Twitter shares are soaring, as are bets that they will collapse

Twitter shares surpassed the $52 mark this morning, which means the stock has now doubled from its IPO price. It’s nothing short of vindicating for the social network, which faced skepticism before its IPO, to outperform the returns of its peers at a similar stage of growth.

Twitter shares surpassed the $52 mark this morning, which means the stock has now doubled from its IPO price. It’s nothing short of vindicating for the social network, which faced skepticism before its IPO, to outperform the returns of its peers at a similar stage of growth.

But as the shares climb higher, so do the contrarian bets.

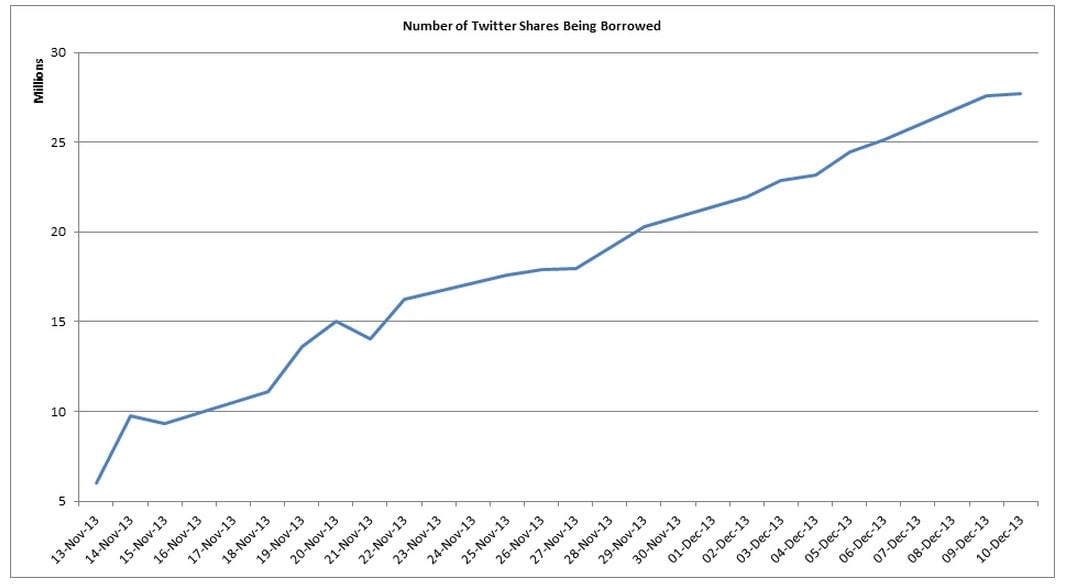

Short sellers borrow shares to sell them in the hope that they can turn a profit by buying them back at a lower price when the share price declines. According to the above chart from SunGard’s Astec Analytics, the number of Twitter shares being borrowed (generally a good proxy for short selling) has been rising steadily, hitting a new high on Dec. 10.