The UK Conservative party has lost its bloody mind (fiscally speaking)

The UK Conservative party, which has been running the government since 2010, seems ready to reverse one of the defining traits of its tenure, fiscal austerity, and adopt a policy at the opposite extreme.

The UK Conservative party, which has been running the government since 2010, seems ready to reverse one of the defining traits of its tenure, fiscal austerity, and adopt a policy at the opposite extreme.

There are four and a half months to go until the UK is scheduled to leave the European Union. Theresa May is now a caretaker prime minister, to be replaced as soon as the party decides on her replacement, and British politics is now focused solely on who will be the next leader of the party (and by extension, the country). Brexit has split the Conservatives into warring factions, but the candidates for party leader hope that a sprinkle of tax cuts and other acts of fiscal generosity can bring them together.

Of the seven MPs currently in the race to be leader, four have announced they would propose large tax cuts if they become prime minister. Torsten Bell, director of the Resolution Foundation think tank, wrote that the these plans “misread the state of the nation’s finances, the state of our public services and the desirability of closing, rather than increasing, the divides in our country.”

What happens next?

The next UK general election is not required until 2022, so following May’s resignation the next prime minister is chosen from a contest for the Tory party leadership. First, MPs whittle down the candidates in successive votes until there are just two left. The first vote was today, knocking out three candidates. Eventually, the final two are put to a postal vote of the party’s membership.

There is no obligation for parties to publish their membership figures, but in March 2018 the Conservative party said it had 124,000 members. Recent reports, though not officially confirmed, say membership has increased to about 160,000 (that is, 0.35% of the British electorate). It’s worth noting that the last leadership contest didn’t make it to the postal vote, as all the candidates but May dropped out.

What are they planning?

The same party that oversaw nearly a decade of spending cuts in the name of fiscal belt-tightening and all-in-it-togetherness to eliminate the deficit is now enthralled by big tax cuts and generous spending plans. Recall that just two years ago, May told nurses that “there is no magic money tree” to fund higher pay.

