Here’s a PowerPoint presentation on how to avoid paying tax to poor countries, made by the experts

A trove of some 200,000 leaked documents belonging to offshore law firm Conyers Dill & Pearman—known collectively as the Mauritius Leaks—have shone a light on the contortions corporate giants go through to avoid paying taxes on money earned in some of the world’s poorest countries.

A trove of some 200,000 leaked documents belonging to offshore law firm Conyers Dill & Pearman—known collectively as the Mauritius Leaks—have shone a light on the contortions corporate giants go through to avoid paying taxes on money earned in some of the world’s poorest countries.

The documents were sent anonymously to the International Consortium of Investigative Journalists (ICIJ) and shared with Quartz and other news organizations around the world. Among them was a handy guide drawn up by Bermuda-based Conyers for anyone considering a scheme to avoid taxes using the Indian Ocean nation of Mauritius.

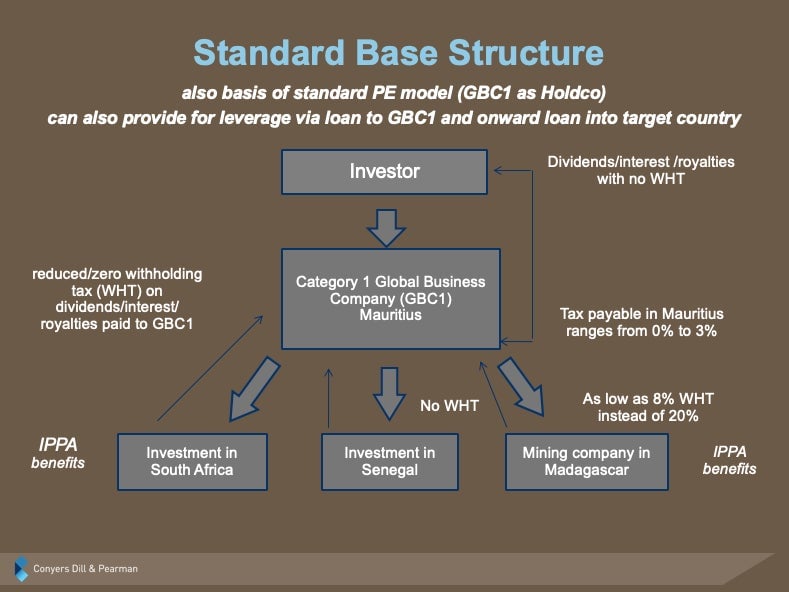

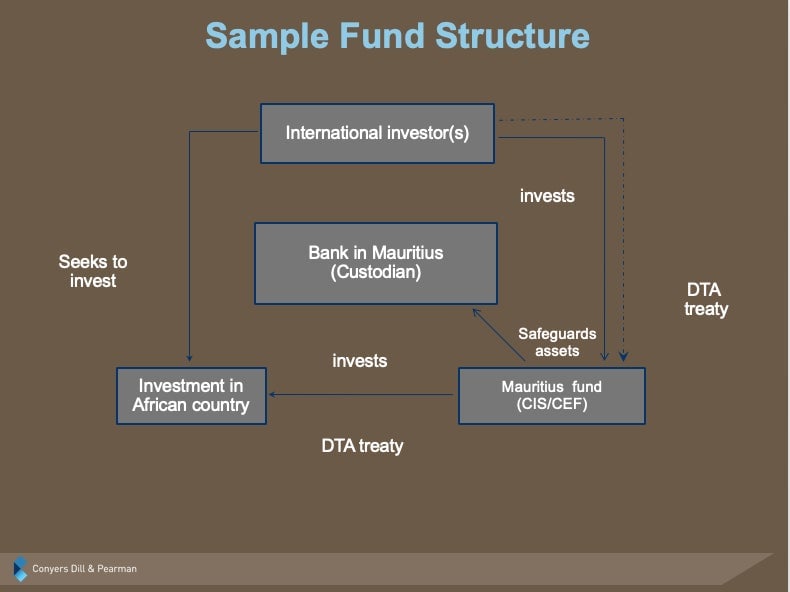

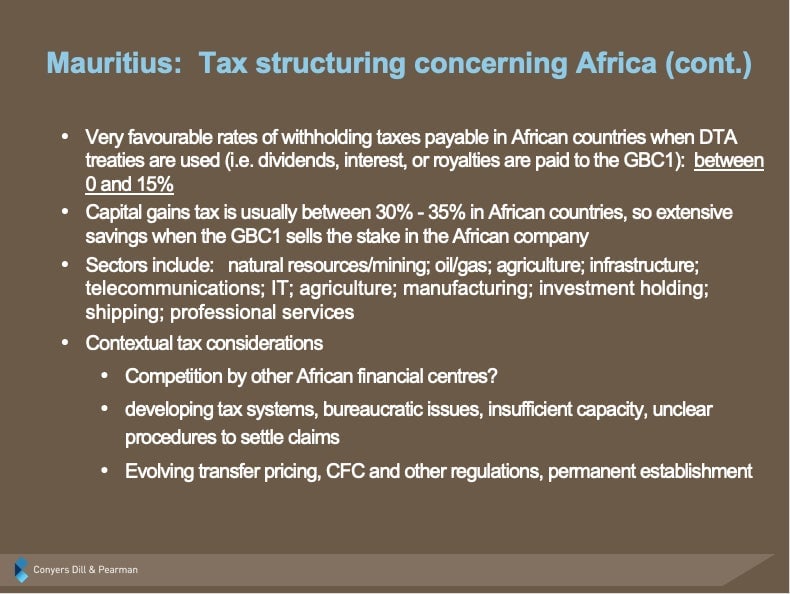

Entitled “Overview of Mauritius as an offshore financial centre,” the 36-slide PowerPoint presentation walks aspiring tax dodgers through the legal—but definitely unseemly—intricacies of corporate structures on the tiny island, which, Conyers notes, “is technically an African country.”

