A guide to late-cycle investing

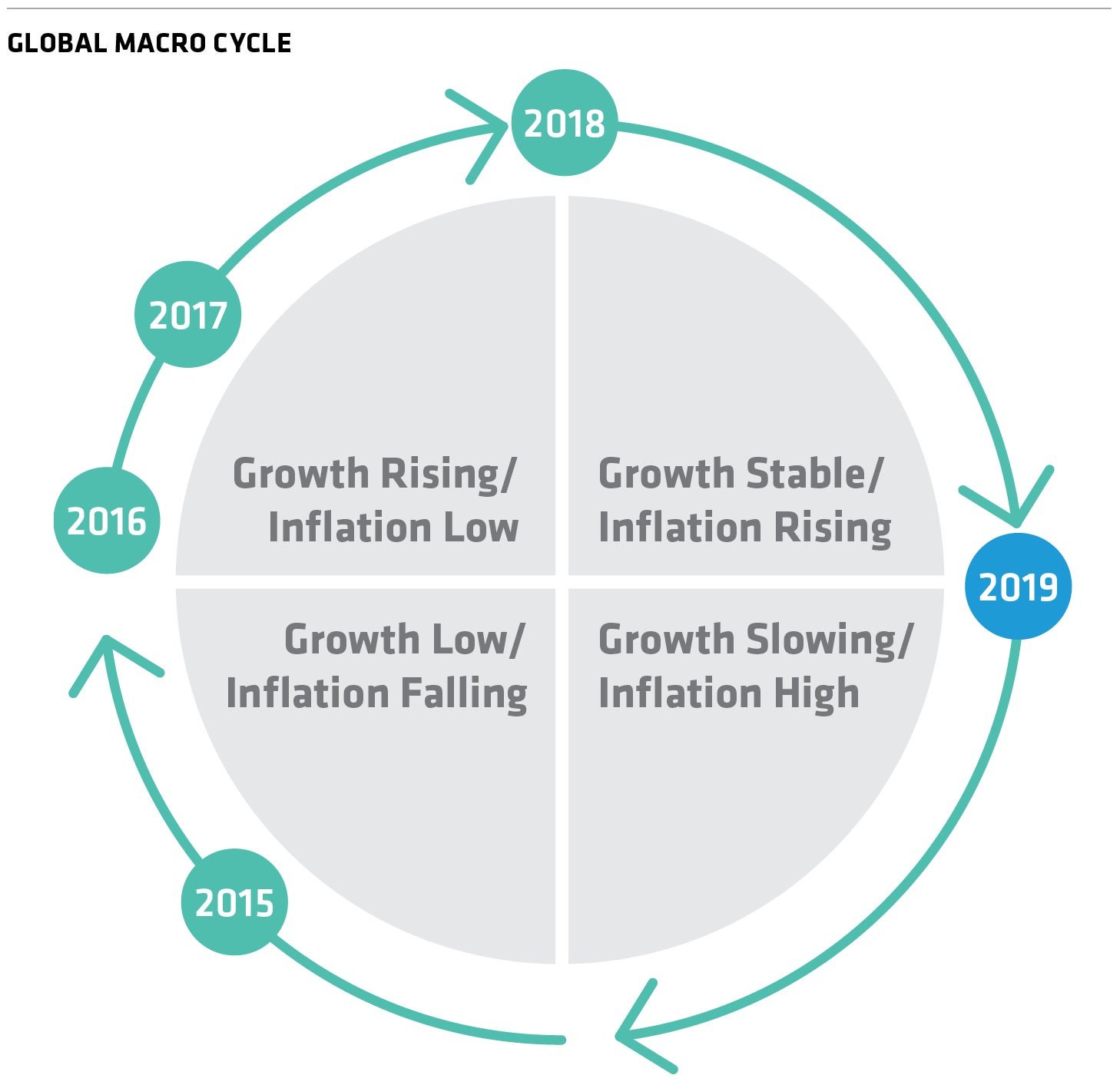

Things were relatively easy for investors in 2015, 2016, and 2017. Economic growth was rising and inflation wasn’t part of the picture. Major central banks ran easy monetary policy to keep things rolling.

It isn’t 2017 anymore

Things were relatively easy for investors in 2015, 2016, and 2017. Economic growth was rising and inflation wasn’t part of the picture. Major central banks ran easy monetary policy to keep things rolling.

Throughout 2018 and into 2019, however, the global economy has transitioned into the later stages of its cycle, and the growth-inflation mix is becoming less favorable. Central bankers simply aren’t trying to fuel the economy as much anymore.

This means a more challenging investment landscape. Investors of all types will need to work harder—and be more creative with portfolio design—to generate the long-term returns.

We have a few ideas on how to refit your portfolio for late-cycle investing.

1. Make “quality” the word in stocks

Growth slows when the economy moves later into its cycle. This makes it even more important to find quality companies that are able to grow consistently over time.

As we see it, quality is defined by profitability, earnings that can last, high levels of free cash flow, and a strong balance sheet with low debt.

Beware of businesses with too much leverage

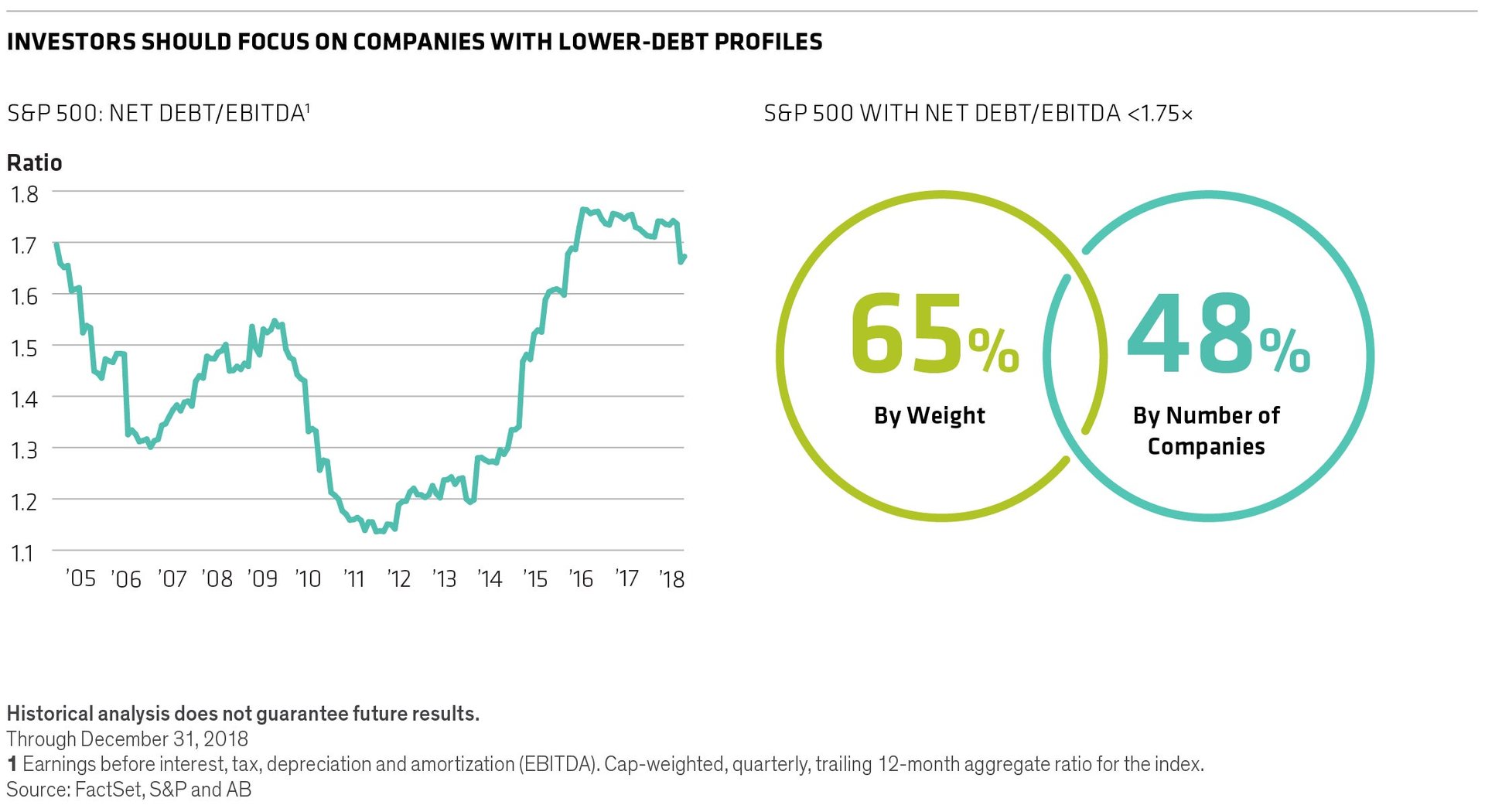

Financial conditions have tightened and rates have risen, which poses problems for companies with too much debt.

Higher interest rates increase financing costs for businesses with a lot of debt. Rising inflation can increase costs and reduce profit margins, which can potentially lead to a debt spiral.

That’s why we think it’s important to focus on companies with healthy balance sheets—including low debt ratios. As interest rates begin to rise from historic lows, focusing on quality companies with healthy balance sheets can help equity investors avoid danger zones.

Look for companies with earnings that last

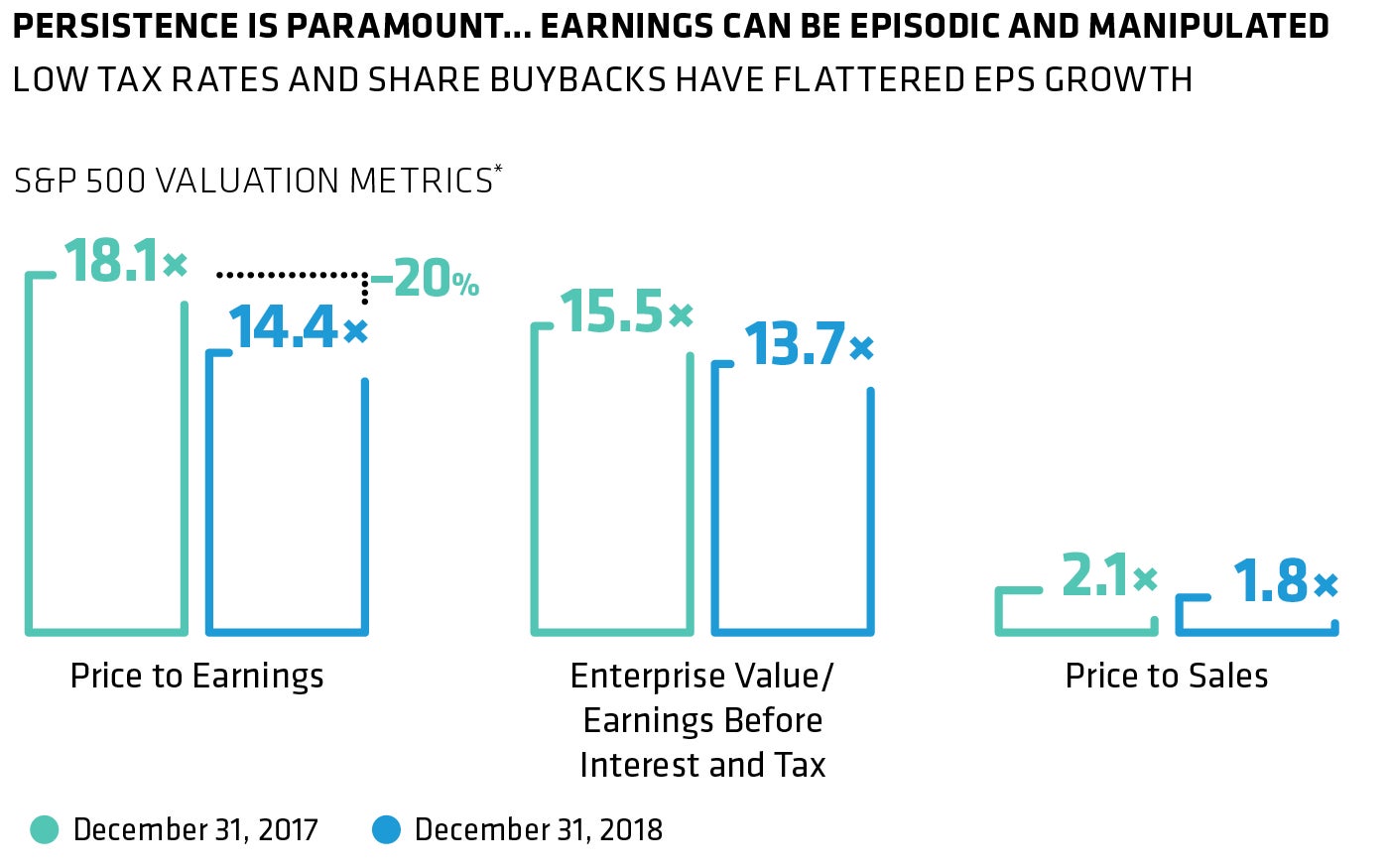

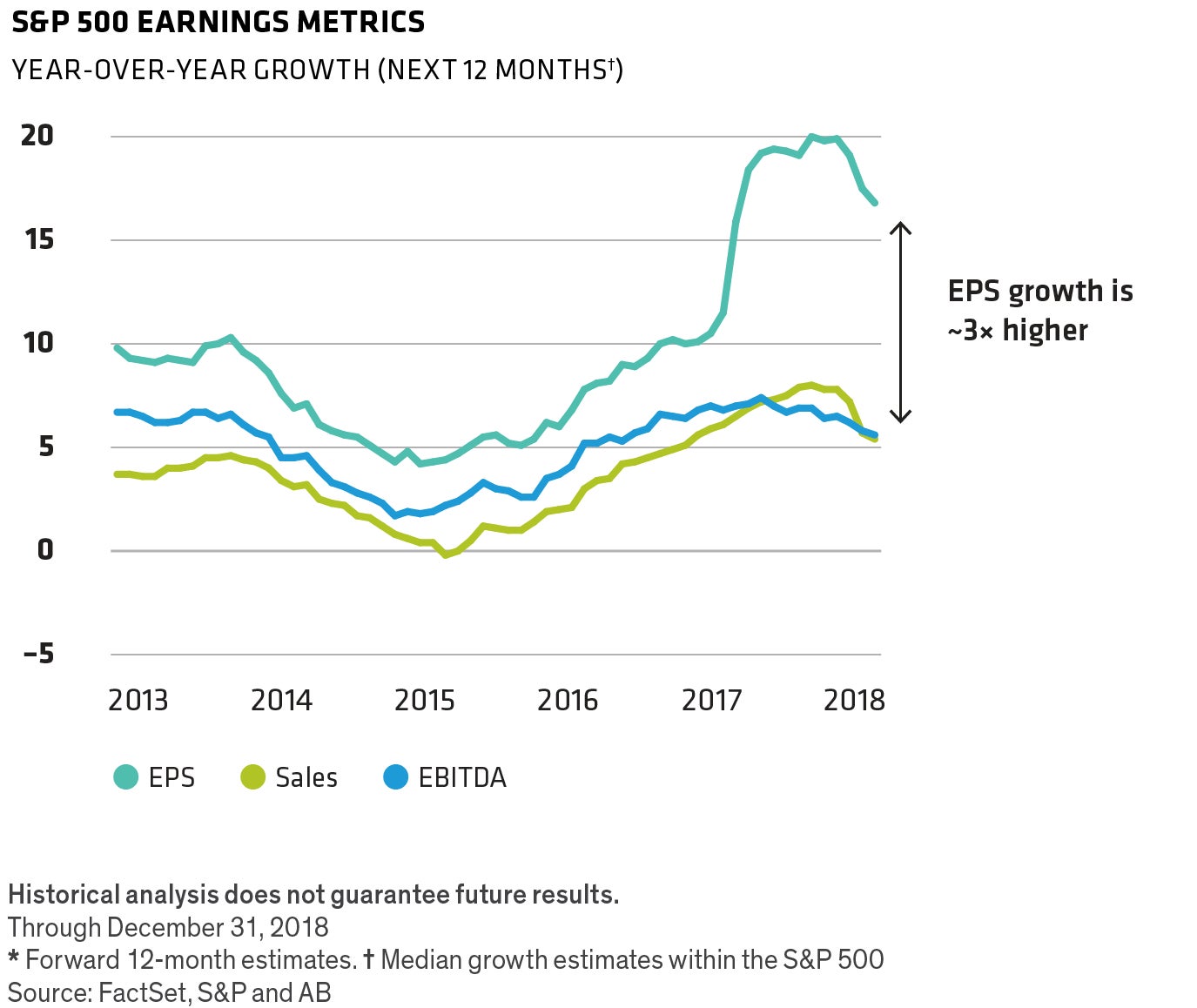

Don’t be fooled by solid EPS—earnings per share—growth alone: Make sure a company’s business is healthy and firing on all cylinders to deliver over the long run.

As we see it, many recent earnings have been inflated by the effects of tax reform and big share buybacks. Sales and EBITDA are better gauges of the actual performance of a business. Rapid EPS growth exaggerates the underlying growth potential of many firms, and we think this will eventually be exposed.

Move beyond benchmarks to find market-resilient opportunities

In the coming decades, some long-term trends will unfold and reshape the market landscape. This will create opportunities for stocks that are more resilient to short-tempered markets.

For example, demographics and AI are two areas of profound change. An aging population needs more doctors, and automation promises to make medicine more efficient, targeted, and effective. Water scarcity is another example—a global challenge that’s driving change. Solving the crisis will require investment in water treatment, management, and infrastructure for many years to come.

We expect sweeping trends like these to last, regardless of how fast the economy grows or where interest rates head.

2. Bolster downside protection

Volatility has returned—with a bang, not a whimper. And that means the risk of more market sell-offs. We believe the “time in the market versus timing the market” principle still works for the current environment. Meanwhile, investors need the long-term growth potential of equities.

But staying invested doesn’t mean standing still. It’s important to make sure your portfolio can withstand the impact of market declines. There are several ways to build in “shock absorbers”—both within your stock exposure and by pivoting to complementary asset classes and strategies.

Look beyond borders for opportunities

Investors shouldn’t restrict their pursuit of high quality to the US. The price/earnings ratio of developed- market international stocks were in the sixth percentile at the end of 2018. That’s very inexpensive versus a 20-year valuation history.

But just because a stock is cheap doesn’t make it a good buy, no matter where the company is domiciled. Investors still need to be selective and carefully identify quality stocks. The goal should be to find growth in companies that possess a solid balance of quality and stability. And, of course, attractive stock prices.

Incorporate a flexible hedge strategy

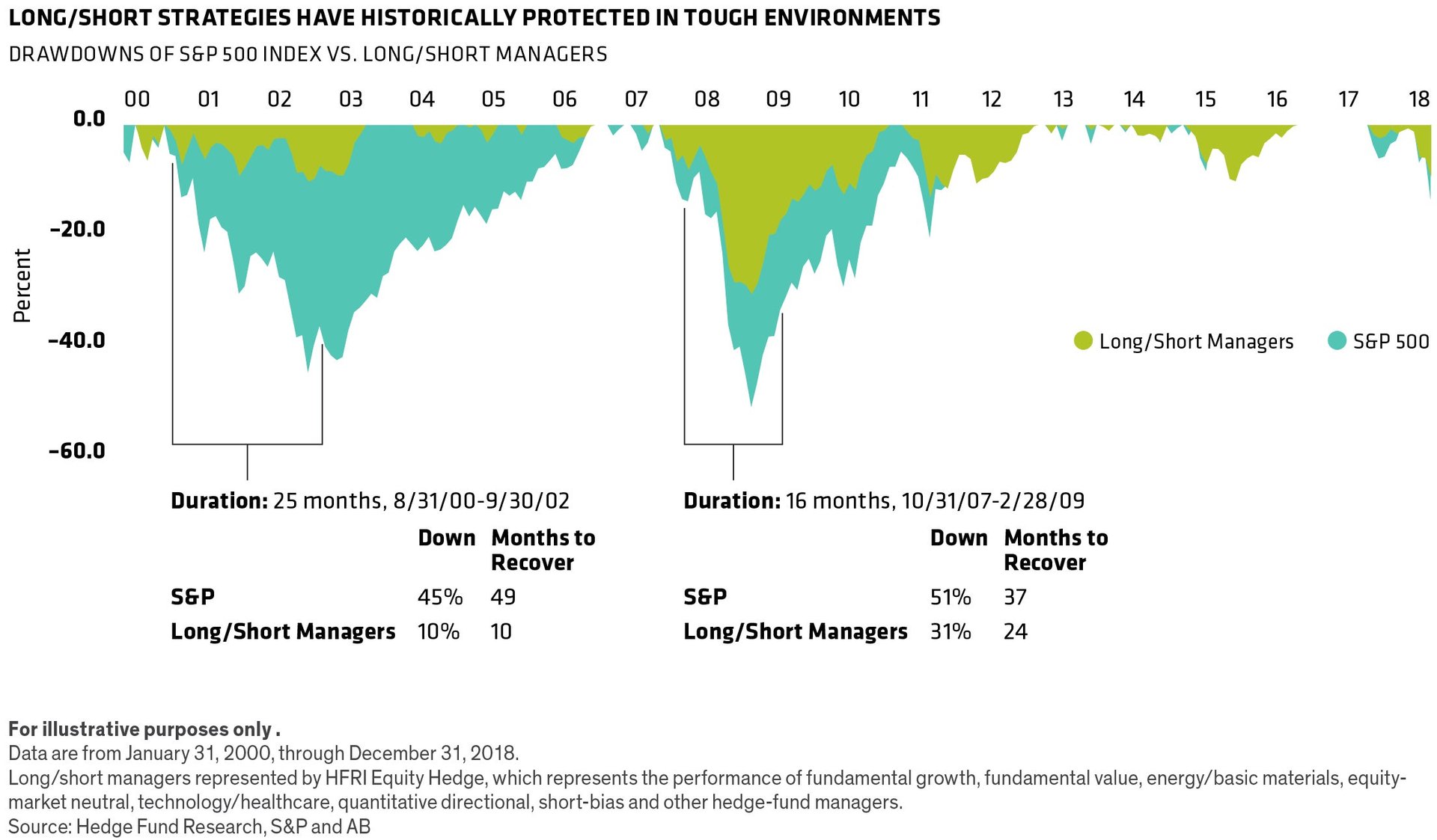

Equity hedge strategies can help maintain equity market exposure while adding downside protection by combining long and short equity exposures. Flexibility is key for these strategies, specifically, the ability to manage risk by adjusting net equity exposure—the sum of long and short exposures.

In tough markets, a long/short strategy might cut its net equity exposure by boosting short positions or hedges, by reducing gross exposure on both the long and short parts, or by using cash to play defense.

Swap some equity exposure for high-yield bonds

Another way to cushion against the downside is to exchange some equity exposure for high-yield bonds. The two have been good partners over time. Historically, combining them has reduced overall risk without sacrificing much in return.

Over the long run, we’ve seen that adding a dash of high-yield debt to an equity portfolio when spreads are wide can reduce volatility without sacrificing too much return potential. Given the uncertainty in today’s market, that’s a reassuring thought. Of course, it’s still critical to actively choose individual high-yield issuers based on research.

3. When it comes to bond allocations, don’t fear duration

Many investors think of rising interest rates as the bogeyman of fixed-income investing. But there are very good reasons not to ditch duration in your bond holdings.

To adapt to this new reality, investors should stay flexible and active. That means evolving bond portfolios to meet the needs of late-cycle investing and taking advantage of market downturns to pick up well-priced assets. Here are a few thoughts on how to reposition your bond exposure.

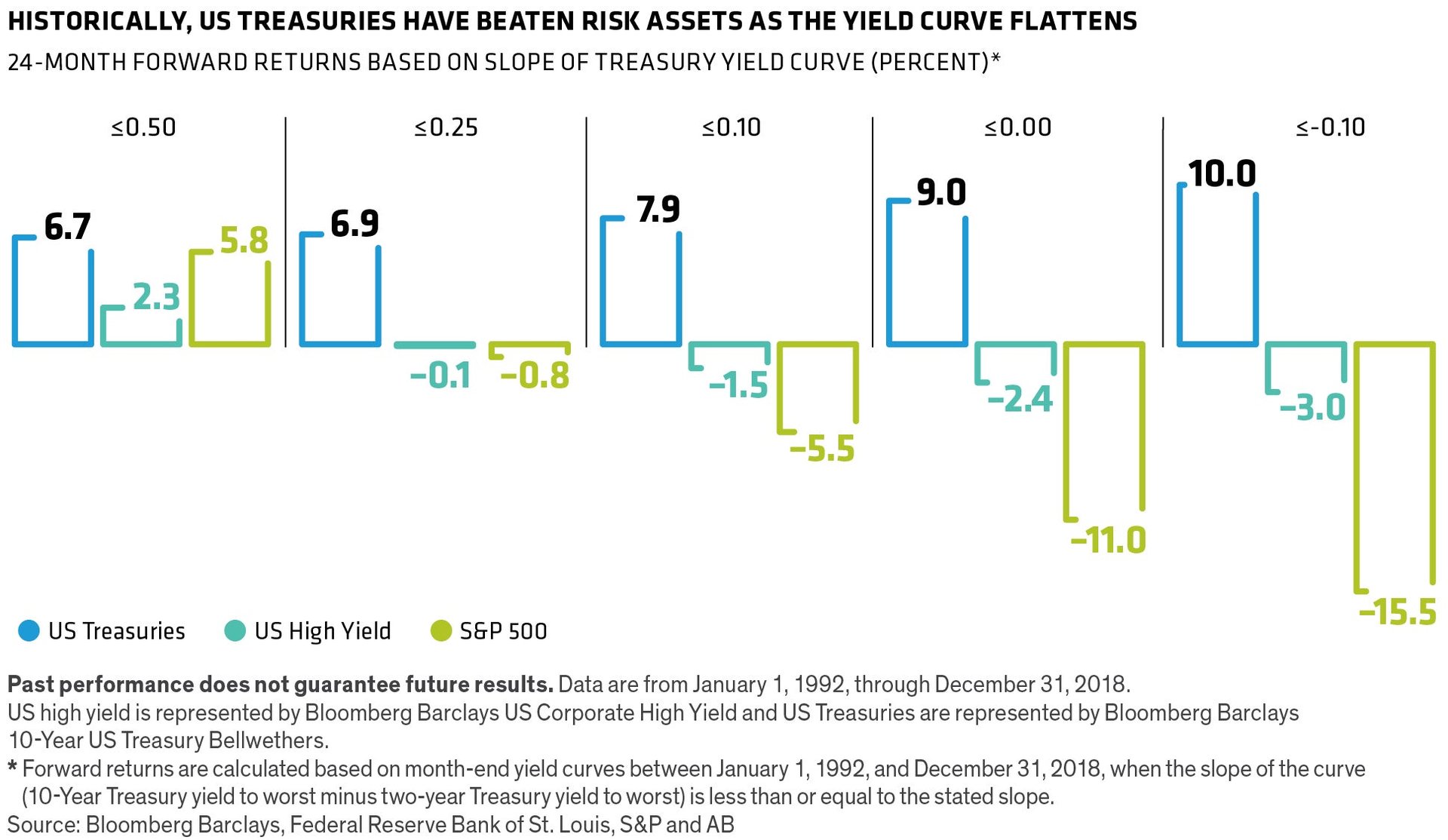

Lean into interest-rate-sensitive bonds

Long-term yields aren’t as high as they normally are relative to shorter-term yields. Historically, when this happens, returns tend to be stronger in high-credit-quality securities and lower in some of the bond market’s riskier segments.

From an investor’s standpoint, that suggests that it makes sense to consider adding higher-quality and interest-rate-sensitive assets to fixed-income portfolios. Investors can also diversify their bond holdings into similar types of bonds in the international arena, adding exposure to bond markets that don’t necessarily move in sync with US ones.

“Barbell” bond exposure with rates and credit

Use a strategy that integrates US Treasuries and other high-quality government bonds with credit assets in a single, agile barbell strategy.

This barbell should be flexible. As interest rates rise, it can tilt away from credit and toward US Treasuries and other high-quality assets that have more duration. When higher rates have slowed the economy, it can start to shift back toward credit.

Done the right way, an approach like this can help generate income while cushioning against losses.