Why Europe foots the bill for Maltese translators and other dubious economic choices in a crisis

To understand how Popeye, the popular cartoon sailor man, who made his debut in the year of the Great Depression, has returned 83 years later to thwart a solution to the European financial crisis, it helps to know something about German Finance Minister Wolfgang Schauble’s muscular Bluto approach to this week’s critical European Council meeting in Brussels.

To understand how Popeye, the popular cartoon sailor man, who made his debut in the year of the Great Depression, has returned 83 years later to thwart a solution to the European financial crisis, it helps to know something about German Finance Minister Wolfgang Schauble’s muscular Bluto approach to this week’s critical European Council meeting in Brussels.

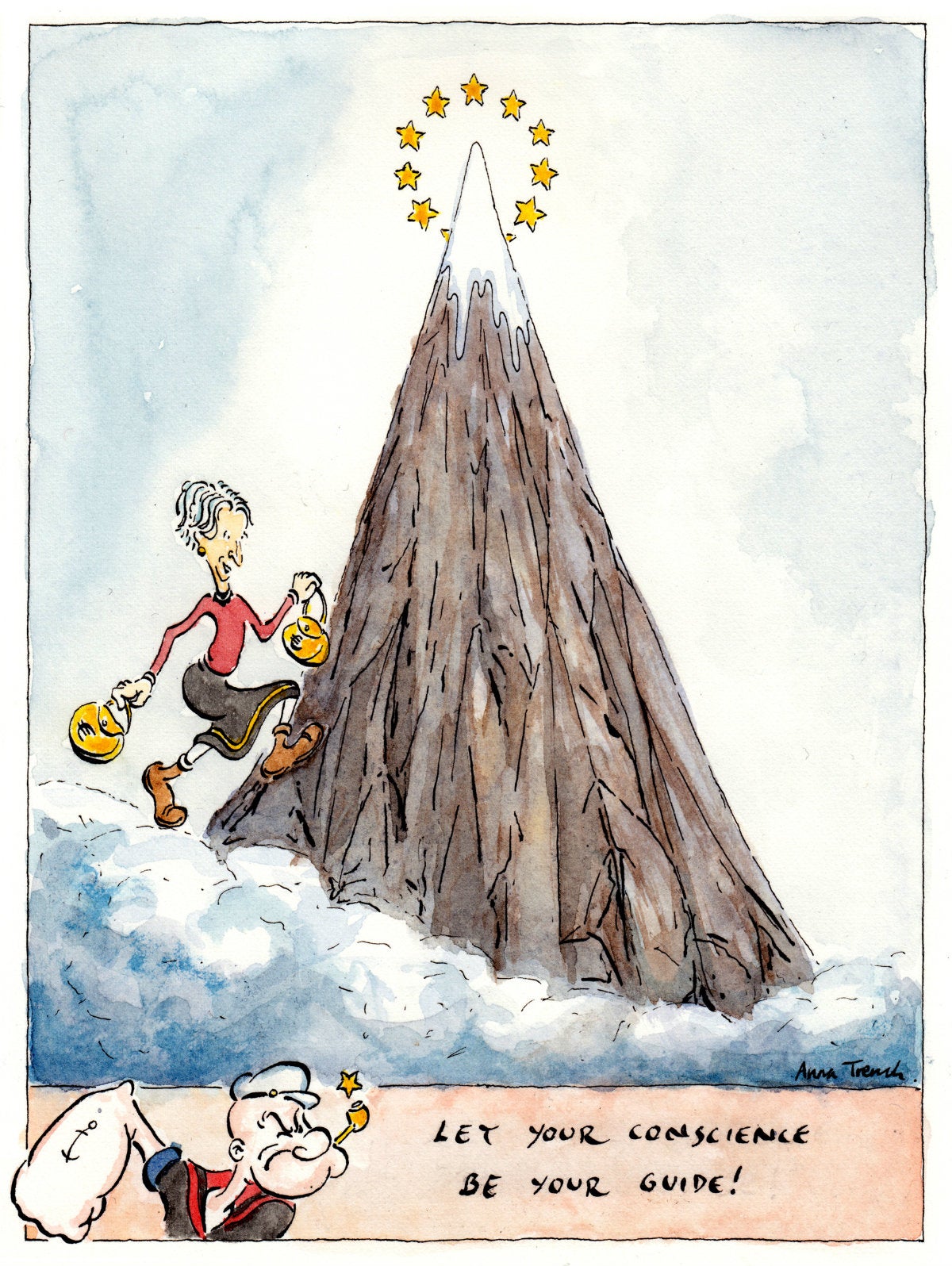

“When you want to climb a big mountain and you start climbing down the mountain, then the mountain will get even higher,” is how Schauble last week described this week’s European challenge; specifically, if International Monetary Fund participation is the path to getting off Greece’s €360 billion debt heap, how many billions in pain will it cost German taxpayers to take Greece and every other near-bankrupt EU country’s public-sector creditors along for the descent.

Although the EU directive on spinach, having already been codified not to exceed more than one portion a day to children between one and three years of age, is not on Schauble’s agenda, the two-day summit brings together leaders from 27 countries; 17 eurozoners; 23 Euro Plus Pact nations; 25 EU fiscal compromise signatories and one Croatian wannabe to parse in 23 official languages the findings of the troika of the European Commission, the European Central Bank and the International Monetary Fund in order to reach a conclusion on whether a portion of Greece’s debt should be written off because it’s not sustainable.

In Popeye’s words, another 48-hour session of I yam what I yam economics.

This is what happens when bickering cartoon characters are put in charge of insolvent mountains. “We don’t need no guide,” Popeye says. “Let your conscious be your guide.”