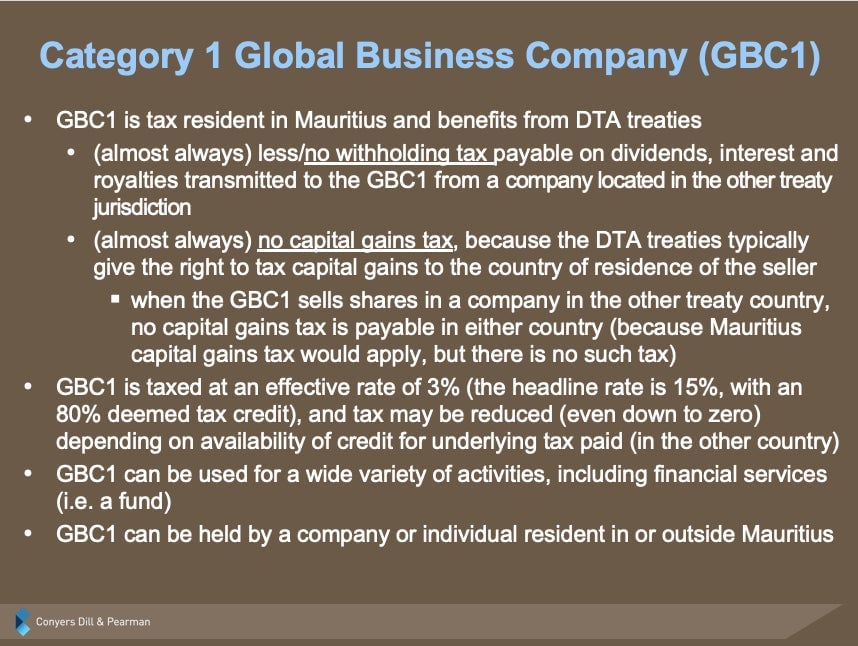

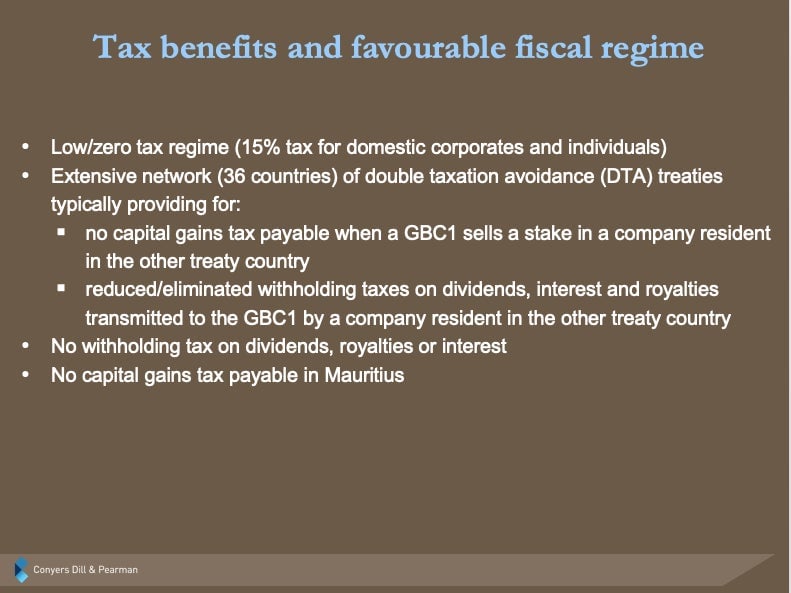

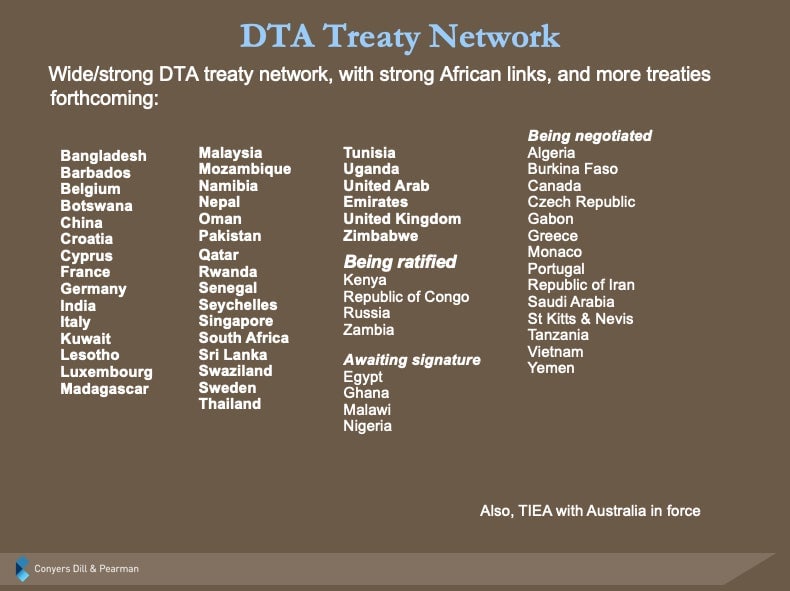

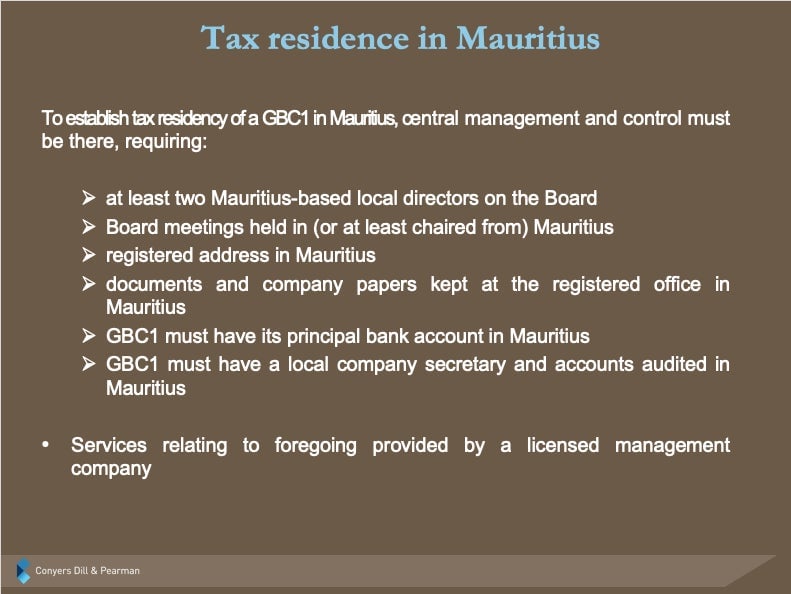

Some of the island’s advantages? An effective 3% corporate tax rate thanks to dozens of tax treaties, pretty simple requirements to set up a tax-avoiding structure, plus “almost always” no capital gains tax and little or no withholding tax. Oh, and a clean-ish reputation, having appeared on the “white list” in the half-hearted annual effort by the Organization for Economic Cooperation and Development (OECD) to name and shame tax havens.

Here is a selection of the key slides.