America’s debt fever may be breaking

With the overwhelming approval of a two-year budget by the US House of Representatives, Washington is bowing to the obvious: There is no need for dramatic boycotts of annual spending that end in government shutdowns when public borrowing has stabilized. Is the era of debt panic over?

With the overwhelming approval of a two-year budget by the US House of Representatives, Washington is bowing to the obvious: There is no need for dramatic boycotts of annual spending that end in government shutdowns when public borrowing has stabilized. Is the era of debt panic over?

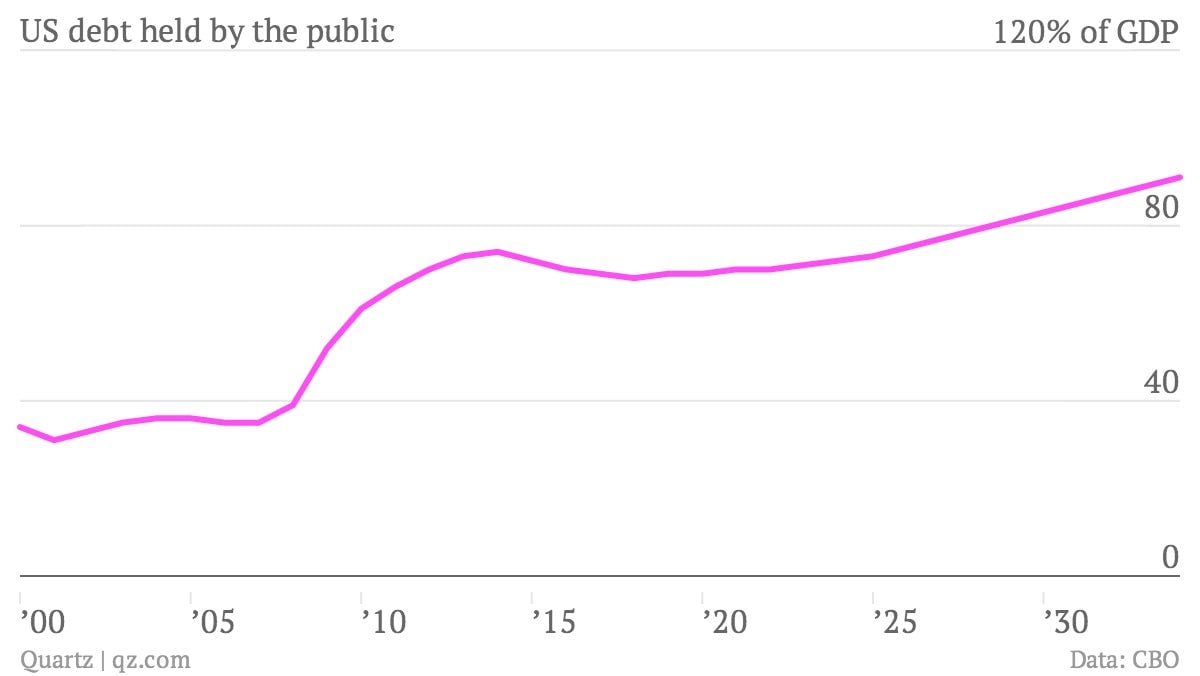

The chart above shows what three years of spending cuts and tax increases enacted by US lawmakers, along with a nascent economic recovery, have already achieved for US public borrowing. There’s an inflection point around 2013 and small reduction in the ratio of debt to US GDP, and then a decade until demographic changes drive health and pension spending—and the debt—slowly upwards.

Chastened by the backlash to the previous government shutdown, Republican leaders dropped demands for dramatic spending cuts and overhauls of health insurance, although their right wing remains unconvinced. Democrats, eager for positive news after the stumbles of the new health care program, put aside their calls for higher tax revenue. The modest agreement that resulted will roll back across the board cuts Congress itself passed as a punitive measure. It replaces them with targeted savings and new revenue from fees and sales, allowing spending to increase over the next two years by $62 billion without changing the path of deficit reduction.

The winners:

- The economy, which stands to expand more rapidly with renewed public spending.

- Oil companies, who can now work with Mexico’s state oil company to explore deep water reserves in the Gulf of Mexico thanks to a diplomatic agreement approved in the bill.

- Defense contractors with appropriations restored.

- Recipients of government services and government employees who won’t be laid off.

The losers:

- Companies with public pensions will need to pay more to insure them.

- Fliers, who will need to pay a little extra to fund the Transportation Security Administration for its services.

- Fraudsters, who will have a harder time accessing the “death master file” to collect a deceased person’s pension.

- The long-term unemployed, some 2 million of whom will lose their benefits in the new year without action—even as a new measures to collect unemployment overpayments are part of the cost-savings package.

- In the long-term, economic growth, absent new investments in infrastructure and shrinking funding for research and development.

The threat of another shutdown averted, Congress can go home for the Christmas holiday rather more merrily. But that problem of the long-term unemployed, a Republican plan to cut food subsidies for the poor, and especially the impending need in February to raise the debt ceiling or face another default threat, will have Congress discussing much more contentious issues. Hopefully, having set aside panic, they can embrace productivity.