Inflation deniers are the anti-vaxxers of the economic world

Ben Bernanke, who chaired the Federal Reserve Bank from 2006 to 2014, made an ominous warning at the American Economic Association meeting this year. He reminded the audience that well-anchored inflation expectations are a valuable asset. The fact that investors believe the Fed is committed to low, stable inflation enabled him to stimulate the economy during the Great Recession without sparking inflation. But he cautioned this asset can’t be taken for granted.

Ben Bernanke, who chaired the Federal Reserve Bank from 2006 to 2014, made an ominous warning at the American Economic Association meeting this year. He reminded the audience that well-anchored inflation expectations are a valuable asset. The fact that investors believe the Fed is committed to low, stable inflation enabled him to stimulate the economy during the Great Recession without sparking inflation. But he cautioned this asset can’t be taken for granted.

His worry may sound misplaced, given inflation hasn’t been a problem for more than 30 years. The US economy is booming, unemployment is at record lows, and yet inflation last quarter was just 1.86%, short of the Fed Reserve’s 2% target. Younger writers like the New York Times’ Ross Douthat don’t think inflation is a worry anymore. Vox’s Matt Yglesias argues history—like the 1970s—is irrelevant when assessing inflation risk. The assumption that inflation is harmless or even dead, may explain why some politicians, journalists, and heterodox economists are suggesting policies that will undermine the Fed’s credibility. Economist Stephanie Kelton, who is advising Bernie Sanders, advocates embracing Modern Monetary Theory, which argues we should monetize debt. US president Donald Trump snipes at Fed policy and his attempts to install political allies on its Board test its independence. Mainstream economists have been pushing back, but inflation risk skeptics and MMT advocates, like Bloomberg’s Joe Wiesenthal, caution that readers shouldn’t trust experts.

Those who argue inflation risk is over and the Fed needn’t worry about it any more are starting to sound similar to the anti-vaxxers who ignore the history of epidemics. But Bernanke is right: Just because inflation appears dead and buried doesn’t mean it can’t come back.

Expectations matter

Take the not-so-recent-but-not-ancient past. In the 1950s and ’60s economists assumed there was a trade-off between inflation and unemployment. Then in the 1970s, structural changes to the economy—namely, the oil price shock of 1973-74—contributed to a new problem: high inflation and high unemployment. This brought a major rethink in the economics profession about the relationship between inflation and unemployment. Economists argued the level of inflation doesn’t matter as much as how it differs from peoples’ expectations of it. Expectations can influence hiring decisions and be self fulfilling if workers, who expect rising prices, demand higher wages and cost of living increases in their pensions, resulting in more money chasing fewer goods. After the 1970s, the scope of monetary policy became more focused on managing inflation expectations than on simply taming inflation. The idea took hold that if inflation expectations were stable and realized, there would be less variability and lower inflation.

A few years later, then-Fed chair Paul Volcker took the economy into a recession by increasing interest rates to fight high inflation. This sent a signal the Fed would do whatever it takes to keep inflation low and predictable. It made monetary policy much easier because everyone—markets, unions, and consumers—expected low, predictable inflation and that became self-fulfilling.

