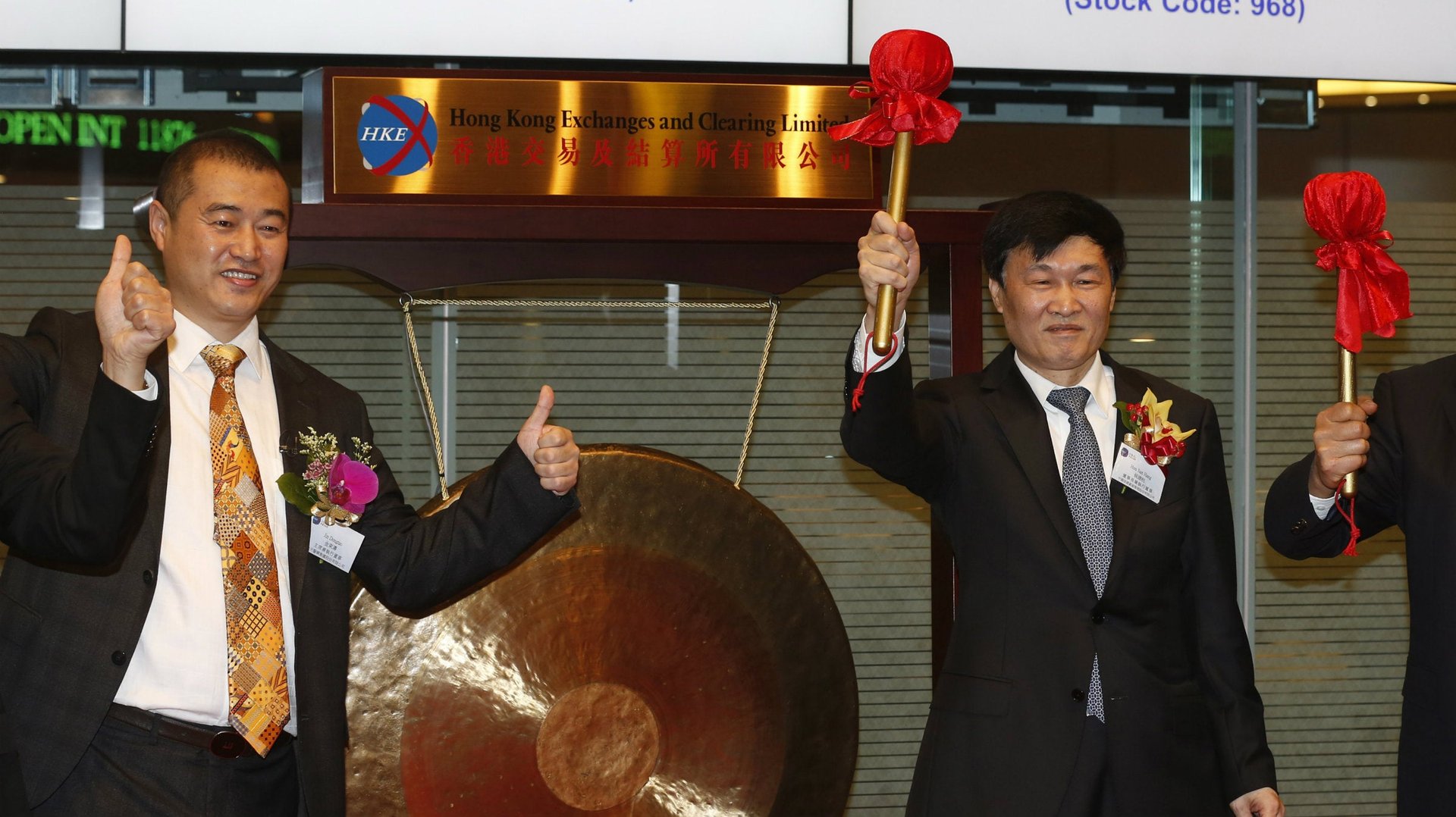

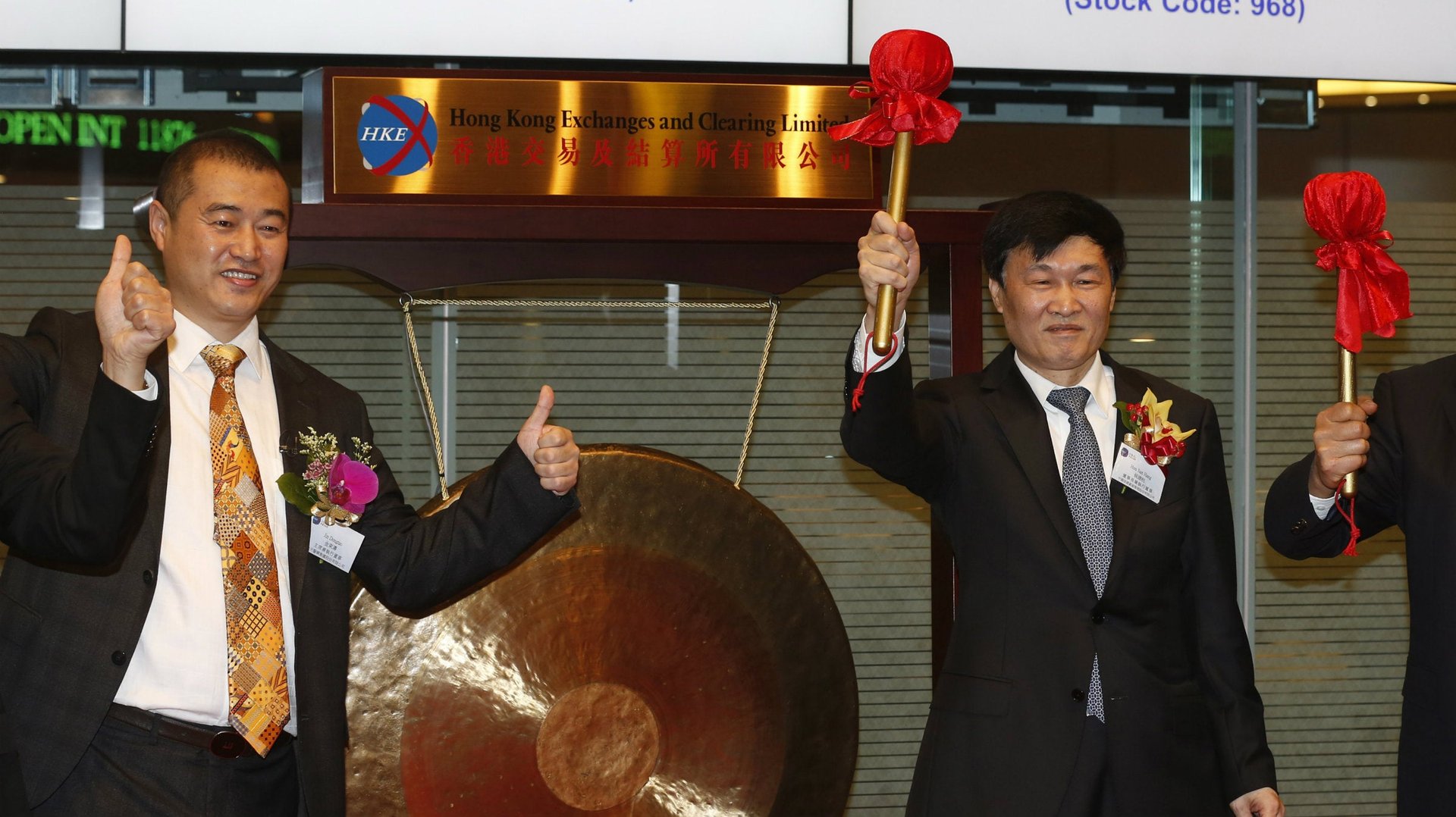

Why the Year of the Horse could be a winner for the Hong Kong stock exchange

On February 3, the Hong Kong Stock Exchange will usher in the first day of trading in the Chinese Lunar New Year, and it could be a banner year for the exchange thanks to newly relaxed regulations for Chinese companies listing overseas. Hong Kong could see over $26 billion in IPOs this year, up from 2013’s $21 billion in listings, and the exchange may hit a five-year high, strategists predicted this month.

On February 3, the Hong Kong Stock Exchange will usher in the first day of trading in the Chinese Lunar New Year, and it could be a banner year for the exchange thanks to newly relaxed regulations for Chinese companies listing overseas. Hong Kong could see over $26 billion in IPOs this year, up from 2013’s $21 billion in listings, and the exchange may hit a five-year high, strategists predicted this month.

Even more Chinese companies could turn to Hong Kong than expected, after a US judge’s six month ban of the Chinese arms of the big four accounting firms from audits in the US. The firms are appealing the decision, and Chinese retailer JD.com said days after the ban was announced it would proceed with a planned US IPO. But the company’s prospectus notes the situation could “ultimately lead to the delay or abandonment of this offering.”

Among the biggest or most interesting deals in the pipeline:

A.S. Watson. Li-Ka Shing’s massive retail drugstore chain could raise as much as $13 billion. The company, which has over 11,000 stores, will sell shares in Hong Kong and have a secondary listing in London, bankers told Bloomberg.

Shuanghui International. The industrial pork giant and owner of Smithfield Foods is planning a $5 billion IPO in Hong Kong as “WH Group” that will be closely-watched for the details it provides on China’s food supply. It is also notable for enlisting a ludicrous number of banks (16 so far, with more expected) as advisers, underwriters and book-runners on the deal.

Alibaba Group Holdings. The will-they-or-won’t-they listing of 2014, Chinese e-commerce giant Alibaba is expected to raise more than $10 billion, if it can come to an agreement with Hong Kong regulators over managers’ desire to retain control after the company goes public. Officials in Hong Kong are expected to launch a public debate about new shareholding structures shortly.

Fast Retailing. The Tokyo-based owner of closing retailer Uniqlo, is planning a secondary listing in Hong Kong, reports the Wall Street Journal.

The enthusiasm about the Hong Kong market’s prospects this year could be undermined, though, by a factor already affecting markets in recent days—an investor sell-off from emerging markets. If the rout continues, expect Hong Kong’s potentially giant Year of the Horse to look more like the Year of the Pony.