Profits at US banks hit a post-crisis record last year

Even after a brutal 2008 credit crisis and tougher regulations, which ostensibly made it harder for financial firms to make money, the top US banks are raking in the cash.

Even after a brutal 2008 credit crisis and tougher regulations, which ostensibly made it harder for financial firms to make money, the top US banks are raking in the cash.

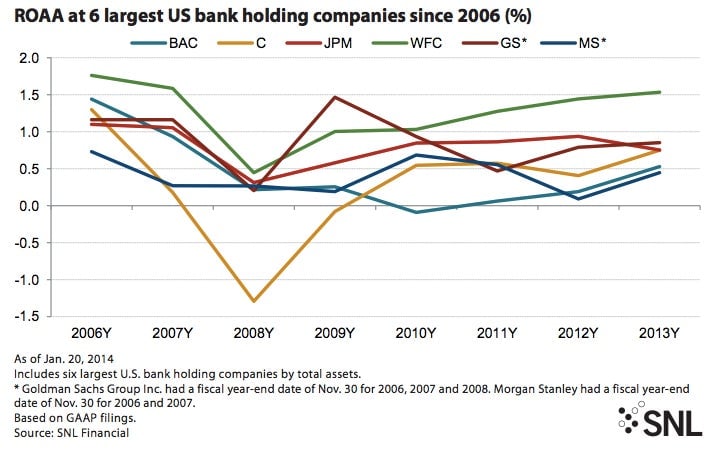

Profits for the six biggest US banks—JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley—totaled $77.5 billion in 2013, their highest in eight years, and a 27.4% increase from the previous year, according to a new report by SNL Financial.

And yet, all this happened even as US banks were facing $100 billion in legal costs (paywall), historically low interest rates that make lending less profitable and stricter regulations to rein in casino-style risk-taking.

So what gives? The profit hike probably boils down to a combination of banks cutting costs and releasing reserves (paywall) set aside for potentially bad loans that didn’t end up going sour.

The above chart also shows that return on average assets (ROAA)—a measure of banks’ ability to get the most bang for their buck—edged higher in 2013 compared to the previous year, except for JP Morgan Chase, which was rocked by more than $22 billion in fines. For the most part, the return-on-assets bump comes from banks like Wells Fargo cutting mortgage-related workers and Goldman Sachs scaling back on sky-high pay.

Growth in trading and lending has also given banks a leg up this year, according to Rafferty Capital Markets analyst Dick Bove. For example, JPMorgan showed a spike in its fourth-quarter results driven by car loan demand, even as the mortgage refinancing boom that drove bank profits in prior years abated. San Franciso-based Wells Fargo also cited an increase in demand for non-mortgage-debt for that quarter, including commercial and consumer loans; its auto loans jumped 10%.