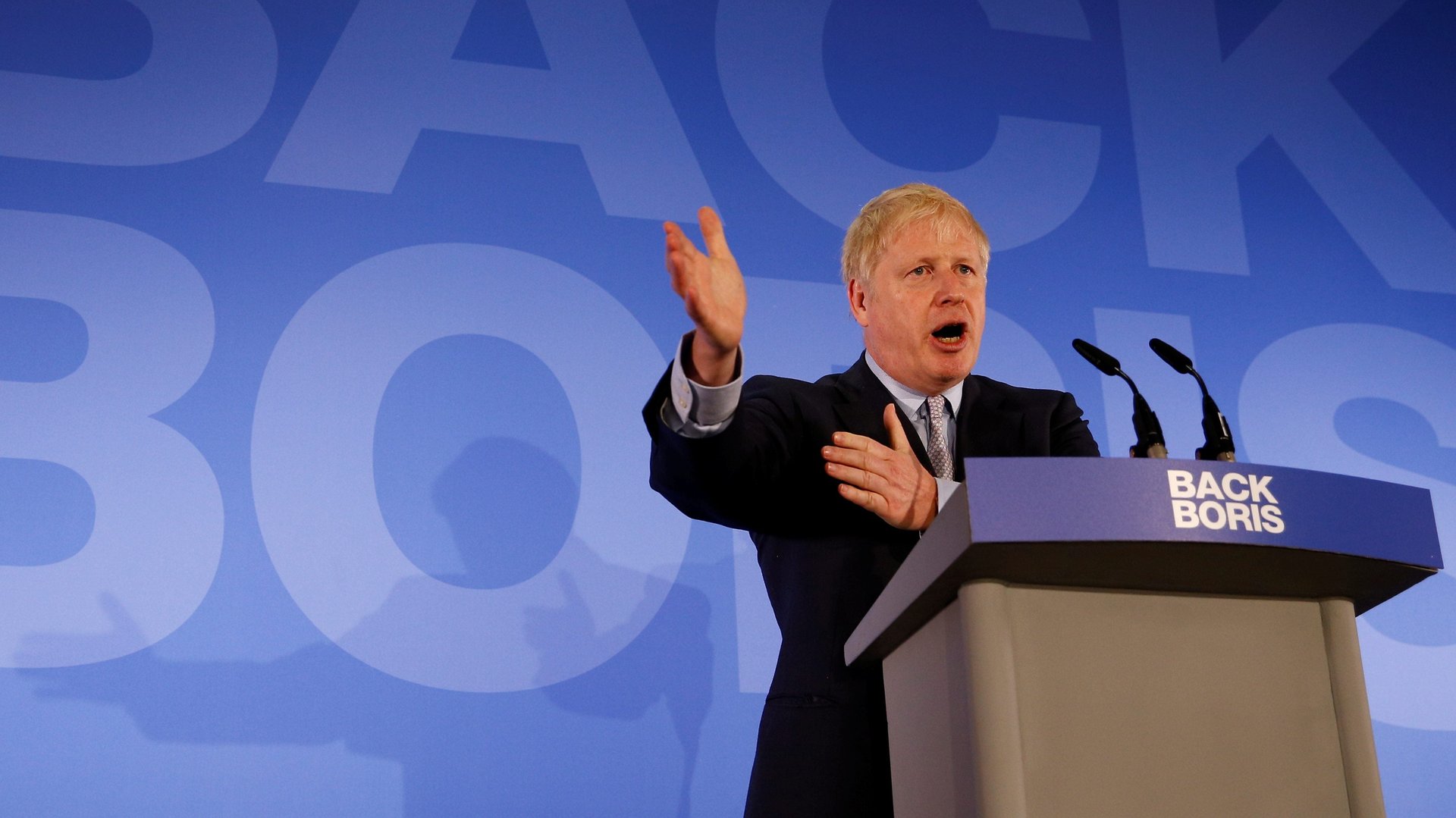

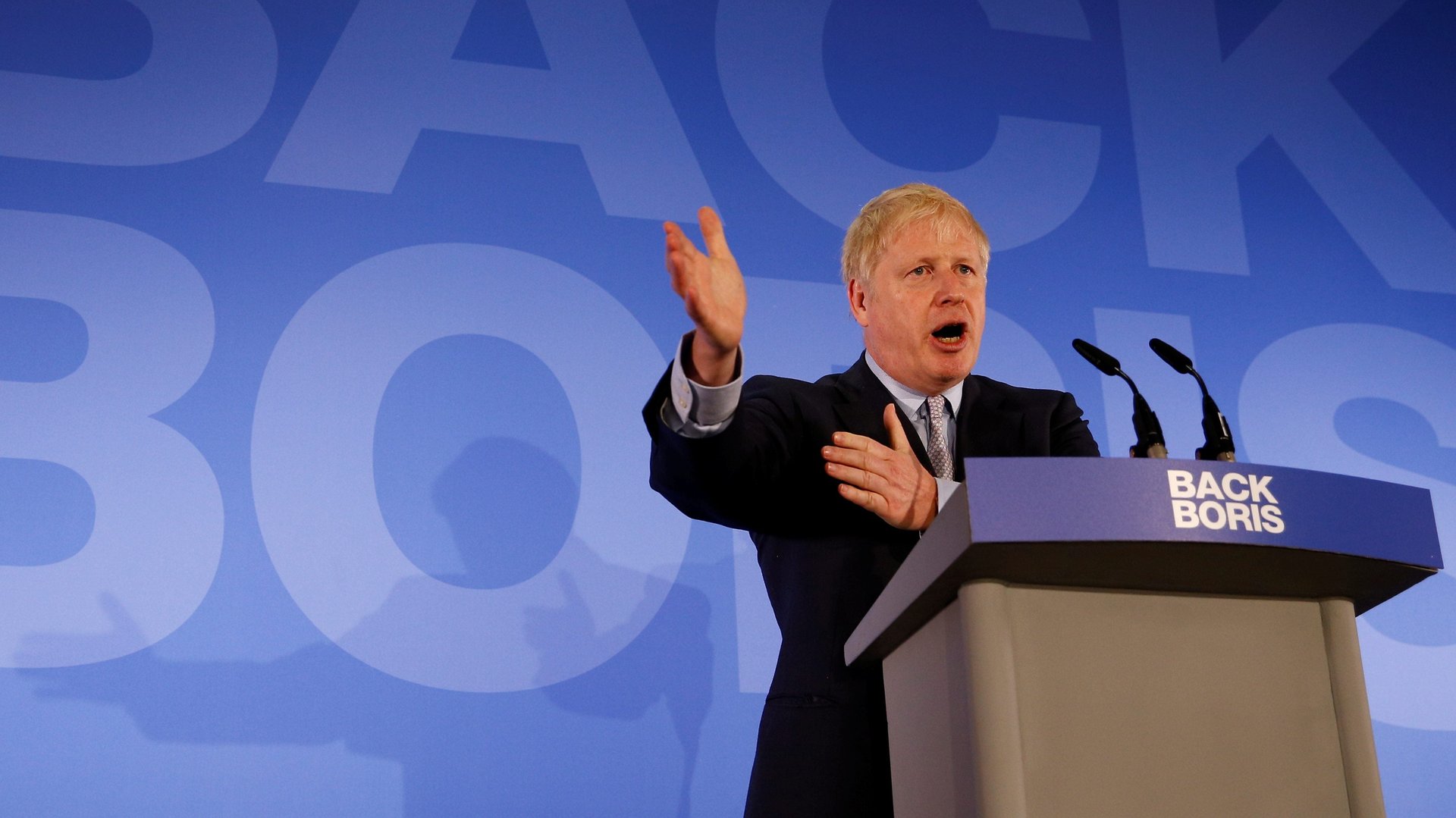

The frontrunner, former foreign secretary Boris Johnson, has the most stark plan. He said he would raise the threshold for the 40% income tax rate from £50,000 to £80,000 (from $63,000 to $101,000). He would recoup some of the revenue lost by increasing how much the wealthy pay in National Insurance tax (which funds certain benefits, including the NHS and state pensions). Even so, Johnson’s plan would cost the government £10 billion.

While it’s not the most expensive plan so far announced, it’s the most regressive, according to the Resolution Foundation. The average UK income is £26,400, so only one in seven people earn enough to benefit from this tax cut. (MPs themselves earn £79,468 per year, and so they stand to gain £2,946, the Resolution Foundation calculates.)

Dominic Raab, a former Brexit secretary, said he wants to cut the basic rate of income tax from 20% to 15%, and raise the threshold national insurance is paid. Altogether, the changes would cost £32 billion. Such largesse would “rule out any end of austerity on the spending side,” which the party had recently said it aimed to achieve, according to Paul Johnson, director of the Institute for Fiscal Studies (IFS).

Jeremy Hunt, the foreign secretary who is currently in second place, wants to cut corporation tax to 12.5%, from 19%, inspired by Donald Trump. This would lower government revenue by about £13 billion, according to the Resolution Foundation. Hunt also said he wants to increase the UK’s defense spending. The IFS says every additional 1% of GDP spent on defense costs £20 billion a year. How would Hunt pay for all of this? He said he will tap nearly £27 billion set aside as fiscal “headroom” by chancellor Philip Hammond as a buffer against Brexit uncertainty.

Michael Gove, the environment secretary, whose campaign is currently embroiled in a scandal over his admission of cocaine use two decades ago, said he wants to abolish value added tax and replace it with a sales tax. “That would be the biggest, riskiest and most disruptive change in the tax system in at least half a century,” the IFS’s Johnson said. VAT raises nearly £140 billion a year in the UK, and is the preferred method of tax in more than 160 countries.

Perceived fiscal irresponsibility has long been the cudgel Conservative MPs have used to bash their counterparts in the opposition Labour party. Now, they risk turning it around on themselves.

