Why the US might want to encourage wealth inequality

Lately, and more in the future, we’ll be hearing more about wealth inequality—the gap between the fortunes massed by the rich and poor. This relates to income inequality (the subject du jour) because high-income earners tend to save more. Yet the disparity between the wealthy and the not wealthy is even greater because it represents years, even decades, of differences in income, education, and the appreciation (or depreciation) of assets such as houses and stocks.

Lately, and more in the future, we’ll be hearing more about wealth inequality—the gap between the fortunes massed by the rich and poor. This relates to income inequality (the subject du jour) because high-income earners tend to save more. Yet the disparity between the wealthy and the not wealthy is even greater because it represents years, even decades, of differences in income, education, and the appreciation (or depreciation) of assets such as houses and stocks.

Indeed, wealth inequality has been increasing, which has sparked concern from economists like Dan Altman and Thomas Piketty. They argue that wealth inequality hampers growth and will only get worse in the future. A problem with wealth inequality is that it is passed on from one generation to the next, namely through inheritances and access to more expensive education. Their solution is a progressive wealth tax (a bigger tax rate on higher amounts of wealth; Altman suggests starting at $500,000). The idea is already catching on in the US; last year’s budget included a tax increase on capital gains, to 20%, just for higher earners. But if wealth inequality is a problem, then progressive wealth taxes aren’t the right solution.

In fact, perhaps we need to be encouraging more wealth inequality. To a large extent, such a gap is a sign of the normal life-cycle of saving. Older people should have more wealth than everyone else. They’ve had more years to save, have higher incomes, and saving rates are highest around middle age; after you’ve paid off mortgage, sent your children to school, and retirement is around the corner.

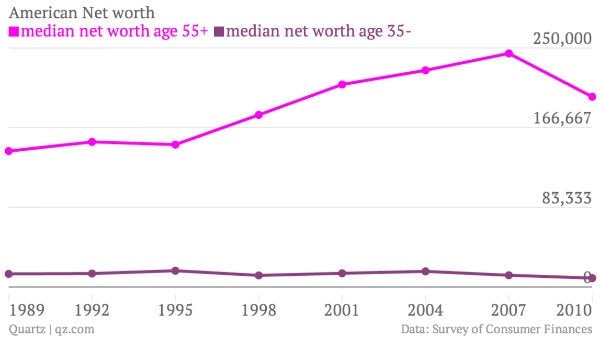

The figure below is median net worth of Americans under 35 and older than 55, calculated using the Federal Reserve’s Survey of Consumer Finances.

Not only do older Americans have more wealth, but note the rising disparity between the old and young in the last 20 years. The growing wealth gap is due to several reasons. Older people have more assets, especially housing, which appreciated steadily until the recession. Also fewer people have pensions from their employer; they need to save more to finance retirement for themselves (though people are still not saving enough, which means wealth inequality, ideally, should be more severe than it is). Meanwhile, young people are laden with more consumer debt and student loans and, since the recession, face a weaker labor market. Indeed, it is no coincidence that the wealth gap peaked in 2007, the start of the recession.

Demographics play an important, and natural, part of wealth inequality. Rather than look at aggregate wealth, we need to consider different cohorts to figure out if there’s really a problem. More wealth inequality would be a good thing if it reflects older people saving more for retirement. But high debt among youth is a worrying trend. It reflects the high cost of education and a weak youth labor market. The high debt will keep many young people from starting healthy financial lives, leaving them vulnerable to a cycle of low saving and financial hardship. Youth debt reflects issues that redistributing wealth won’t fix. If we tax the wealthy, who tend to be older, only to then give the revenue back to the elderly (a large share of future spending is Social Security and Medicare), what purpose do wealth taxes serve if the goal is redistribution?

Progressive wealth taxes are also problematic because they can discourage the heavy buildup of assets people need in middle age. We could simply define a cutoff where people have more money than they need to retire (though that point is arbitrary and there aren’t that many super wealthy millionaires). The 95th percentile of wealth has amassed about $1.8 million. It sounds like a lot, but that only buys about $95,000 a year of real income for a 65-year-old. That’s enough for a very comfortable retirement, but not enough to live like a millionaire. Also the very wealthy can afford creative accountants. High taxes on the very wealthy may be self-defeating, because it encourages rich people to send their capital abroad where they face lower taxes.

True, wealth inequality has increased across and within cohorts. The figure below is the ratio of the 95th percentile to the median of net worth among people older than 55. It has been increasing; which means wealth inequality is worse among older people than it used to be. But much of the population-wide inequality is because of demographics. The second line is the ratio of median wealth of the old to young—it more than doubled.

If wealth inequality is a problem of fairness and the goal is redistribution, a progressive wealth tax isn’t the answer. A more thoughtful and effective policy might be different tax treatment of capital based on wealth and age so we encourage more retirement saving. Or even better—policy should give the same priority to the young that older Americans get, and do more to finance quality and accessible education and address structural problems to make the youth labor force more globally competitive. Wealth inequality highlights deeper structural and intergenerational issues we need to address.