JP Morgan mulls sale of commodities trading unit, as fines weigh on its overall results

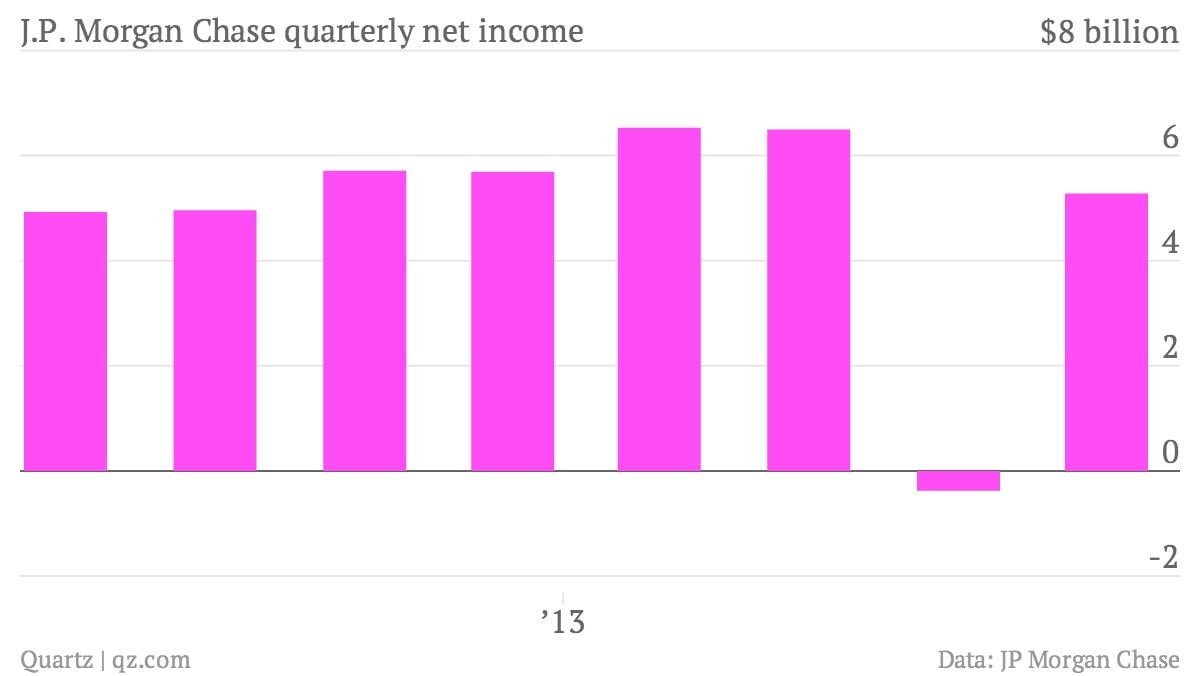

The numbers: With all the fines the bank has been paying lately, Wall Street wasn’t expecting much better. CEO Jamie Dimon’s bank got whacked by nearly $23 billion in legal claims that sapped the financial institution’s profits. Net income fell 7.3% to $5.28 billion, or $1.30 share, missing most analysts’ estimates or $1.35.

The numbers: With all the fines the bank has been paying lately, Wall Street wasn’t expecting much better. CEO Jamie Dimon’s bank got whacked by nearly $23 billion in legal claims that sapped the financial institution’s profits. Net income fell 7.3% to $5.28 billion, or $1.30 share, missing most analysts’ estimates or $1.35.

The takeaway: Overall the big sprawling bank had a very unimpressive quarter. But its fundamental business is still performing solidly. With other consumer areas down the bank saw its credit card sales volume up 11%.

What’s interesting: JP Morgan may be getting ready to offload its physical commodities trading operation, which it grew into one of the biggest in the world, for between between $2 billion and $3 billion — a deal for the unit run by global commodities chief Blythe Masters is likely to be announced in the first three months of 2014, if not sooner, according to people familiar with the matter. Sources tell Quartz the buyer is likely to be a Russian institution similar to oil giant Rosneft, which agreed to buy Morgan Stanley’s oil trading platform last month