For now, these are just promises designed to garner votes. Regardless of who wins, it’s hard to imagine policies that aren’t directly related to Brexit getting much attention. Still, this relaxed approach to fiscal prudence echoes a waning belief in deficit reduction by another right-of-center political party. In the US, data published yesterday showed the public deficit had grown by 40% in the first eight months of the fiscal year under Donald Trump’s watch, to around $740 billion. And in notoriously austere Germany under Angela Merkel, the government is loosening the public pursestrings to allow for spending.

While the UK’s public sector finances are healthier than they used to be, with debt as a share of GDP on the decline, there are reasons to be cautious about cutting taxes, said Bell of the Resolution Foundation. The UK doesn’t have assets “to sell off to bankroll lower taxes,” Bell said, a warning given by the IMF last year. Meanwhile, the UK’s aging population is expected to put more pressure on public spending in the future. At the same time, after years of austerity there’s a growing public desire for more spending on schools, the NHS, police, and other services. A recent UN report charged the Conservative party with a “systematic dismantling of social protection policies since 2010.”

Compounding concerns about large tax cuts and hefty spending on things other than public services, is that the leading contenders for prime minister have said that the UK should leave the EU at the end of October, even without a deal to smooth its exit with transition agreements. Threats of so-called “no-deal Brexit” are therefore back, despite recent votes showing there is no majority for it in Parliament. Several candidates have suggested they might consider shutting down Parliament to force a no-deal Brexit through.

A no-deal Brexit is widely agreed by economists to hurt the UK economy by cutting GDP, which would require higher government borrowing. A Conservative prime minister who advocated a no-deal Brexit would struggle to push through tax cuts without doing further damage to public services or public finances. “Such promises risk destroying the Conservative party’s reputation for economic competence,” said Rory Stewart, the international development secretary and surprise candidate for prime minister. He just barely scraped through the first round of voting.