QE3=slow growth+inflation: Monetary policy is sowing the seeds for the next crisis

Only a few days after Brazil’s finance minister, Guido Mantega, accused the US Federal Reserve of provoking a currency war by flooding the international markets with dollars and forcing developing countries to depreciate their own currencies, the head of the International Monetary Fund threw her support his way. Managing director Christine Lagarde said:

Only a few days after Brazil’s finance minister, Guido Mantega, accused the US Federal Reserve of provoking a currency war by flooding the international markets with dollars and forcing developing countries to depreciate their own currencies, the head of the International Monetary Fund threw her support his way. Managing director Christine Lagarde said:

Accommodative monetary policies in many advanced economies are likely to spur large and volatile capital flows to emerging economies. This could strain the capacity of these economies to absorb the potentially large flows and could lead to overheating, asset price bubbles, and the build-up of financial imbalances.

Reacting to these remarks, Bernanke went on record with some startling declarations of his own:

In some emerging markets, policymakers have chosen to systematically resist currency appreciation as a means of promoting exports and domestic growth. However, the perceived benefits of currency management inevitably come with costs, including reduced monetary independence and the consequent susceptibility to imported inflation. In other words, the perceived advantages of undervaluation and the problem of unwanted capital flows must be understood as a package—you can’t have one without the other.

Bernanke is right in saying that resisting currency appreciation is a choice, not a necessity, and in suggesting that monetary management may have costs. He could have added, though, as I argued last week in Quartz, that the previous boom in Brazil was caused by dollar inflows brought about by high commodity prices and large capital inflows, that its slowdown was due to the decline in these inflows, and that the recent currency depreciation has not brought about economic growth. As shown in that article, facts would have supported these observations if he had uttered them. In that sense, his comments were not surprising.

However, Bernanke’s remarks were startling because they become damning when applied to his own monetary policies. He, who has created more dollars than anybody else in the history of the United States, has never said what the cost of his feat could be. Also astonishing was his use of the word “perceived,” rather than, say, “realized,” when referring to the benefits that may come from currency manipulation. From the point of view of the Fed, which normally argues that the benefits of currency manipulation are not just perceived but undeniable, and that in some circumstances such as those prevailing today they can be attained at zero cost, this statement was, to say the least, demoralizing.

Figure 1 is very useful to take a guess at the benefits that the United States is deriving from Bernanke’s QEs and other vehicles to create liquidity. You can see how the money created by the Fed—called Base Money—jumped by $1.8 trillion since the financial crisis started in September 2008. Now look at what the commercial banks have done with that money. They increased their credit to the federal government by $324 billion (buying bonds and Treasury bills) and deposited the $1.8 trillion back into the Fed. They also reduced their credit to the private sector by $438 billion.

This graph is devastating for the Fed’s position in the controversy about quantitative easing and, in general, about the benefits of monetary manipulation. How could you say that monetary creation has helped the economy if credit, the vehicle that would supposedly convey those benefits, has decreased instead of increasing while the Fed keeps on creating more money? If all that banks do with the new money is to deposit it with the Fed and buy government debt? What you can say is that the enormous monetary creation has mightily increased the cash commanded by the banks, independently of their solvency situation. In this way, even insolvent banks, those with claims on Greece and the PIIGS countries (Portugal, Italy, Ireland, Greece and Spain) or in banks with claims in those countries, or with claims on unviable real estate projects or their derivatives, stay liquid, even if they are bankrupt because the market value of those claims is just a small fraction of their book prices.

Thus, the perceived benefits of Bernanke’s monetary creation seem to be that—perceived–because, for the enormous majority of Americans, it has not translated in an increase in credit, not even in preventing its decline. Credit and monetary creation seem to be in different circuits.

