history of Latin America. Thus, it’s time to brace yourself—again.

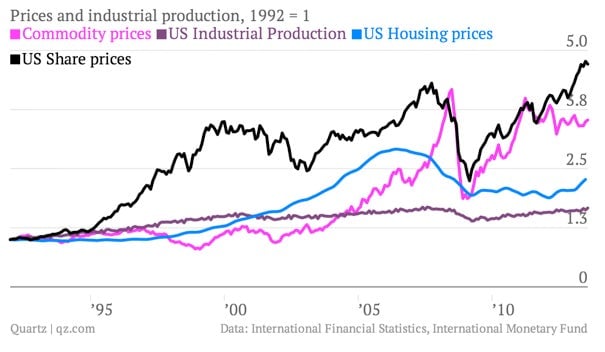

The bubble behavior of commodities raises some uncomfortable questions. As shown in the next graph, commodity prices have shown a behavior similar to that of equity share prices in the United States. Could it be that commodity prices are in a bubble and the shares are not? Is the behavior of commodity prices an advance sign of what will happen to shares?

We’ll have to wait and see.