The Swiss central bank lost an enormous amount of money on its gold holdings last year

The Swiss national bank is not like most other central banks. For one thing, it is listed on the stock market. Thus, it is obliged to keep shareholders informed of important events that could impact its financial health.

The Swiss national bank is not like most other central banks. For one thing, it is listed on the stock market. Thus, it is obliged to keep shareholders informed of important events that could impact its financial health.

Today the bank issued the equivalent of a profit warning (pdf), saying that it will report a loss of 9 billion Swiss francs ($10 billion) for the 2013 financial year. This means that it won’t be able to transfer any money to the central government or cantons; it paid out 1 billion Swiss francs in 2012 thanks to a profit of more than 6 billion francs.

The culprit for the 2013 loss is easy to identify—the bank holds more than 1,000 tonnes of gold in its reserves. The historic plunge in the price of gold last year put a big dent in the value of the bullion in Swiss vaults, saddling the bank with a loss of $16.6 billion on its holdings, overwhelming the gain it made on its foreign exchange reserves last year.

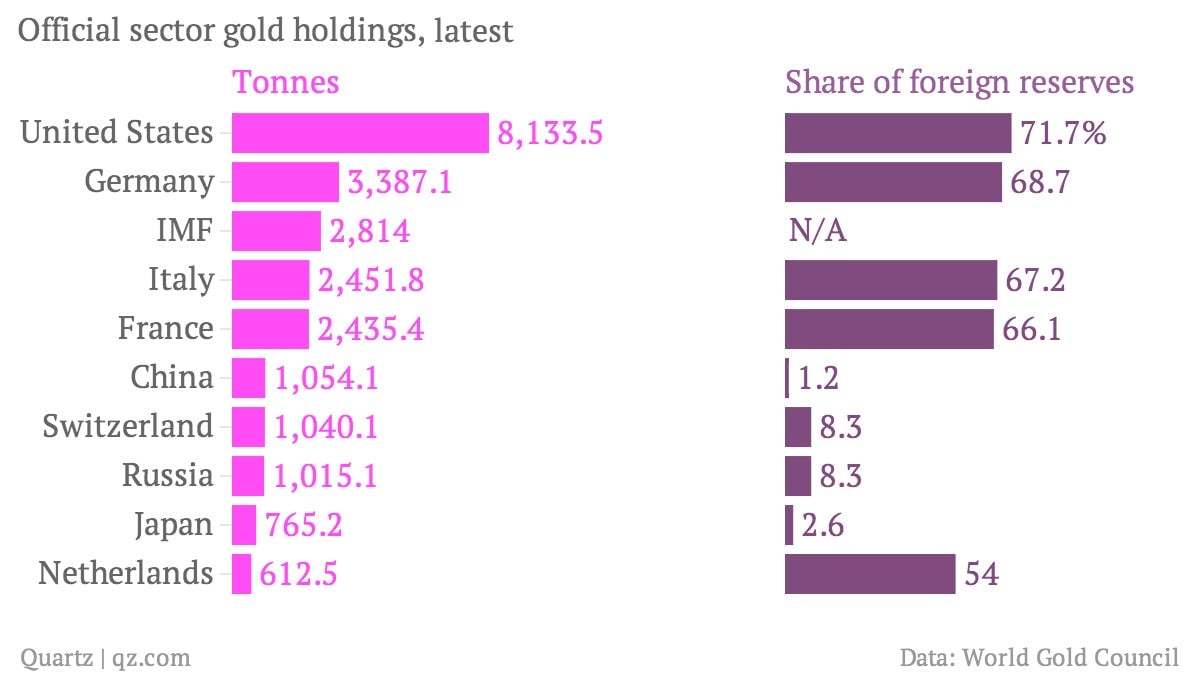

The impact on the bank’s balance sheet could have been much worse; gold comprises only around 8% of Switzerland’s foreign reserves. The share of gold in reserves is much higher in other countries:

In all, analysts reckon that central banks lost more than $400 billion on their gold holdings last year. According to the World Gold Council, central banks added just over 200 tonnes of gold to their holdings in the first nine months of last year, meaning that they either looked to buy on the dips or were just as badly wrongfooted as private investors in the precious metal.

Alternatively, as US Federal Reserve chairman Ben Bernanke once remarked, since the link between gold and currencies was cut by most countries long ago, central banks’ continued dalliance with gold is simply down to “long-term tradition.” This casual attitude is useful considering central banks’ terrible record on gold investing in recent years. After all, the occasional loss is not that big of a deal if, unlike a normal company, you have the power of the printing press to fall back on when times get tough.