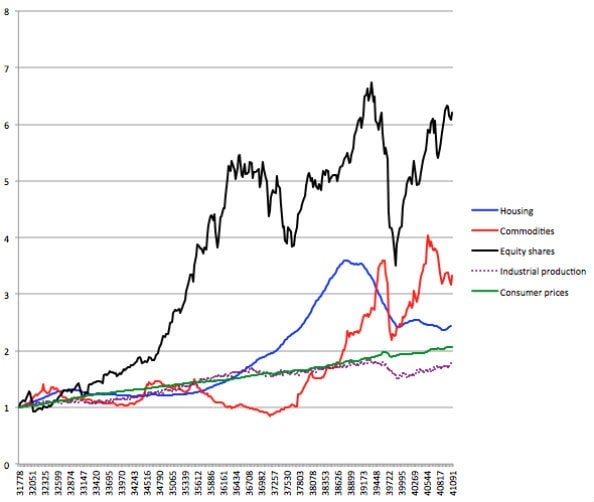

Regarding the cost of the monetary creation in the United States, Figure 2 shows what has happened since Alan Greenspan took over the chairmanship of the Fed in 1987, inaugurating a period of unrestrained low-interest rates. They include three consecutive equity share bubbles, two consecutive commodity bubbles, one housing bubble, two equity share crises (2000-02 and 2008-09), a major financial crisis in 2008-09 and a weak industrial expansion throughout. The bubbles became serial because monetary creation increased after the previous bubble, caused by previously excessive monetary creation, collapsed. Remember Lagarde’s words: “overheating, asset price bubbles, and the build-up of financial imbalances.”

Since credit to the private sector has not increased since September 2008, the credit that sustains the serial bubbles has been taken away from credit to other, real private companies. Thus, the deleterious effects of monetary creation that Lagarde spoke about have happened not just in emerging countries but also in the United States (and Europe, as the PIIGS attest). Neither Lagarde nor Bernanke mentioned this, however.

There is another aspect to the costs of monetary creation, one that the Fed thinks is not impending—the risk of high inflation. According to the Fed’s Keynesian doctrines, monetary creation does not lead to inflation when unemployment is high, because the added money would go first to increase production, and therefore employment, and only after reaching full employment would turn to increase prices. Yet, as we can see in the previous two figures, the new currency has not gone to increase employment but only the prices of equity shares, commodities and housing in times past, as well as to provide liquidity for banks to look solid even if their solvency is not certain. Unemployment remains extremely high by historic standards.

Thus, the reason why there is no inflation is not that the new currency is reducing unemployment but only that the new cash is accumulating in the accounts of the commercial banks in the Fed. It is not being used. Now, if the banks used this cash to increase credit, inflation would go up sharply because the amounts involved are huge. The reserves that the commercial banks hold in the Fed are like time bombs that would explode as soon as the banks start using them.

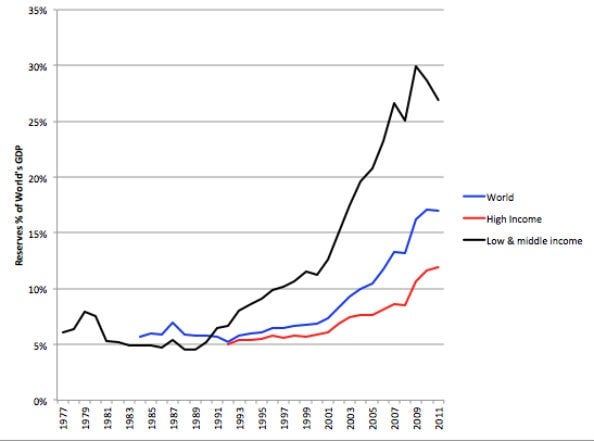

But this is happening not just in the United States. As shown in Figure 3, other countries, especially low- and middle-income countries, have been accumulating dollar reserves at a very fast rate, from around 5% of their gross domestic product (GDP) when Greenspan began his mandate to around 27% in 2011. That means that the world has excess reserves equivalent to 22% of their GDP (5% was enough). If these countries decide to use these reserves to counterbalance a recession like the one that seems to be coming to them, the world’s inflation rate would increase significantly. In the United States, this would complement the expenditure of the commercial banks’ reserves to increase the rate of inflation.

You may think that this would not happen. You may say, “Surely Bernanke and the other central bankers would increase the rate of interest if the rate of inflation increases.” That is taking a heroic view of central bankers that may not coincide with reality. No central banker is likely to increase interest rates if production does not recover while prices begin to increase—as it happened in the 1970s, when the world suffered the consequences of a previous orgy of monetary creation. They are unlikely to do so because if they do it people will blame the stagnation on their decision to increase the interest rates. Thus, the next crisis could be the continuation of this one, in a different shape—slow growth plus inflation, which in the 1970s was called stagflation. Neither Mantega, nor Lagarde nor Bernanke spoke about this.