The VA charged disabled veterans $286 million in fees they didn’t owe

The Department of Veterans Affairs (VA) improperly charged almost 73,000 disabled veterans more than $286 million in home loan fees they didn’t owe, according to a report by the VA Office of the Inspector General (OIG) released Thursday.

The Department of Veterans Affairs (VA) improperly charged almost 73,000 disabled veterans more than $286 million in home loan fees they didn’t owe, according to a report by the VA Office of the Inspector General (OIG) released Thursday.

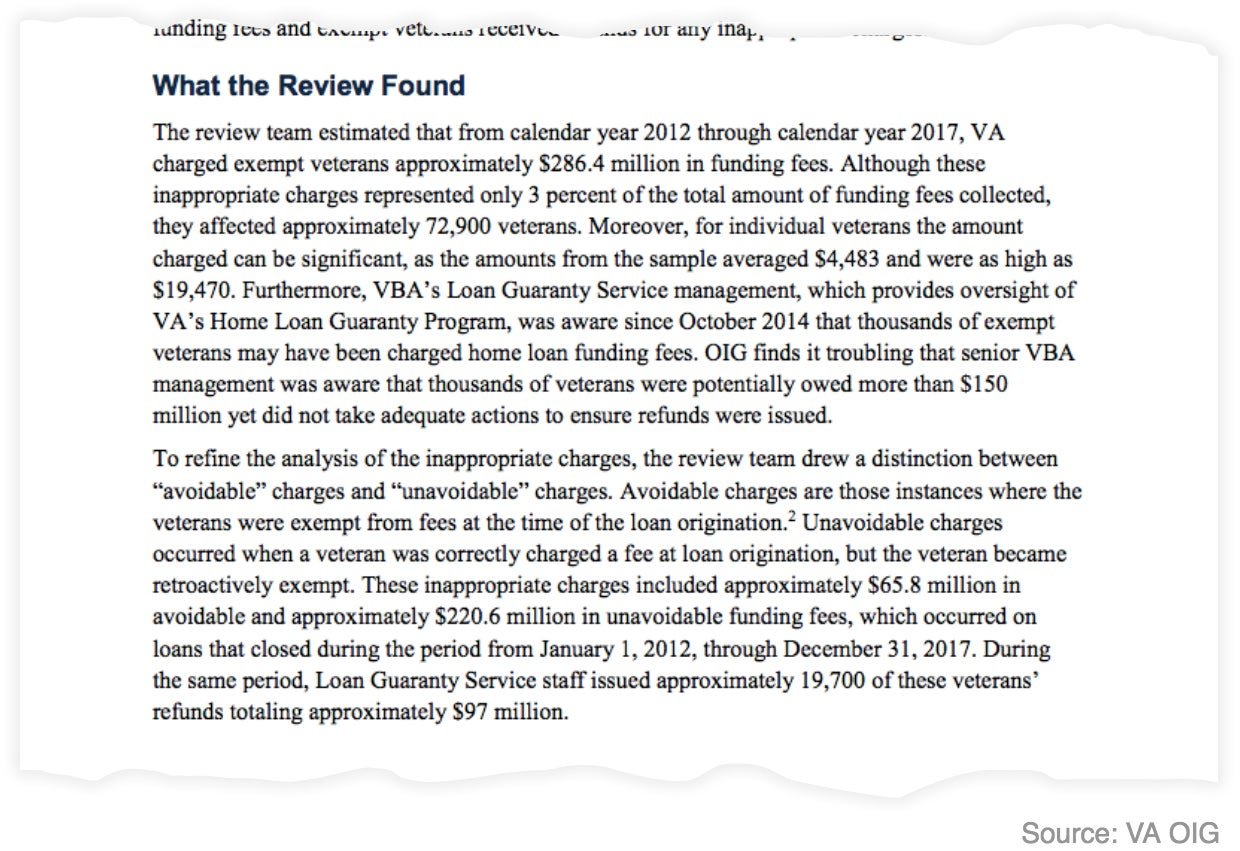

More than 53,000 vets may still be owed almost $190 million in wrongly-paid fees, charged between 2012 and 2017, the report says. VA managers were made aware of the issue in 2014 but never took action, something the OIG report describes as “troubling.” At that time, about 48,000 veterans were due refunds of more than $150 million.

The VA’s home loans themselves are provided by banks and other private lenders. The VA’s Home Loan Guaranty Program, which is overseen by the Veterans Benefits Administration (VBA), guarantees a portion of the loan for vets who qualify. This normally comes with a “funding fee” of 0.5% to 3.3% of the loan amount, from which veterans with service-connected disabilities are exempt.

The improperly paid fees amounted to only 3% of the nearly $10 billion in funding fees collected by the VA during the same 5-year period. However, the OIG report says, “for individual veterans the amount charged can be significant, as the amounts from the sample averaged $4,483 and were as high as $19,470.”

Adequate controls did not exist within the VA to prevent disabled veterans from being overcharged, the OIG found. VA officials said they had been “focused on other competing priorities, such as addressing serial refinancing, a high blocked call rate and long wait times, and appraisal timeliness for pending home loans.” The report also discovered that veterans are required to file a claim to request a fee refund, yet the VA’s loan guaranty service has never published a standard form for doing so.

Reached for comment, a VA spokesperson referred Quartz to a section of the report that contains its official response. In its statement, the VA says it plans to implement procedural changes going forward and, in the interest of efficiency, has “requested a legal opinion from VA’s Office of General Counsel to determine whether VA has the authority to issue funding fee refunds directly to veterans.”

A problem beyond fees

Kristen Rouse, founding director of the NYC Veterans Alliance, a nonprofit that advocates for ex-service members, served 20 years in the US Army. Her stint included three separate deployments to Afghanistan.

Rouse told Quartz the report’s findings were “very disconcerting.”

The VA’s latest misstep is just one of several serious accounting errors the agency has made in recent years, she noted. (The VA’s new IT systems contain flaws so serious that some veterans have become homeless while waiting for their benefits to be issued.) However, there’s a larger issue at play, Rouse said.

“I think it is not well-known that veterans receiving VA service-connected disability are exempt from closing fees,” Rouse said. “My organization has held gatherings of veteran homeowners and invested time and resources into researching and addressing issues that limit usage of VA home loans in NYC, yet my team and I were unaware of the exemption until this release yesterday. My assumption is that the veterans themselves were [also] unaware.”

The VA home loan has been a fundamental benefit of military service going back to the GI Bill of Rights in 1944. But it’s been vastly underutilized, Rouse said. In total, only about 6% of eligible service members and veterans are using their VA home loan benefit, according to data Rouse got from VA staff in Cleveland, where the VA’s home loan program office is based.

In certain places, like New York City, Rouse said the benefit is “virtually unusable” because the area’s median housing price far exceeds the cap on the guaranty amount. It also can’t be used to buy co-ops, which rules out an entire class of housing stock. There is also “a general lack of understanding of the VA home loan process” by many brokers and agents.

Meanwhile, if the VA doesn’t correct its funding fee problem soon, the OIG estimates it could overcharge another 34,400 veterans another $164 million in the next five years.

“The OIG acknowledges that the actual future monetary impact will vary because events and circumstances change,” the report concludes. “However, that variance is largely dependent on if, when, and how [the VA] implements its corrective actions.”