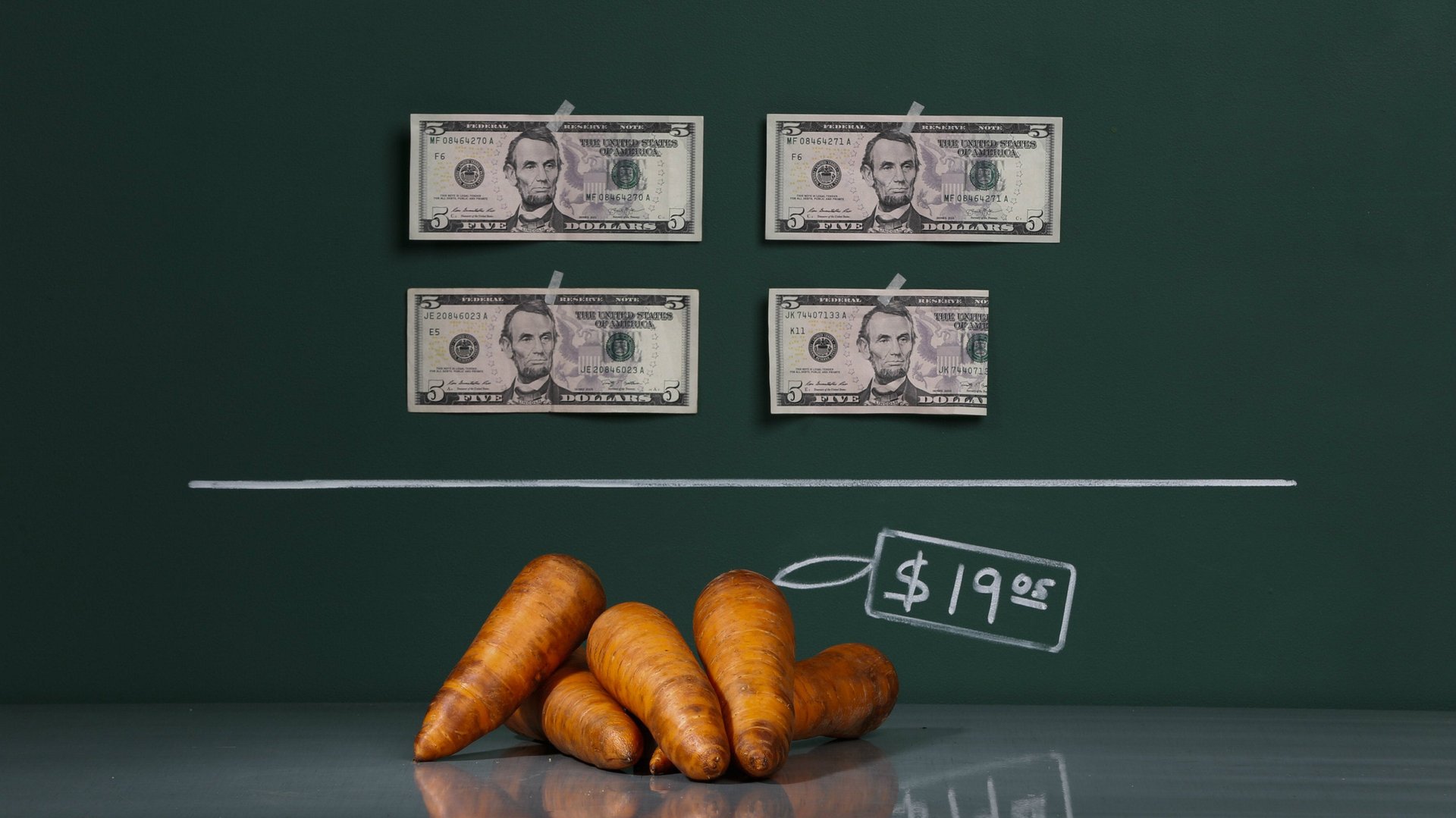

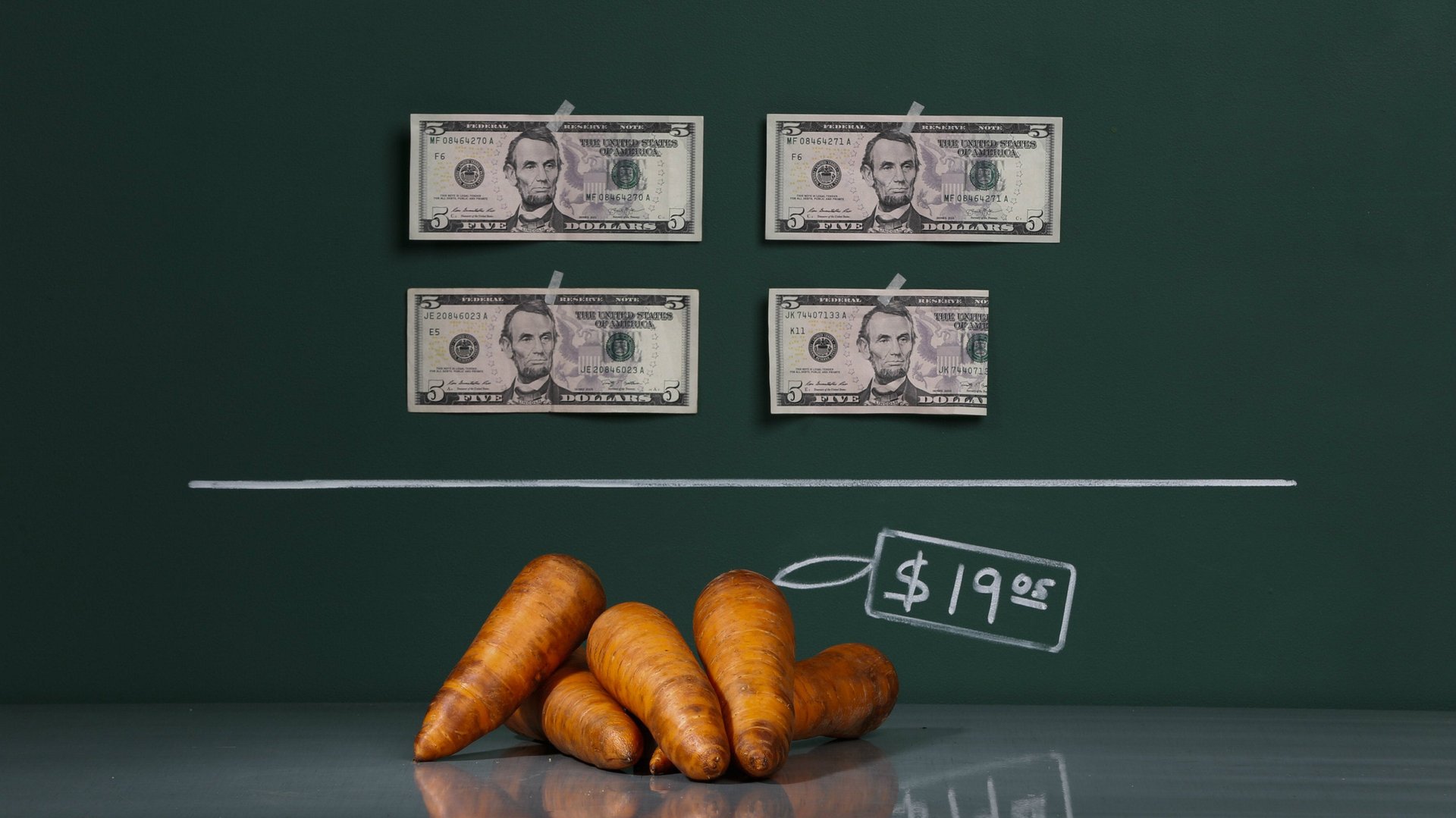

In the 1990s central banks, including the Fed, started inflation targeting as their primary tactic, where they set expectations directly by announcing an inflation target. It seems like a modest way to implement their goals, considering all the tools at their disposal, but it works well because the power of monetary policy—the ability of the Fed to influence the Fed Funds rate and pay interest on reserves—is pretty limited. The Fed can’t do much to change the structure of the economy but it can promote stability and predictable inflation. Credible inflation targeting is like a vaccine. If it works, inflation is stable, but if you weaken or undermine it, either by eroding the Fed’s independence or pushing policies that risk high inflation, it’s no longer as effective at keeping everyone safe.

True, inflation is lower today because of these well-anchored expectations and structural reasons, such as a more global economy where the price of goods are set in the international market, advances in technology such as Amazon that provides more price transparency, and an aging population where consumers spends less.

If inflation were truly dead for all these reasons, there would be major consequences for monetary policy. But economies adapt to structural changes, and inflation can happen again. Or new changes come along we can’t predict that will cause inflation. In either case the Fed will need that credibility.

The risk of inflation is greater if the Fed signals it is no longer committed to low, stable inflation. If so, without credibility, during the next recession, the Fed won’t have the same latitude to cut rates and keep them low without inflation getting out of control. To many people who want to try MMT or keep rates low to prop up the stock market, that may sound like a risk worth taking, but odds are they don’t have any memory of how costly high, unpredictable inflation can be.