Sentiment, however, costs money. “The consequence of a deal with a 60% or more haircut for creditors, and new bonds governed by English law, would effectively eliminate the private sector as creditors for Greece,” Peterson Institute for International Economics Research Fellow Jacob Kirkegaard earlier this year told his followers. “Greece would essentially become a euro area domestic problem, a complete ward of the state/euro for all practical purposes.”

Purse in hand, IMF managing director Christine Lagarde is the Olive Oyl of Brussels. Her call to ease demands for further austerity throughout Europe’s failing economies steams Schauble. According to Lagarde, the IMF miscalculated the impact of austerity measures across the region. It’s time to be nice. Schauble continues to urge even tougher cuts. More paperwork, less love.

There’s an old American political saw that stipulates folks in a democracy get what they deserve and deserve what they elect. The EU’s alleged representative democracy is more H.L. Mencken: “Running the circus from the monkey cage.”

Allowing the Popeyes to continue navigating the EU is a recipe for a toxic luxury cruise wreck. The theorists and bureaucrats of Brussels no longer have the cash or public support to keep their phony ship of state afloat for Europe’s 500 million people, most of whom so far want no part in exchanging their national sovereignty for creating a United States of Europe. Such cohesiveness is necessary to collectively elect real legislators, establish an effective central bank and launch all the other decent and debauched political institutions that invigorate and infuriate truly democratic unions.

Until then, how about dumping the politically correct comic translations. This will not go down well in the hamlet of Popeye Village or within the Brussel’s bureaucracy, where the biggest group of Maltese employed outside the country but still living in the EU can be found working as translators. According to Maltese politician Peter Grgis, making this week’s European Council meeting understandable back home is part of the EU’s €30 million expenditure to translate more than 700,000 EU directives annually into Maltese, despite the fact that few read them and English is also the country’s official language.

The Maltese will grumble. Popeye is a celebrated economic hero among the 420,000 citizens who make up the EU’s only island nation, an archipelago that owes creditors some €5 billion and sinking at an interest rate of €8 a second. Unless the EU by Thursday admits the Klingon Empire, it’s the best Schauble can hope for.