The companies as big as entire countries’ stock markets

The US economy is the largest in the world. It is 50% bigger than China’s, in second place, as measured by GDP. But when it comes to the size of the stock market, the US is five times larger than second-place China, as measured by market capitalization.

The US economy is the largest in the world. It is 50% bigger than China’s, in second place, as measured by GDP. But when it comes to the size of the stock market, the US is five times larger than second-place China, as measured by market capitalization.

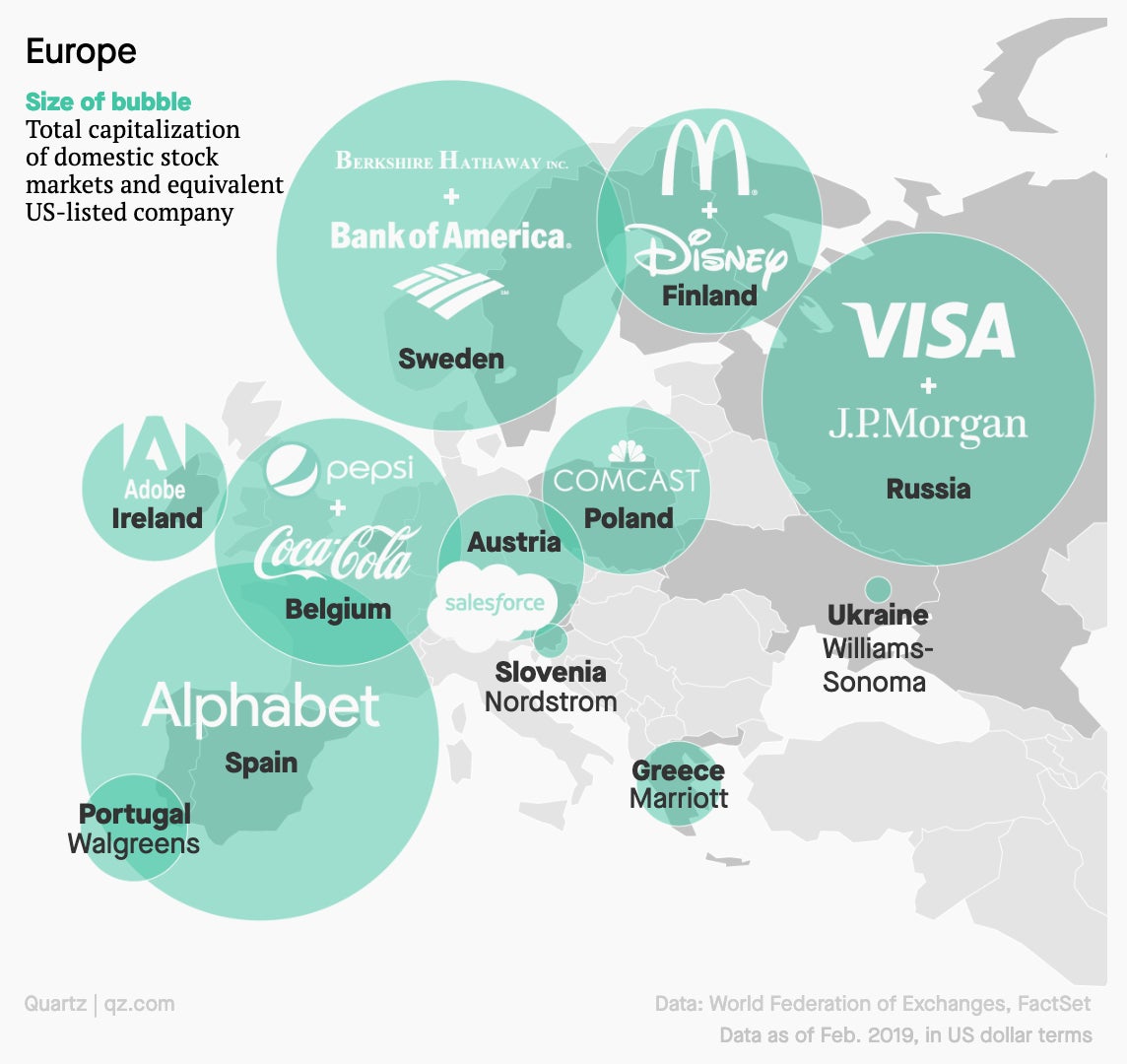

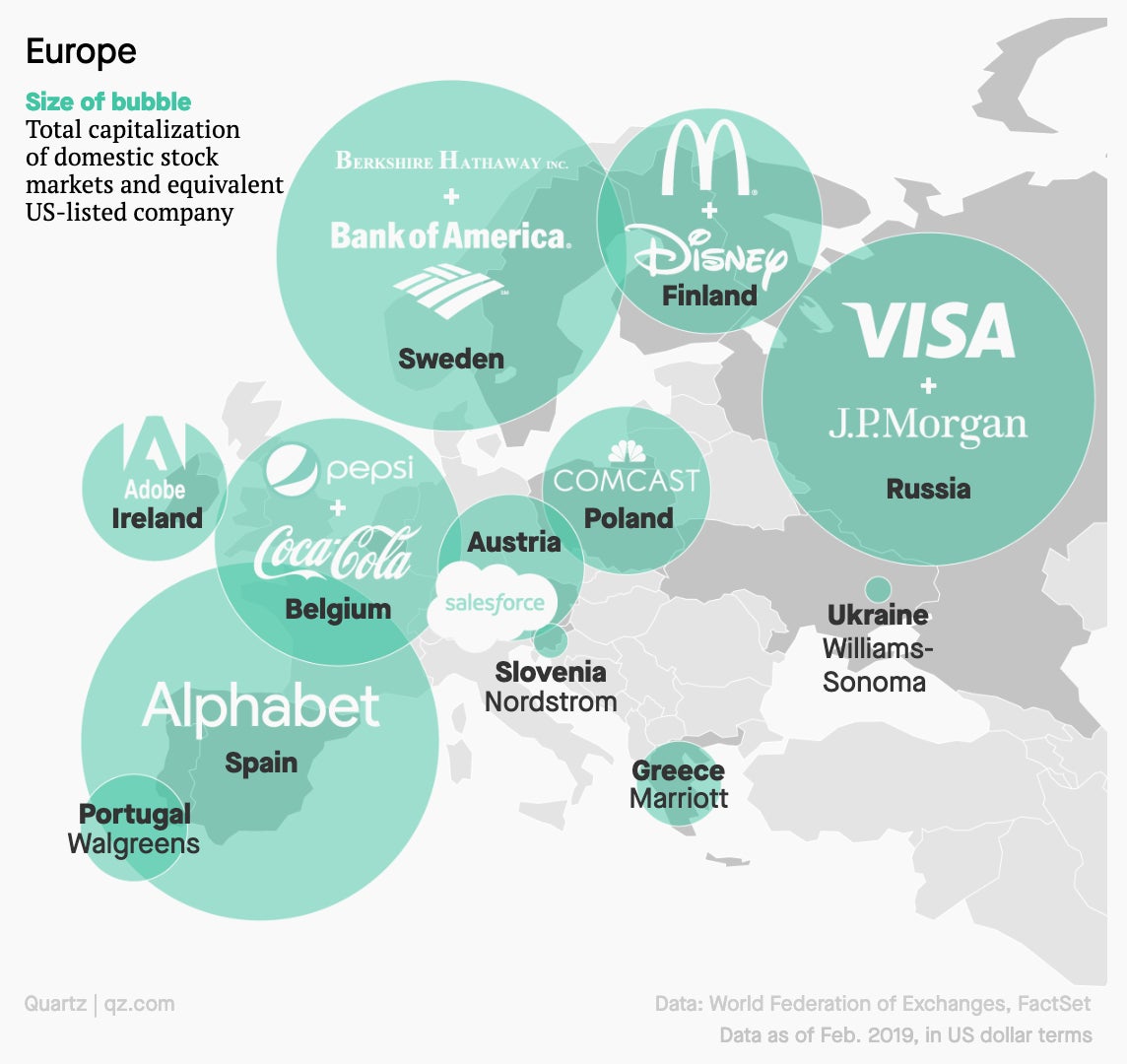

In aggregate, US stock markets are worth well over $30 trillion, serving as the home to a bevy of corporate behemoths each worth hundreds of billions of dollars. The country’s deep, liquid capital markets also attract listings from foreign companies, making US markets even bigger relative to their counterparts elsewhere. Less developed markets, combined with cultures where buying stocks isn’t common, also explain why markets in many otherwise large, wealthy countries still pale in comparison to the US.

To put the size of some US-listed companies in perspective, consider that many are as large as the market cap of entire countries’ stock markets. For example, Google parent Alphabet is worth roughly the same as every company on the Spanish stock market put together. The same goes for Disney and Turkey, Salesforce and Colombia, Bank of America and the Philippines, and eBay and Nigeria. For more company-country comparisons around the world, check out the maps below: