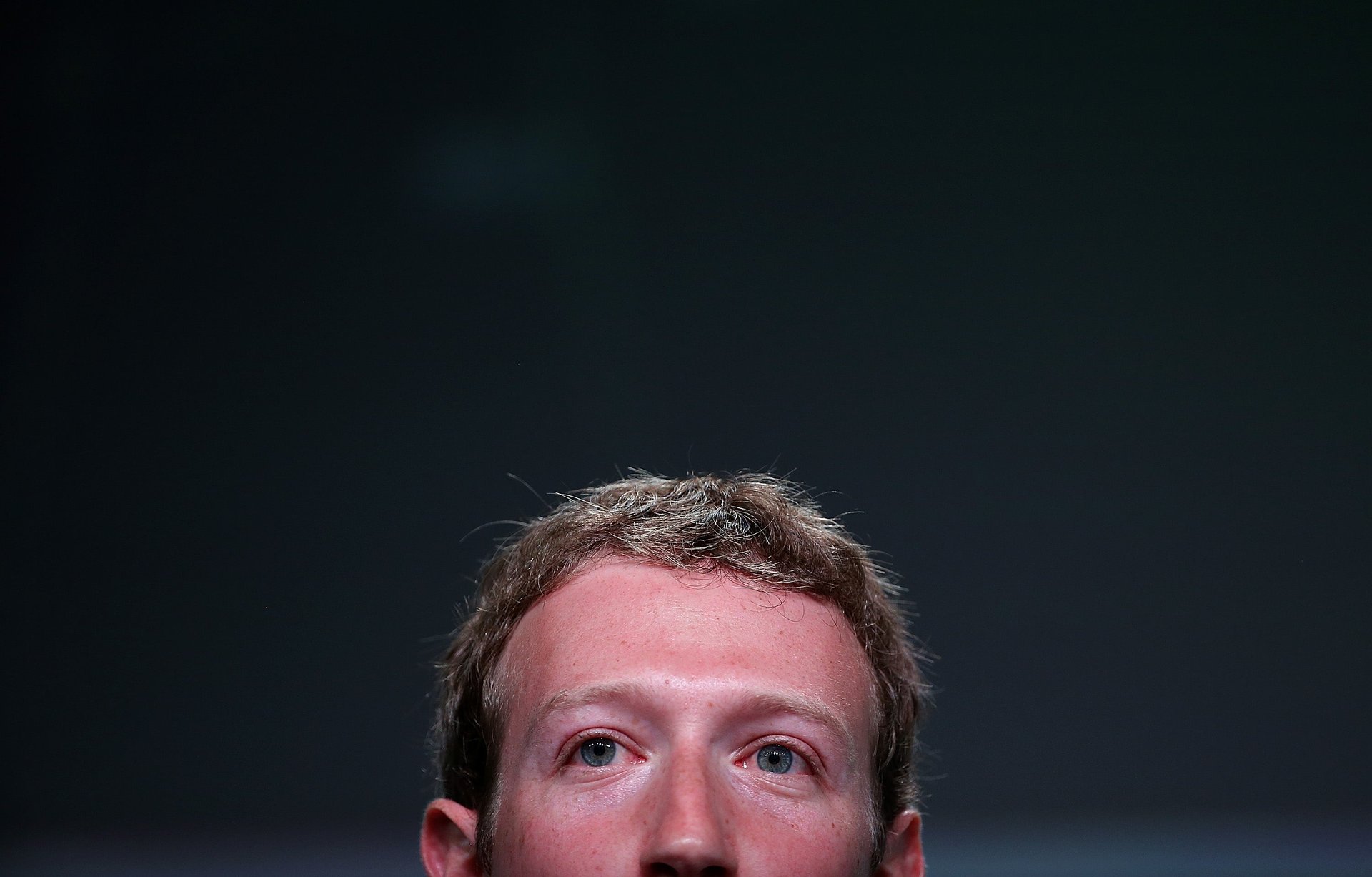

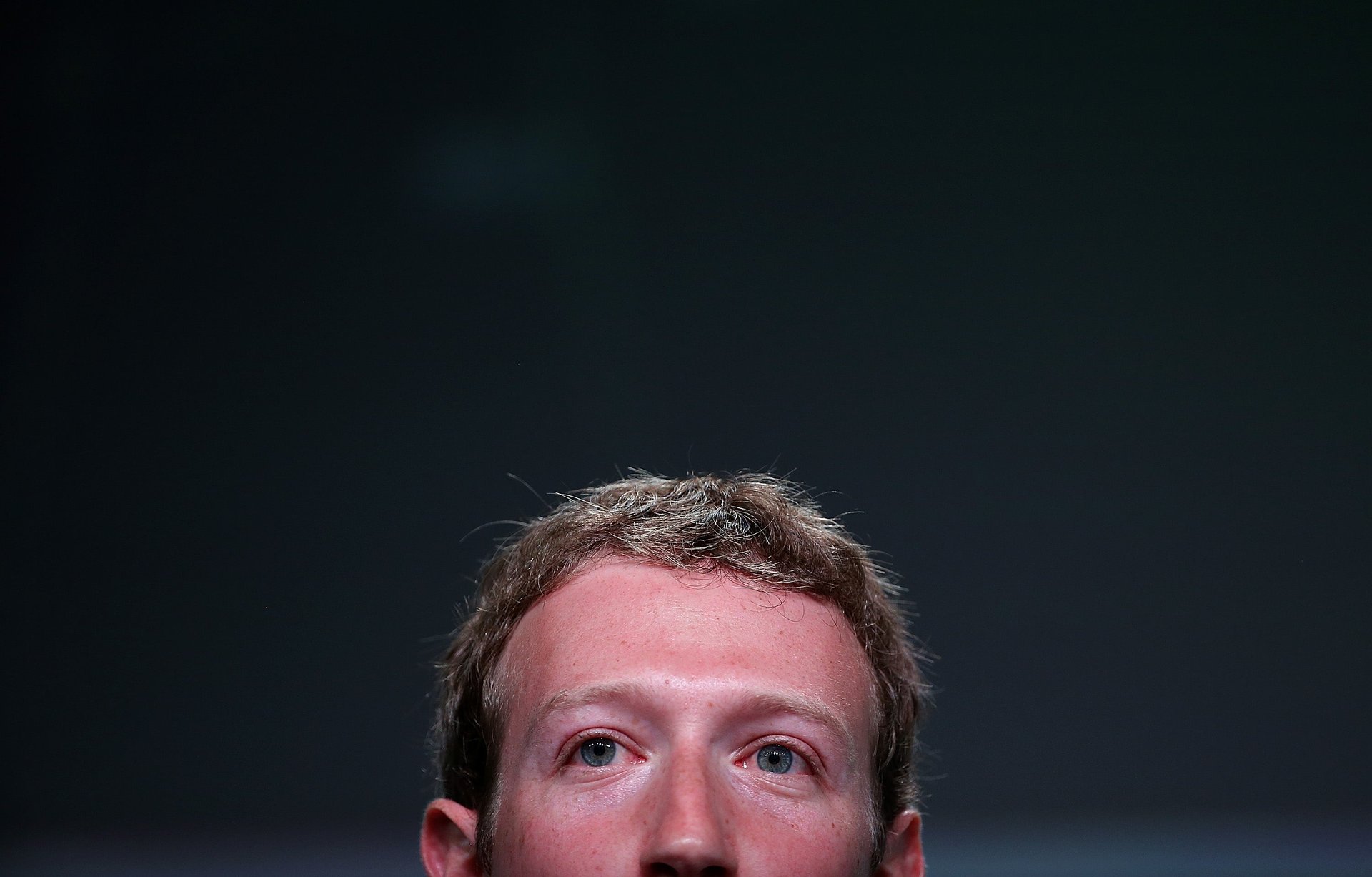

Why Facebook shareholders want Mark Zuckerberg out

As CEO, board chair, and the company’s most powerful shareholder, Mark Zuckerberg has too much control over Facebook. The danger is clear: Users suffer from a mismanaged platform, and investors risk Facebook’s increasingly tenuous fate.

As CEO, board chair, and the company’s most powerful shareholder, Mark Zuckerberg has too much control over Facebook. The danger is clear: Users suffer from a mismanaged platform, and investors risk Facebook’s increasingly tenuous fate.

Zuckerberg’s consolidation of power was no accident. From Facebook’s humble beginnings at Harvard University, to its current status as a global behemoth used by more than 2 billion people, Facebook’s growth has been driven by Mark Zuckerberg. Yet, his dominance over the company continues unchecked, as the platform and online content is weaponized to propagate election interference, violence, hate speech, sexual harassment, discriminatory advertising and rampant privacy violations.

With no sign of Zuckerberg loosening his grip, I am among a growing number of investors who believe that Zuckerberg must be removed from the board.

Unfortunately, he seems locked in his ivory tower, unmoved by decreasing investor confidence, and blasé about the serious problems at hand. Yesterday, he skipped a global summit to sign a pledge against online hate speech. The meeting was hosted by French President Emmanuel Macron, and attended by British Prime Minister Theresa May, Canadian Prime Minister Justin Trudeau, Irish Premier Leo Varadkar, and his counterpart at Twitter, Jack Dorsey.

Last week, shareholders and civil rights groups launched a “Vote No” campaign urging Facebook investors to vote against Zuckerberg as a member of the company’s board at the annual meeting on May 30. “Vote No” follows months of revelations of abuses and no persuasive evidence that the existing governance structure can fix Facebook. My company, Arjuna Capital, supports the “Vote No” effort as a clear path for fundamental change.

Arjuna Capital is no stranger to Facebook’s intransigent hierarchy or its inability to address investor concerns. In December 2016, we filed a shareholder proposal expressing concern that fake news propagated over the platform was impacting our elections and our democracy. Yet, the company waited until after that proposal went to a vote in the spring of 2017 to even speak to us. When we did speak, company representatives assured us that there was not an issue and ignored our recommendations to report to investors on fake news flows.

Talk about getting it wrong! Six months later, Facebook testified before Congress about the 126 million Americans who may have viewed Russian propaganda on Facebook in the lead up to the 2016 US presidential election.

In 2018, Arjuna Capital filed a related proposal on “content governance”—that is, the fake news, hate speech, and sexual harassment propagated over the platform that is in direct violation of the company’s own terms of service. Along with our co-filers, the New York State Common Retirement Fund and Illinois State Treasurer, we requested a dialog but were dismissed completely.

Another symptom of Zuckerberg’s dictatorial leadership is the now-largely-forgotten PR nightmare that unfolded with vice president of global communications Elliot Schrage. Under Zuckerberg’s cult of personality, Schrage hired opposition firm Definers Public Affairs. Definers placed critical news stories about Facebook’s competitors, including Apple and Alphabet, while casting George Soros as the architect of a negative Facebook spin campaign. Schrage was forced to fall on his own sword, but it was and continues to be Zuckerberg who has greenlit these “deny and deflect” tactics.

But despite public scrutiny of Facebook’s mismanagement, Zuckerberg says that stepping down now doesn’t “makes sense.” Really, when is the time?

The truth is that Facebook is facing more litigation, public policy risk, and controversy than ever. As the group Fight for the Future recently commented, “After nearly a decade’s worth of second chances, Facebook has still failed to address the underlying issues around data use and civil rights.”

At the annual meeting this month, Facebook investors have an important choice to make: Whether to continue to throw their support behind Zuckerberg’s failing autocracy, or support a more democratic, transparent, and accountable governance structure. Apart from simply voting against Zuckerberg’s board role, investors can vote yes for a number of shareholder proposals that seek to establish independent oversight, stronger content governance, and long-term accountability at Facebook. One proposal calls for an independent board chair, a second proposal asks Facebook to evaluate its policies governing content, and a third proposal requests the board bring on independent advisors to consider “strategic alternatives” to the company’s current business model, to maximize shareholder value. Arjuna Capital is urging “yes” votes on all three.

Facebook will always be a monument to Mark Zuckerberg. The question is whether that monument reflects the best of his genius, or the worst of his drive toward power. Absent change, Zuckerberg will continue to hold the keys to the castle as chairman and CEO, control the majority voting power of shares, and ignore the concerns of the company’s shareholders.

Natasha Lamb a managing partner at Arjuna Capital, a sustainable investment advisor. Arjuna clients have been invested in Facebook since 2016.